Is the American Dream Dead? High Earners Say $100k 'Isn't Enough' — Now Need at Least $500k to Survive

Rising costs and shrinking wages have high earners questioning whether the American Dream is still achievable

Once considered the benchmark of middle-class success, a $100,000 annual income is now being dismissed by many Americans as insufficient to maintain a comfortable lifestyle.

Amid rising inflation, housing costs and stagnant wage growth, a growing number of high earners claim that even half a million dollars a year is barely enough to 'scrape by' in major cities, prompting renewed debate over the viability of the American Dream.

The Shifting Definition of 'Comfortable'

According to a 2025 GOBankingRates survey, nearly half of Americans (48%) believe it's still possible to live comfortably on $100,000 or less.

However, generational differences reveal a more complex picture. Gen X respondents (ages 45–54) were most likely to say that a salary between $100,000 and $150,000 is necessary for comfort, while 19% of all respondents said that $500,000 or more is required to be considered 'upper class'.

Boomers, meanwhile, were more optimistic, with 24% stating that a salary between $50,000 and $75,000 is sufficient, likely reflecting lower housing costs and more stable retirement income among older Americans.

'Scraping By' on $500,000 a Year?

The notion that $500,000 might be the new survival threshold has gained traction online, particularly through platforms like Reddit and personal finance blogs. In one widely shared post on Financial Samurai, the author breaks down the expenses of a hypothetical family living in a high-cost urban area.

After accounting for taxes, mortgage payments, childcare, insurance and retirement savings, the family is left with just $7,300 in discretionary income, which many argue is alarmingly low given the salary.

Experts who support this view argue that such budgeting reflects lifestyle inflation rather than genuine hardship. However, supporters say the rising cost of essentials, particularly housing and healthcare, has made traditional middle-class aspirations increasingly unattainable.

Inflation and the Erosion of Purchasing Power

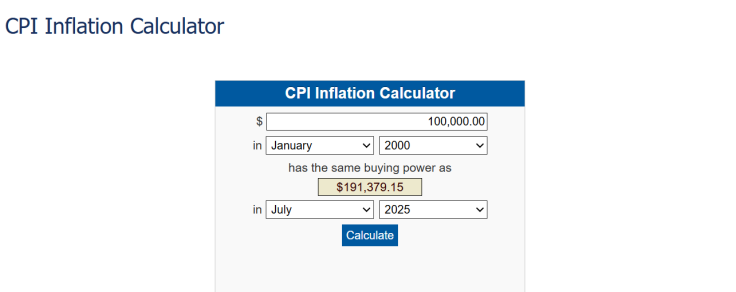

The erosion of purchasing power is central to this debate. Based on the US Bureau of Labour Statistics' CPI Inflation Calculator, $100,000 in the year 2000 holds the same buying power as approximately $191,000 today, when adjusted for inflation.

However, wages have not kept pace with this shift, especially in metropolitan areas where housing prices have outstripped national inflation rates by a factor of four.

'People who bought homes 15 years ago are locked into low mortgage payments', one commenter noted. "But for those trying to enter the market now, it's more like $200,000 to get what $100,000 bought you in 2000'.

The Myth of the Millionaire Benchmark

The perception that one must earn $500,000 or even $1 million annually to feel financially secure is increasingly common among younger professionals. A recent episode of the Money Guy Show explored this mindset, noting that while $100,000 remains a psychological benchmark, it no longer guarantees comfort or upward mobility.

'True wealth is built with discipline, margin and time', the hosts argued, suggesting that financial literacy and long-term planning are more critical than income alone. Yet they acknowledged that the cost of living has dramatically reshaped what 'enough' looks like in 2025.

Is the American Dream Still Alive?

The American Dream, once defined by homeownership, stable employment and upward mobility, appears increasingly out of reach for many. While some still believe in its promise, others argue that the dream has been replaced by a relentless 'rat race' where even high earners feel financially insecure.

Whether the dream is dead or simply evolving, one thing is clear: the definition of success in America is undergoing a profound transformation. And for many, $100,000 is no longer the ticket to a life of comfort but merely the starting line.

© Copyright IBTimes 2025. All rights reserved.