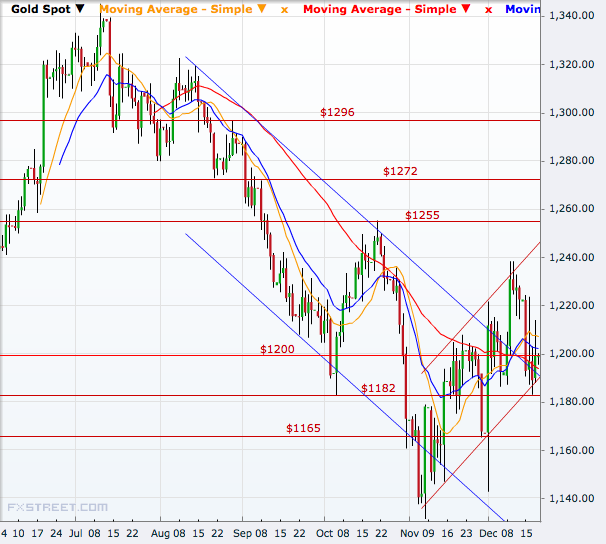

Gold holding channel support despite dollar gains and shows upside room in coming days

Despite the 2.5% rally in the dollar index since Wednesday's large set of US numbers including the CPI data and FOMC decision, gold has managed to hold above the support within an upward channel in place since early last month.

In fact, the metal is still slightly higher than it was trading prior to the US data.

This shows that the yellow metal will most likely rise within the channel even with a slight catalyst and can break above the $1,240 resistance it hit in the previous wave.

In that case, the first levels to watch will be $1,220 and $1,240, for hitting channel resistance afresh near $1,255.

For the time being, the metal does not seem to possess enough momentum to break the channel on the upside, so the next move could be downward.

If the metal finds reasons to hold the channel, the new support to look at should be $1,200, although $1,220 may come in as an intermediate support on the way.

Only if the metal drops below the $1180 support, will one have to look at the possibility of the downtrend since July getting back in focus.

If that happens, $1,165 and $1,140 will offer some support but then new lows near $1,000 will be easy to hit.

© Copyright IBTimes 2025. All rights reserved.