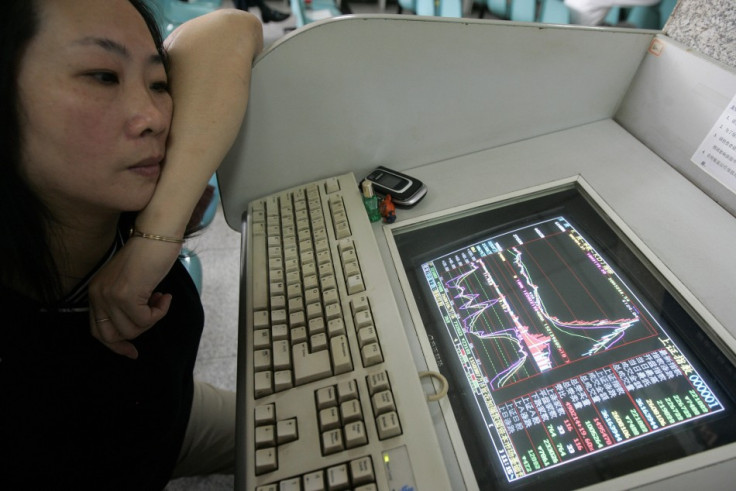

Asian shares extend losses amid fresh China concerns

Asian shares were mostly lower on 19 August as renewed volatility in Chinese markets spooked investors.

The Shanghai Composite index dipped by 3.4% to 3,620.80 points at mid-day after closing more than 6% lower in the previous session.

The steep plunge came amid a CN¥120bn (£12bn; €17bn; $18.8bn) injection into the financial market from the People's Bank of China – the largest single-day injection from the central bank in almost 19 months, according to the Wall Street Journal.

China's benchmark stock index has shed 30% of its value since June, forcing Beijing to introduce a raft of support measures to stem the rout.

Fu Xuejun, a strategist at Huarong Securities, said investors were becoming "too reliant" on such measures and likened the government's efforts to "feeding the market with too many drugs".

"Investors were disappointed that Beijing did n't rescue the market yesterday," he told the Journal.

Australia bucks trend

Markets elsewhere also extended losses, with Japan's Nikkei sliding 1.3% to 20,287.46 points after data showed the country's trade deficit unexpectedly widened in July.

Exports grew 7.6% from the same month a year ago, beating expectations for a 5.2% gain, but lower than the 9.5% increase posted in June.

Imports on the other hand decreased by 3.2%, resulting in a trade deficit of ¥268.1bn (£1.4bn; €2bn; $2.2bn) - the largest since February and well shy of forecasts for a ¥53bn shortfall.

Hong Kong's Hang Seng benchmark was down by 0.8% at 23,293.08 while in South Korea, the Kospi shed 0.8% to 1,939.84.

However, Australian shares bucked the regional trend, with the S&P/ASX 200 rebounding by 1.5% to 5,380.20 after sinking to a seven-month low on 18 August.

Thailand reaction

Share prices in Thailand recovered after a deadly bomb blast in Bangkok had sparked a sell-off in the country's bourses.

The benchmark SET index was up 0.4% at 1,378.04 after closing down 2.6% in the previous session.

However, analysts at Maybank Kim Eng Securities warned that the recovery could be short-lived, saying the attack would likely continue to weigh down tourism stocks going forward.

"As investors are waiting for more detail from the bomb attack investigation, medium- to long-term retail and foreign investors will continue reducing investment weights in tourism-related sectors," they told Reuters.

Thailand's currency, the Baht, was trading 0.2% lower against the US dollar.

A bomb explosion at a Hindu shrine killed at least 20 people, including eight foreigners, in the Thai capital on 17 August.

© Copyright IBTimes 2025. All rights reserved.