Michael Burry Shutters Scion Asset Management, Renews AI Bubble Warning With Lord of the Rings Meme

Burry highlights dangerous market patterns and warns investors of a potential crash driven by overinvestment in AI

Michael Burry has deregistered his hedge fund, Scion Asset Management, with the decision confirmed on 10 November. The move follows his cryptic posts weeks earlier about an AI bubble forming, suggesting that the best approach is 'not to play at all.'

Burry, renowned for his contrarian bets—including his famous wager against the 2008 housing market—has made hundreds of millions of dollars betting against bubbles in the past. His decision to close Scion ends the fund's requirement to file public disclosures with regulators, effectively removing it from the scrutiny of the US Securities and Exchange Commission (SEC). He believes that the current market landscape, characterised by overstretched valuations, is out of sync with his value-based investment philosophy.

Warning Signs of an Impending Market Downturn

Burry's confidence in a looming market downturn stems from his concerns over an AI bubble. Evidence of his bearish stance is apparent in his latest SEC filings, which show substantial bets against AI giants like Nvidia and Palantir Technologies.

In recent weeks, Burry has used pop culture references to warn about the risks. After drawing parallels to the 1983 film WarGames, he turned to The Lord of the Rings to further illustrate his warnings. On Sunday, he posted on X, teasing more of his contrarian research with the message: 'One chart to refute them all ... to be continued Nov 25th, or before.'

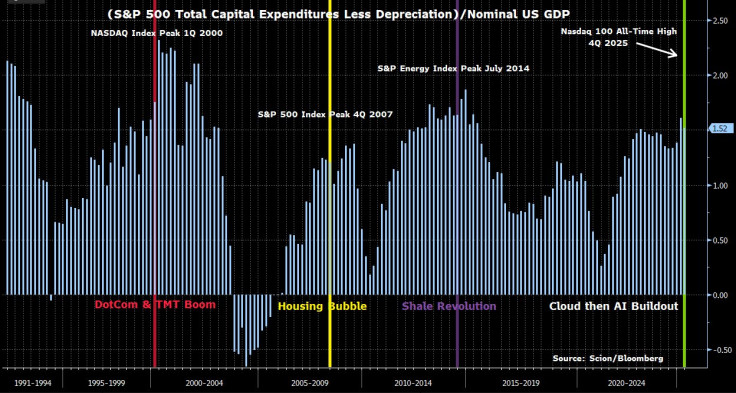

He also attached a chart tracking the S&P 500's total capex over the past 35 years, with depreciation subtracted and amounts divided by US GDP. His intention could have been to highlight new investments and display them as a share of the economy's total output.

The chart revealed that US stocks have topped out in the middle of past investment booms, while capital spending kept increasing or remained elevated for another year or two before crashing hard. Overall, he possibly wants investors to understand that periods of overinvestment are followed by major market corrections.

The Pattern of Overinvestment and Market Crashes

Burry's chart clearly illustrates key market peaks: the Nasdaq index before the dot-com bubble burst, the S&P 500 preceding the housing crash, and the S&P Energy index before oil prices plummeted. Each of these peaks was followed by a significant downturn, often lasting years.

His warning suggests that the current record-high of about 26,000 points on the Nasdaq 100 could mark the market's peak within the current capital cycle. While major US tech stocks like OpenAI, Meta, and Nvidia continue heavy investments in chips and data centres, Burry hints that these may be the final overextensions before a severe correction.

If history repeats itself, AI companies could maintain high levels of spending for another two years before a market crash triggers a recession. Burry's analysis implies that the ongoing investment frenzy in AI could be a sign of an approaching bubble that is destined to burst.

A Look Ahead

Burry also announced that he will soon appear on a podcast hosted by The Big Short author Michael Lewis, marking the 15th anniversary of the book and the 10th anniversary of the blockbuster film adaptation.

His warnings serve as a stark reminder for investors to remain cautious amid the hype surrounding AI and high valuations. While the market may currently appear robust, Burry's historical insights suggest that overinvestment and speculative bubbles often lead to painful corrections.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks and past performance doesn't indicate future returns.

© Copyright IBTimes 2025. All rights reserved.