How to Trade Covered Calls with the Option Samurai Options Screener

Inside the smart trading tool helping investors earn steady income from covered calls

Covered calls are one of the most widely used option income strategies by traders and long-term investors alike. Whether you're looking to generate steady cash flow from a stock you already own or to enhance yield in a conservative portfolio, covered calls can deliver consistent returns, when executed correctly.

Option Samurai simplifies the process with its powerful option screener, allowing you to quickly filter opportunities based on your trading style, risk tolerance, and market conditions. Here's a practical guide on how to use Option Samurai to trade covered calls more effectively.

The Best Ways to Trade Covered Calls on Option Samurai

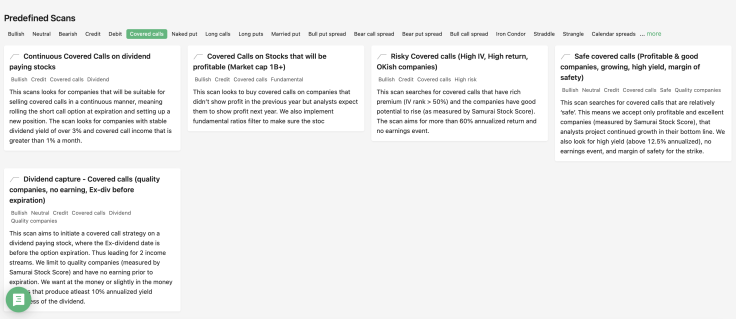

Thanks to Option Samurai's predefined scans, every trader can put in place a covered call in the way a professional investor would do it. Below are some of the best ways to trade covered calls through this powerful options screener:

Let us share more details in the next subsections.

1. Continuous Covered Calls on Dividend-Paying Stocks

This is the bread-and-butter approach for conservative income investors. This scan finds companies that pay stable dividends (yield over 3%) and offer covered call premiums of over 1% per month. These are ideal for traders who want to 'roll' their covered calls every month (selling calls at expiration, collecting the premium, and repeating the process). This is often called a buy-write strategy, where you own the stock and sell a call option against it every month.

Here are some good moments to consider this strategy:

● When markets are range-bound

● When you're holding high-quality dividend stocks

● When you want monthly income with lower volatility

You don't have to guess which stocks are suitable. The scan filters out the noise and gives you a list of candidates that meet both yield and premium criteria.

2. Covered Calls on Stocks That Will Be Profitable (Market Cap $1B+)

If you're comfortable taking more risk for a better return, this scan offers a smart angle. In this way, Option Samurai's options screener targets companies that didn't show profits last year but are expected to turn profitable this year. The scan applies a fundamental filter (e.g., analyst EPS projections and ratios) to find stocks with an improving outlook and at least a $1B market cap.

So, when should you use this scan? Here are a few good scenarios to test:

● During earnings season

● In a bullish or recovering market

● If you're looking to front-run improving fundamentals

Some covered call traders may avoid these stocks. But if you're willing to take on moderate risk, you can benefit from both stock appreciation and rich premiums. The market often misprices these turnaround plays, which can lead to enhanced income.

3. Risky Covered Calls (High IV, High Return, OKish Companies)

This scan is built for aggressive traders who prioritise return over quality. The setup finds covered call trades on stocks with high implied volatility (IV rank > 50%, since these setups are often based on high implied volatility options, which allow traders to collect higher premiums).

These strategies typically offer annualised returns over 60% from call premiums alone, but they come with baggage: erratic fundamentals or weak technicals (in finance, you will often see that, for a higher risk, you will normally find a higher return possibility).

As you may guess, here are a few typical cases in which you can consider using this scan:

● When you're confident in your directional bias

● When trading momentum or meme stocks

● If you're OK with higher drawdowns in exchange for higher potential income

These setups are not for the faint of heart. But with proper risk controls (you should check these positions at least once per day) they can boost overall portfolio performance.

4. Safe Covered Calls (Profitable & High-Quality Companies)

Now let's go back to something safer. This scan is for traders who want reliable income without surprises. The idea here is to target only profitable companies with high Samurai Stock Scores (which is Option Samurai's proprietary quality metric), strong bottom-line growth, and high dividend-adjusted yields (12.5%+ annualised). Also avoids earnings events and filters for a 'margin of safety' on the strike price.

You can use it in various cases, such as:

● When markets are volatile

● When capital preservation matters

● If you're building a semi-passive income portfolio

This is a rather classic way to trade covered calls. The idea is that, since the potential losses for this strategy are uncapped, you should make every effort to avoid cases in which you actually find yourself on the losing side.

5. Dividend Capture - Covered Calls (Ex-Div Before Expiration)

Last but not least, this is a precision-based strategy that seeks to capture two income streams from the same trade (the call premium + the dividend). In fact, it finds dividend-paying stocks where the ex-dividend date is before the call expiration, so you get both the option premium and the dividend. The scan limits itself to high-quality companies, avoids earnings, and prefers options that are at- or slightly in-the-money.

When should you use this? Here are a few ideas:

● When a dividend payout is near

● If you're looking for optimised short-term income

● For traders who are comfortable with short holding periods

Dividend capture trades can be sensitive to early assignment risk. But with the right strike selection, you can often keep both the dividend and the premium. If done right, you can effectively trade covered calls for income and boost your total yield by capturing dividends too.

Go Beyond: Build Unconventional Covered Call Strategies with Option Samurai's Custom Scanner

If you're ready to level up from predefined scans, Option Samurai also offers a Custom Options Strategy Screener, a powerful tool for traders who want full flexibility in how they construct trades. This feature lets you find trades you cannot find anywhere else.

With this tool, you can build non-standard covered calls (like writing calls against 50 or 90 shares to boost return), or scan for more complex structures like covered straddles, risk-free collars, risk reversals, and more.

You're no longer limited to traditional setups. Want to finance a long call with a put spread? Add extra upside protection to an iron condor? This screener allows you to scan the entire market for any strategy you can imagine, and compare trades with precise filters, from delta and breakeven to stock fundamentals and technicals.

To get started:

● Click 'Compose new scan'

● Select 'Custom'

● Define your trade legs, apply filters, and scan the whole market for your unique strategy

It's a unique feature not found on any other platform perfect for advanced traders looking to optimise every edge.

Bottom Line: Why Use Option Samurai for Covered Calls?

There are thousands of tickers and millions of option chains. Finding covered call trades manually is like finding a needle in a haystack. Option Samurai does the heavy lifting with smart filters, fundamental data integration, and proprietary scoring systems to surface trades that match your specific risk/reward profile. Sign up for a free trial at Option Samurai today (no credit card needed) and start trading options as real professionals do. If you're serious about learning how to trade options for income, Option Samurai is the tool for you.

© Copyright IBTimes 2025. All rights reserved.