UK interest rates raised for 12th time in a row to highest level for almost 15 years

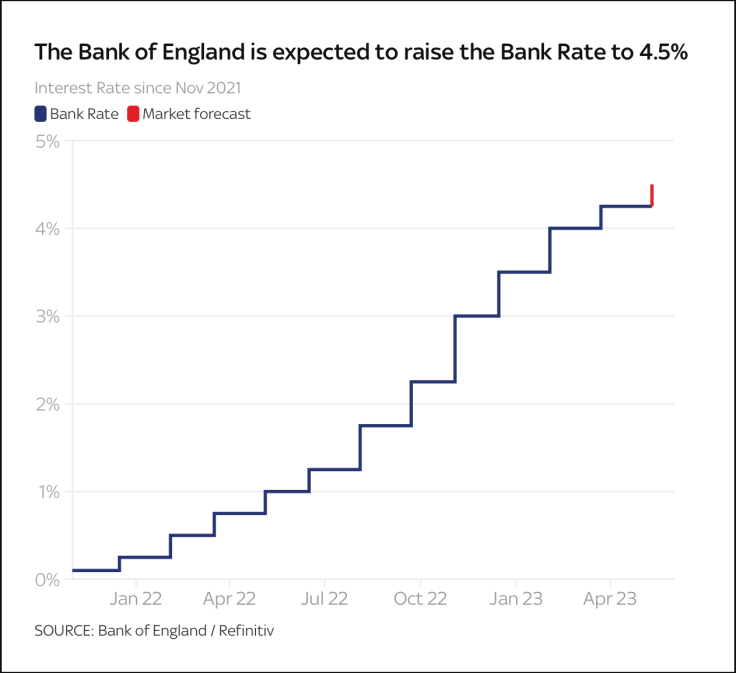

UK interest rates have been raised for the 12th time in a row in a further attempt by the Bank of England to slow the rising cost of living, increasing the Bank's base rate from 4.25 to 4.5 per cent.

UK interest rates have been raised for the 12th time in a row in a further attempt by the Bank of England to slow the rising cost of living.

The increase to the Bank's base rate from 4.25 to 4.5 per cent means rates are now at their highest level since the height of the global financial crisis in October 2008 when several banks collapsed, almost 15 years ago.

The latest spike has been described as "necessary" due to rising inflation levels across the UK. The Bank Rate had stood at 0.1 per cent in December 2021, before inflation began to hamper business growth in the aftermath of the Covid-19 Pandemic.

Russia's invasion of Ukraine the following February then exacerbated the inflation problem, with soaring energy costs piling additional misery on Western nations.

Average energy bills in the UK increased by 54per cent in April 2022 and rose a further 27 per cent in October last year.

Now, according to data collected by the British Retail Consortium (BRC), average shop prices are now 8.9 per cent higher than they were at this time a year ago. It is the highest rate ever recorded and represents a significant acceleration from the 8.4 per cent measured in February.

These considerable extra costs, faced by households and businesses alike, are still filtering through in the form of stubborn inflation for many goods and services. The latest official figures showed the headline consumer prices index (CPI) measure at 10.1 per cent.

The UK's Conservative government, headed by Prime Minister Rishi Sunak, had last month unveiled a budget aimed at tackling a cost-of-living crisis – which has sparked widespread strikes as many worker's wages fail to keep up with the increasing demand.

But it seems his economic measures have failed to prevent a 12th consecutive interest rate bump. And the new raise is likely to heap further pressure on many households struggling with the cost of living. It will mean higher mortgage payments for some homeowners, while people looking for loans will face higher borrowing costs.

According to research by TotallyMoney and Moneycomms, a further quarter-point interest rate rise will add £26 to monthly repayments for variable customers on the average UK property.

The Bank Rate increases, they said, meant the same customers were now facing forking out an extra £482 per month compared to pre-December 2021. It is also bad news for many small businesses, who are already having to contend with surging operating costs and the impact of the cost-of-living crisis on product demand.

One CEO of a major data company has described how businesses are "on their knees" thanks to energy prices, inflation and the wage crisis.

As expenses have gone up significantly in the past 18 months, small businesses have had to work harder to sell more to attain the same level of wealth. And the financial crunch is hitting them right where it hurts, with data from the Office of National Statistics revealing a 0.9 per cent drop in sales through March following consecutive rises in January and February.

As well as increasing interest rates 12 times now to an almost 15-year high, the Bank of England has outlined the foothills of economic recovery starting this summer. In a rare glimmer of optimism, they predict that the economy not only avoids a recession but now does not shrink at all from here.

The economy is now forecast to make up the ground lost since the pandemic by the end of this year, rather than 2025. It is a significant upgrade from the very weak forecasts made last year.

Underpinning all of this is the collapse in energy prices from their Ukraine war highs, and the investments made across Europe in storing gas supplies.

The Bank of England governor Andrew Bailey says there will now be "modest but positive growth," further adding that "consumer confidence has improved."

Significantly, he also anticipates a reduction in energy prices. Baily estimates that the average annual energy bill will drop from £3,000 to £2,100 by the end of 2023. He admits this is "still high" but is, at least, lower than the bills many people have experienced.

However, this outlook is very sensitive to any changes in the energy market this winter. Even as it is, inflation is expected to be above 5 per cent at the end of the year, and 3 to 4 per cent in June 2024.

The UK is not alone in seeing interest rates rise, with other countries taking a similar approach to tackling inflation. The US central bank called the Federal Reserve, has increased its benchmark rate to between 5 to 5.25 per cent, which is the highest level in 16 years - up from near zero in March 2022.

The Fed's hike in interest rates was particularly notable given that financial markets have been roiled by wavering confidence in banks globally following a run on Silicon Valley Bank last month and the sudden demise of Credit Suisse.

In Europe, inflation in France was 5.7 per cent in March – down from 6.3 per cent in February – while the Eurozone's largest economy, Germany, saw inflation at 7.4 per cent in March (down from 8.7 per cent in February).

© Copyright IBTimes 2025. All rights reserved.