Britain's Hunt to keep tight budget with eye on 2024 election

British finance minister Jeremy Hunt looks set to keep his grip on public finances in next week's budget, holding off on any big tax cuts or spending increases until the next election comes closer into view.

British finance minister Jeremy Hunt looks set to keep his grip on public finances in next week's budget, holding off on any big tax cuts or spending increases until the next election comes closer into view.

Lawmakers in Hunt's governing Conservative Party want him to halt April's sharp jump in the corporate tax rate to kick-start an economy on the verge of recession.

Meanwhile, trade unions and opposition parties are demanding bigger pay rises for nurses, teachers and other public sector employees whose incomes have been hit by double-digit inflation.

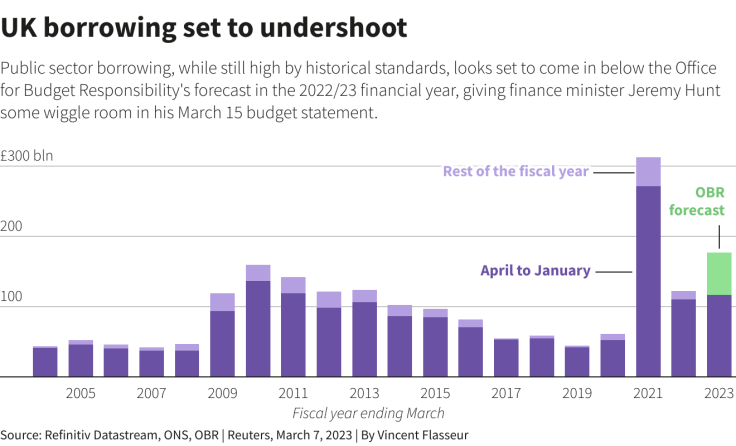

A 30 billion pound ($35.6 billion) windfall in the public finances has added to the pressure on Hunt to relax the fiscal stance he took when he was parachuted in as finance minister in October, after former Prime Minister Liz Truss's "mini-budget."

UK borrowing set to undershoot

Her plans for sweeping, unfunded tax cuts triggered a bond market meltdown, leading to her replacement in Downing Street by Rishi Sunak. He and Hunt told investors that Britain was not ripping up the economic orthodoxy after all.

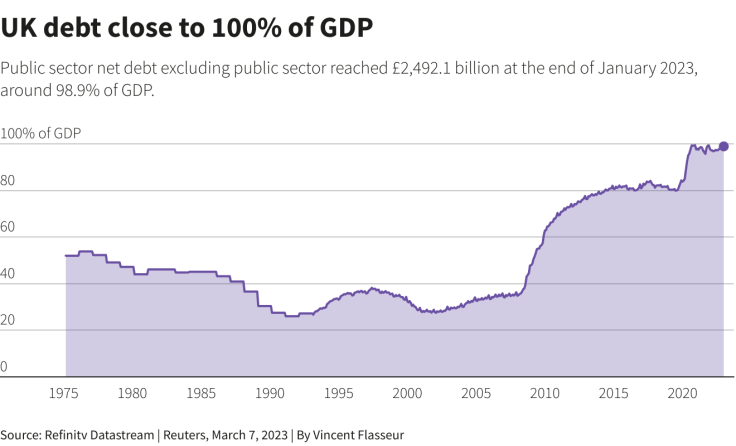

Their pledge to have Britain's 2.5 trillion-pound debt mountain falling as a share of the economy in five years' time will constrain Hunt in his March 15 budget statement.

About two thirds of the 30 billion pounds of wiggle room in his existing plans comes from one-off factors, according to the Resolution Foundation think tank.

UK debt close to 100% of GDP

The remaining 10 billion pounds, from stronger-than-expected tax revenues, would be enough to pay for another three months of subsidies for households hit by soaring energy bills and another 12-month freeze on fuel duty, but little else to ease the cost-of-living squeeze in the approaching 2023/24 financial year.

However, Hunt's restraint now is also seen as a political choice: the Conservative Party will need all the help it can get next year to overcome the opposition Labour Party's big opinion poll lead before a national election expected in 2024.

"The reason he's waiting until next year isn't really the fiscal rules, is it? It's the election timetable," Resolution Foundation Chief Executive Torsten Bell said in a panel discussion about the budget this week.

Analysts at BNP Paribas also said keeping room for tax cuts ahead of the next election would be a priority for Hunt, meaning he would probably use only half of the 30 billion-pound windfall in the public finances in next week's plan.

GLOOMY OUTLOOK?

Hunt's future room for manoeuvre could be further constrained if Britain's fiscal watchdog turns gloomier about the economic outlook in its forecasts that underpin the budget.

Until now, the Office for Budget Responsibility (OBR) has been less pessimistic about growth than the Bank of England (BoE).

The OBR said in its last forecasts in November that gross domestic product would slump by 1.4% this year, but expand by 1.3% and 2.6% in 2024 and 2025.

Last month, the BoE said GDP would show no growth at all over 2024 and 2025 after a 0.5% fall in 2023.

Even if the recent drop in gas prices softens the expected recession this year, a shortage of workers, long-standing productivity problems and the after-effects of Brexit risk hobbling the economy.

Britain is the only Group of Seven country whose economy has yet to recover its pre-pandemic size.

Hunt has said he will lay out economic growth measures in the budget, including ways to address the fall in the size of Britain's workforce. Business groups and researchers argue that among the possible moves he could make, acting on childcare would do more to unlock greater economic growth.

Hunt is also expected to announce tax incentives to get businesses to invest more, boosting productivity, even as the corporation tax rate jumps to 25% from 19% in April.

($1 = 0.8430 pounds)

(Writing by William Schomberg; Graphics by Vincent Flasseur; Editing by Josie Kao and Alexander Smith)

Copyright Thomson Reuters. All rights reserved.