Sterling Back Down as UK PMI Drops to 17-Month Low

Sterling dropped off sharply and traded near a three-week low against the dollar on Wednesday as the Markit/CIPS manufacturing PMI fell to a 17-month low in September - weakening the call for sooner rate hikes by the Bank of England.

GBP/USD fell to 1.6162, matching the 16 September low, a break of which will lead to a three-week low.

The pair seems headed for its sixth straight day of losses and is not far away from the 10-month low of 1.6052 when worries about the Scottish referendum was high on agenda.

Against the euro, the pound was strong as the German PMI was a disappointment but then the UK currency lost ground as its numbers was a bigger negative surprise.

EUR/GBP dropped 20 pips to 0.7770 after the German data but recouped most of the losses shortly as the UK PMI was worse. The cross is still near the 26-month low of 0.7766 touched on Tuesday, indicating the pressure on the common currency relative to the pound.

The UK manufacturing PMI came at 51.6 for September, down from 52.2 in August while analysts were anticipating an unchanged reading.

Markit said the easing of output and new orders growth was the main drag on the index while price pressures remained subdued.

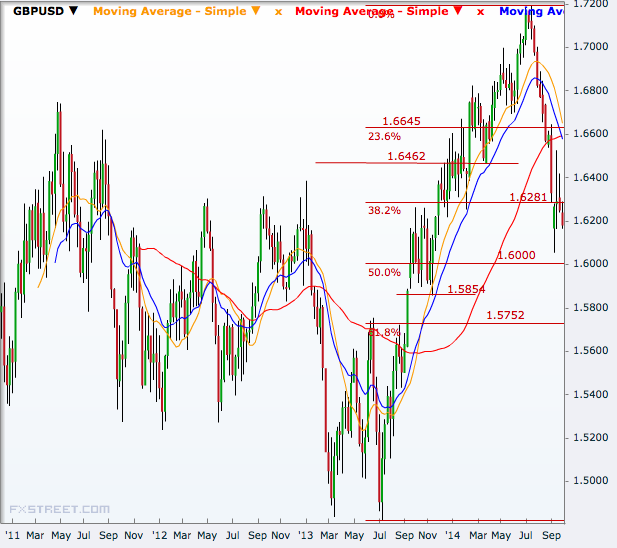

Sterling Technical Analysis

A break of the pre-referendum low will take the pair to 1.6000, a psychologically important level, which is also endorsed by the 50% retracement of the one-year rally through this July.

Beyond that, GBP/USD will aim 1.5854 and 1.5752 before breaking the 1.5 mark, which will open doors to 1.50 area.

On the higher side, 1.6281 is the nearest target but a break above 1.6462 seems crucial for the uptrend to resume. Further north, the pair may target 1.6645 before rallying to 1.7 and beyond.

© Copyright IBTimes 2025. All rights reserved.