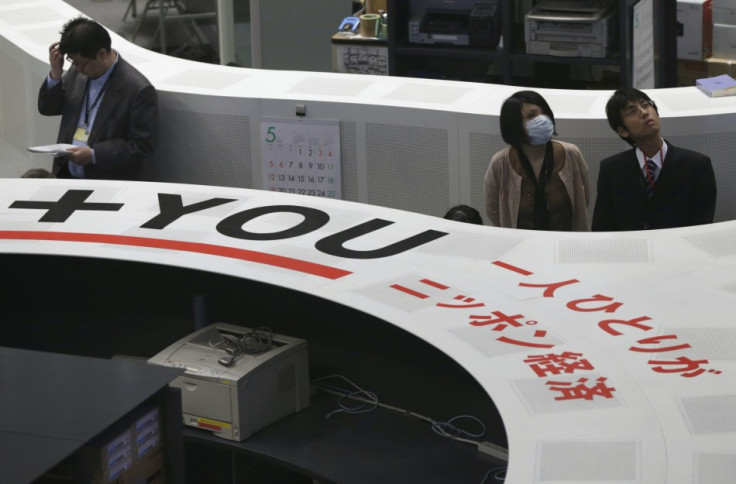

Asian Markets Open Higher, Nikkei Remains Stable

Most Asian equities inched up in early trade while Japanese stocks overcame their shakiness, after the previous day's volatile trade that forced the Nikkei to shed over 3%.

The Nikkei gained 1.1% or 140.37.21 points to 14292.02, supported by exporters' stocks. China's Shanghai composite index added 0.1% or 3.38 points to 2296.46.

Australia's S&P/ASX was up 0.3% or 17.50 points to 4977.40, boosted by banking shares, on its way to post its first advance in six trading sessions.

South Korea's Kospi was up 0.4% or 8.81 points to 1988.78, while Hong Kong's Hang Seng gained 0.1% or 31.81 points to 22717.86.

In Tokyo, Matsui Securities shed 4.2% while Nomura Holdings was down 0.6%.

Mazda Motor rose 3.2%, Fast Retailing moved up 1.5%, while Sony added 1% as the dollar strengthened after dropping below the 101 yen level on Monday.

The greenback, which hit a four and a half year peak on 22 May, moved up 0.9% against the yen to 101.86 early in the day and was trading was trading 0.98% higher to 101.95 at 2:45 p.m. Japanese time .

Banks provided support to the Australian market, after suffering huge losses in recent trading sessions when investors locked in profits in high dividend-yielding stocks.

Bank of Queensland gained 1.5% while Westpac Banking moved up 1.2%

In Hong Kong, Cathay Pacific Airways added 0.8% after crude-oil prices eased. Brent crude dipped 0.1% to $102.53 while US crude futures dropped 0.5% percent to $93.67 a barrel on lower demand.

Data from China last week, pointing to surprisingly poor manufacturing activity in the world's second biggest economy, introduced demand concerns.

China Construction Bank inched up 0.5%, while Industrial & Commercial Bank of China added 0.4%.

On 27 May, the European markets closed higher but volumes were low given that the UK and the US markets were closed on account of a holiday.

© Copyright IBTimes 2025. All rights reserved.