Falling Oil Prices Help Indonesia's Rupiah Gain But Budget Concerns Keep Indian Rupee Pressured

Falling oil prices helped the Indonesian rupiah to gain ground from the face of a retest of the record lows on 30 June, but India's rupee could not gain from the oil advantage with the market focus on the Union Budget on 10 July.

Brent crude fell to $113/bbl in the spot market on Monday, its lowest since 17 June, adding to the previous week's losses. The commodity has dropped 2.3% from the nine-month peak of $115.67 touched on 19 June.

Indian rupee and Indonesian rupiah are two Asian units most vulnerable to the import prices of crude oil, given the high dependence of imported fuel and the very large share of its cost in their overall import bills.

Japan's Nikkei average ended o.5% stronger and European shares traded higher on Monday, indicating the comfort the stock market has received after the drop in crude oil prices.

Rupiah Rallies to Two-week High

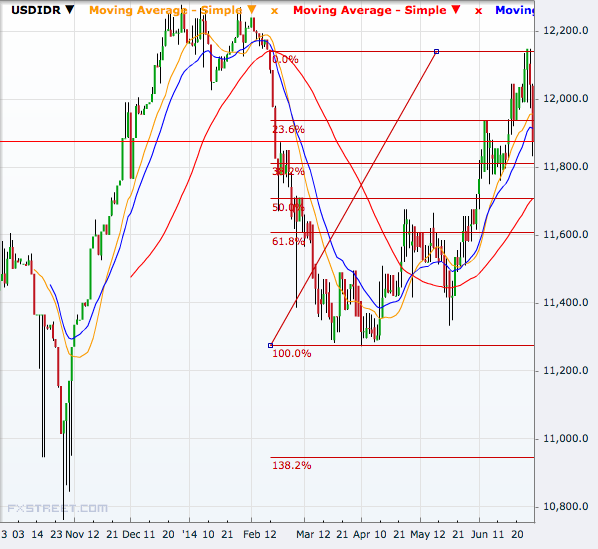

USD/IDR fell to 11,831 on Monday, its lowest since 16 June, from the previous close of 12,40. The pair had touched a near five-month high of 12,148 on 26 June and at that level, a retest of the all-time peak of 12,503 seemed to be an easy target.

A break of 11,800 will open up 11,700, the 50% Fibonacci retracement of the April to June uptrend, a break of which is necessary to strengthen the reversal from the multi-month high.

The pair then aims the 11,600-11,500 region ahead of the 1 April trough of 11,271, which was a five-month low.

Rupee Cautious

USD/INR traded higher helped by the month-end dollar demand from importers. Broadly, the pair has been in a downward channel and the recent spike on account of oil price rise has only managed to aid a weak break of the upside barrier of the channel.

With regard to India, the market is waiting for the July 1o Union Budget, the first by the newly elected Prime Minister Narendra Modi and his government.

Inflation and various challenges to the fiscal health are expected to be the main concerns for the government, or at least so demands India Inc, and what Mr. Modi delivers on the same will obviously be crucial for the medium-term outlook for rupee.

USD/INR rose to 60.27 from Friday's close of 60.02. The pair had touched a two-month high of 60.53 on 18 June, which was a near 4% stronger level from the 11-month low of 58.23 touched on 22 May.

On the downside, the pair aims 59.59 and 58.88 ahead of the May low of 58.23. It has resistance at 60.53 initially and then comes the 60.85-61.30 region. A break of that will expose 63.50, endorsed by the 38.2% Fibonacci retracement of the May 2013 to August 2013 uptrend that took the pair to its all-time peak of 69.23.

© Copyright IBTimes 2025. All rights reserved.