Worsening Iraq Crisis Weakens Risk and Asian Currencies, Indonesian Rupiah Drops to New Low

Equities fell and Asian currencies weakened on Wednesday as the Iraq crisis worsened again, increasing oil supply woes and safe haven demands for the US dollar. The Indonesian rupiah has fallen to a new four-month low.

Syrian government aircraft bombed Sunni militant targets inside Iraq on Tuesday, a day after Israeli warplanes and rockets struck targets inside Syria, the Washington Post reported.

The Pentagon said that 90 additional US troops arrived in Iraq. They are part of up to 300 military advisers whom President Obama said he would deploy, to assess the situation before taking any further US military action.

Brent for August delivery rose to as high as $114.48 from $114.07 at Tuesday's close. The US dollar index, the gauge that measures the greenback's strength against the currencies of the six largest trading partners of the US, edged higher to 80.42 from 80.31 at previous close.

Risk Appetite Weakens

At 5:42 GMT, Japan's Nikkei 225 traded at 15,278.00, down 122.00, or 0.79% from Tuesday. Stock indices of Australia, New Zealand, China, South Korea, Indonesia, Malaysia and Thailand - all were in the red on Wednesday.

AUD/USD dropped to 0.9354, a seven-day low, from 0.9368 at Tuesday's close. It had touched a multi-month high of 0.9447 before turning south on Tuesday.

The Indonesian rupiah, the Asian unit most vulnerable to crude oil prices, fell to a new 4-1/2-month low of 12,087.50 against the US dollar. The rupiah has fallen more than 3.4% so far in June.

The Indian rupee, another major Asian currency heavily affected by global crude oil trends, weakened to 60.42 from 60.08 against the greenback.

USD/CNY rose to a two-week high of 6.2344 from its previous close of 6.2285.

The Malaysian ringgit dropped to 3.2288, a seven-day low, from 3.2137 against the dollar on Wednesday.

The Rupiah Weakness

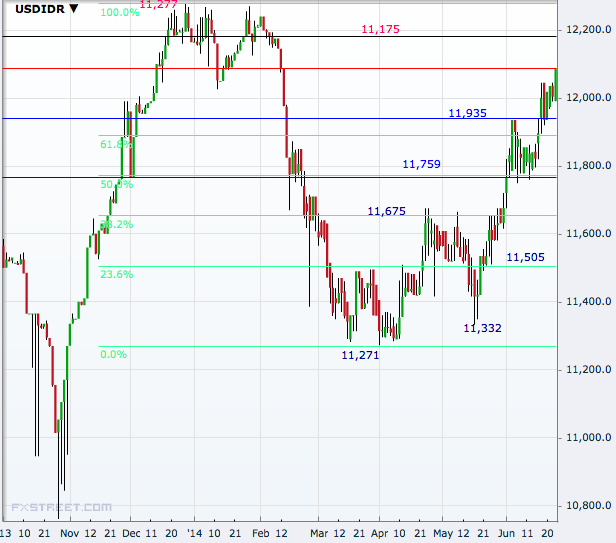

The Indonesian unit is facing tougher days compared to its regional peers. USD/IDR is not far away from 12,325 the record high touched in December 2008.

On the way up, the pair has its first resistance in the 12,125-175 region, a break of which will open doors to 12,277, the five-year high hit last December.

Immediate levels on the downside are 11,935 and then 11,759, the 50% retracement of the December 2013 to April downtrend. A break of the Fibonacci level will significantly weaken the uptrend since April and increase risks of a downtrend.

Next levels are 11,675 and 11,505, the 38.2 and 23.6 levels, ahead of 11,332 and 11,271, the five-month low hit in April.

Rupee and Ringgit

Both the Indian rupee and Malaysian ringgit are still holding a rising trend against the US dollar despite the recent fall owing to the oil price-related challenges.

At the same time, the fact that both USD/INR and USD/MYR are holding above the upside barrier of a downtrending channel for the past few days also keeps investors concerned about a possible upside break, opening new weaker levels for the regional currencies.

USD/INR has its first target on the topside at the 18 June high of 60.53 and then near the 60.85-61.20 area, ahead of the 61.80-62.30 zone. On the downside, the pair targets the 59.59-59.45 area, ahead of 58.88 and then the one-year low of 58.23 hit in May.

USD/MYR eyes 3.2357 and 3.2395 on the higher side ahead of the more important 3.2518. The downside levels to watch are 3.2122 and 3.2040 ahead of 3.1937, the eight-month low hit earlier in June.

© Copyright IBTimes 2025. All rights reserved.