Rightmove: Good Time for House Buyers to Get Best Deal

The average asking price of newly-marketed property in the UK has fallen 2.9% in August, the sharpest drop for the month ever recorded by Rightmove.

Rightmove says this is the right time for buyers to search for best deals.

August is typically a quieter month with an average price fall of 1.6% over the last 10 years. It is a lead indicator of a slower market in the second half of 2014, the agency said.

The August drop has substantially pulled the annual rate of increase lower though new seller asking prices are still 5.3% (+£13,202) higher than they were a year ago. This is down from 6.5% last month, and a sharp decline from the May year-on-year reading of 8.9%.

"Those looking to buy should remember they are a scarcer species in the summer months, and if they can identify sellers who are keen to sell then there is a better deal to be had in many parts of the country," said Miles Shipside, Rightmove director and housing market analyst.

"The big drop in new seller asking prices is evidence of a 'Summer Sales' mentality, with those coming to market at a quieter time of year obviously having a more pressing need to do so and pruning their prices."

"This is not a glut of property for sale or a major price drop drama, though we do expect more holiday season price falls next month before the usual autumn activity flurry."

The present scenario is seen by Rightmove as a relief for the Bank of England.

"It will, however, come as some relief to the BoE that there are signs the market is effecting its own natural slowdown without a rate rise, though under-pinned by greater awareness among the public that the five year holiday of record low interest rates is coming to an end."

Sterling Move

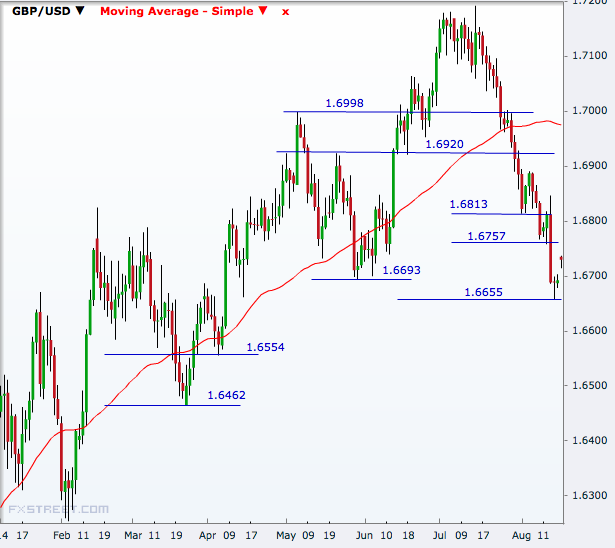

The pound traded higher on Monday despite the weak house price data. The GBP/USD was up to 1.6734 at the open from Friday's close of 1.6691 and further distancing from the four-month low of 1.6655 touched on Thursday.

The market is now waiting for the July price data on Tuesday, ahead of the BoE minutes and July retail sales data on Wednesday and Thursday.

The CPI numbers will be of more importance compared to the producer and retail price indices on the same day.

The surprise rise in the year-over-year CPI rate to 1.9% in June had strengthened sterling last month to a six-year high of 1.7192 before the broad dollar rally weighed down the UK currency.

This week too may prove significant for the dollar direction as Fed Chair Yellen is likely to provide fresh cues regarding the US interest rates at her Jackson Hole speech.

Technically, the GBP/USD will have its next target higher at 1.6757-66 ahead of 1.6813. A break of that will open the doors to 1.6920 and then 1.6998, which is just above the 50-day moving average as on 18 August.

On the downside, the pair has its immediate support at 1.6693 and then at 1.6655 ahead of 1.6554 and 1.6462.

© Copyright IBTimes 2025. All rights reserved.