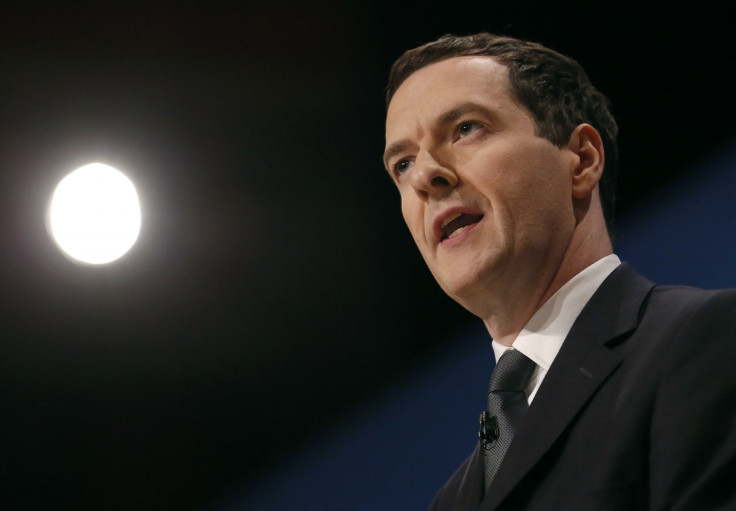

UK's Osborne Warns Germany is the Greatest Concern for the Eurozone

Britain's Chancellor George Osborne warned that dismal German economic data is the greatest concern for the Eurozone as European shares fell further on 10 October.

Osborne added that "there are serious clouds gathering on the economic horizon and the biggest risk is the Eurozone falling back into recession.

"Britain is not powerless in the face of external risks and has an economic plan. If you create rules on fiscal guidelines, you can't break the rules on the first test.

"However, I am skeptical about repeated calls for more public spending."

Data showed that August factory output in Germany was down 4% on the month and manufacturing orders slid 5.7%, both well below expectations. On Thursday the country recorded its biggest drop in exports for August since January 2009.

Germany's growth sensitive Dax 30 was the biggest loser of the European indexes, down 2.2%, also reaching at a one-year low, and a decrease of 4.2% since the start of the week.

The benchmark is down more than 12% since its all-time high in late June, placing the index into correction territory—a phrase often used to describe a drop of anywhere from 10% to 20% from a recent peak.

Analysts said investors were spooked by the fragile state of recovery and future growth prospects – thanks in part to the IMF downgrading its outlook for global economic growth earlier in the week.

"There have been questions over the strength of the German economy for a long time, so this data makes for a convenient excuse to sell the FTSE. There is a bit of a herd mentality at the moment," Trustnet Direct market analyst, Tony Cross, said.

The FTSE 100 slipped to a 12-month low following a fourth consecutive session of losses on Friday taking its month-to-date decline to 2.5%.

Mining and energy stocks fell - UK mining index fell 2.7% and the oil and gas index was down 2.1% - as commodity prices dipped, while the looming uncertainty over Ebola hit travel and leisure shares.

The pan-European Stoxx 600 was down 8.5% from its 2014 peak, while the S&P 500 has lost 4.5%.

"The current weakening in economic momentum may postpone somewhat more the resumption in private investment, which is also negatively affected by heightened geopolitical risks," said European Central Bank President Mario Draghi.

"Steadfast implementation of fiscal consolidation in a growth-friendly manner and determination in structural reform efforts should contribute to supporting business and consumer confidence going forward."

© Copyright IBTimes 2025. All rights reserved.