Quantum Computing Stocks Surge as Trump Seeks Stake in Exchange for Federal Funding

JPMorgan unveiled a $1.5 trillion initiative to support firms including quantum computing

Quantum computing stocks soared Thursday after media reports emerged that the US government is planning to acquire equity stakes in these companies, and in turn, offering them federal funding to support their growth and innovation.

Shares of quantum computing companies like IonQ (NYSE:IONQ), Rigetti Computing (Nasdaq:RGTI), D-Wave Quantum (NYSE:QBTS), and Quantum Computing (Nasdaq:QUBT) significantly gained on the reports. Companies like Atom Computing could also be considering an arrangement with the Trump Administration for equity sale.

According to the Wall Street Journal, these companies would receive a minimum of $10 million (£7.5 million) from the Chips Research and Development Office as part of the investments from the US Commerce Department.

The potential investments would bolster the ongoing trend of the US government buying stakes in companies it deems vital to national security.

The quantum computing stocks pared some of their double-digit gains when the Commerce Department said it is not currently negotiating equity stakes with quantum companies. A spokesperson for the department noted that companies have reached out to the Administration and are receiving tons of pitches to take equity stakes, but Trump seeks a good return for taxpayers. The person added that any investment would be made using funds from the government's overhaul of the Biden administration's CHIPS Act commitments.

A spokesperson from Rigetti Computing said that it was 'continuously engaging with the US government on funding opportunities.'

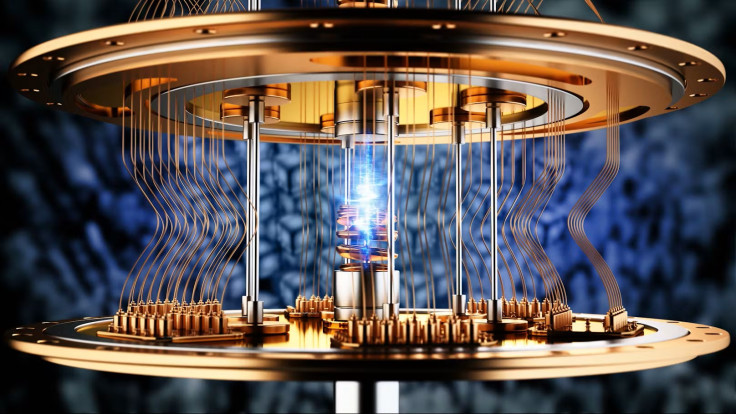

Trump's interest in quantum computing was evident during his first term as US President when he enacted the National Quantum Initiative Act, pledging $1.2 billion (£900 million) in federal funding for quantum research. The current administration pledged an additional $2.7 billion (£2 billion) for research to develop useful quantum computing applications. Once created, quantum computers would solve problems that would take classical computers countless years.

In September, Rigetti Computing received a $5.8 million (£4.3 million) contract with the US Air Force, and the Department of Energy also announced a partnership with IonQ.

Quantum computing shares have been on an uptrend this month after JPMorgan announced a $1.5 trillion (£1.1 trillion) 10-year initiative to invest in industries vital to national security, including quantum computing. Some of the stocks have surged over 100% year-to-date, but most have a 'strong buy' rating from analysts polled by TipRanks.

Treasury Secretary Scott Bessent had stated earlier this month that the Trump administration will not seek equity stakes in nonstrategic industries. 'We do have to be very careful not to overreach,' he said.

However, Trump had argued that the government should benefit from a firm's success, particularly if federal funds have played a role in its growth.

Quantum computing is seen as one of the next critical technologies for Washington to prioritise, given the massive economic and security implications.

As of now, the US government has acquired a 10% stake in Intel (Nasdaq:INTC) and forged a partnership between US Steel and Japan's Nippon Steel. It has also acquired a stake in MP Materials (NYSE:MP) and Lithium Americas (NYSE:LAC).

Disclaimer: Our digital media content is for informational purposes only and does not constitute investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks, and past performance does not guarantee future returns.

© Copyright IBTimes 2025. All rights reserved.