'Stop Following the Wrong Money Advice': Netflix's Ramit Sethi Shares Exact Steps to Go From $0 to $100K

Personal finance expert Ramit Sethi shares a five-step system to help anyone grow their wealth from $0 to $100,000 while living comfortably.

Ramit Sethi, New York Times bestselling author and star of the Netflix show 'How to Get Rich', has shared a refreshingly realistic game plan for going from broke to $100,000. His five-step framework outlines how to build sustainable wealth—without sacrificing life's pleasures.

Rather than dishing out tired advice like skipping lattes or never travelling, Sethi focuses on creating systems that let your money grow in the background, while you continue to live what he calls a 'rich life'.

Ramit shared his insights on how to earn $100,000 from $0 by exploring this concept, encouraging his audience that doing so won't detract from living a rich life.

Eliminate High-Interest Debt

Before building your finances, readers have to take compound interest into account. Essentially, this occurs when the interest on your savings also earns interest.

The key takeaway here is the snowball effect it has. The longer your money is left to compound, the more dramatic its growth will be in building wealth.

That said, the first step is to eliminate high-interest debt, which requires awareness of a few personal financial numbers. This includes how much debt you owe, the interest rate, and the exact date (month, year) you project yourself to be debt-free.

When you have debt, compound interest is working against you. Ramit emphasises that people have to stop giving money to banks and credit card companies.

For example, if someone has an annual return of 7%, 27% of collective credit card interest can eliminate steady gains. Once this is cleared, you can allocate your finances into investing, pouring more into existing investments, and build wealth faster.

Build The CEO System

Ramit has established himself for his keen outlook on financial freedom. With that, he discussed building a system that you control, and therefore doesn't control you.

First is 'C', or cutting costs, which doesn't mean spending less on food or electricity. Ramit says people don't have to cut costs on everything, and that they shouldn't.

His main point here is cutting costs mercilessly on things you don't care about. To help people root these out, he talks about four (4) key numbers. This includes fixed costs, investments, savings goals, and guilt-free spending.

This means spending more on the things you love at the cost of cutting back on stuff you don't. Some things matter more than others, which people have to be honest with themselves about.

The next part of the system is 'E', or earning more. He notes that income alone won't make you rich, but building the skill of earning more money is key.

This may come in different, effective forms, such as getting a raise or rewriting a resume to secure a job. What is less effective is completing multiple surveys for $3 each.

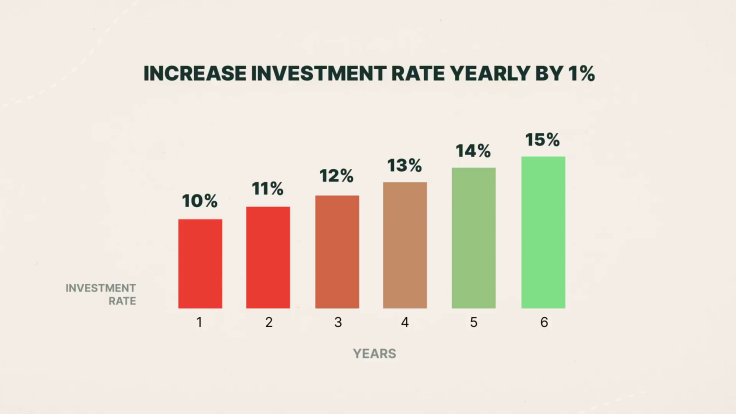

A key tip he shared was the 1% December Increase, which is increasing your investment rate by 1% every year. This number is so negligible that investors won't even mind doing this once every year. It will even scale as you start earning more.

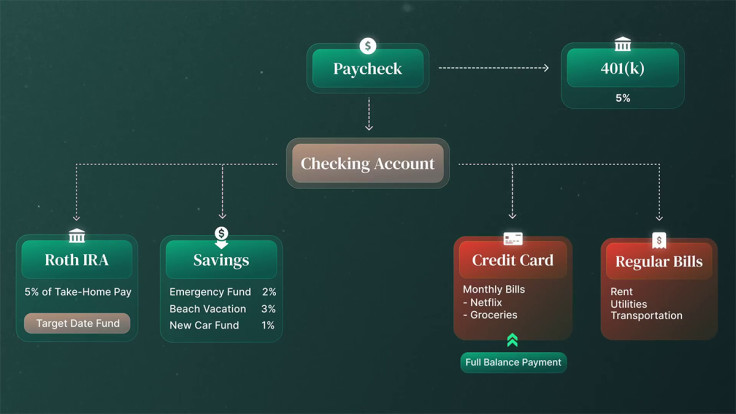

The last part of the system is 'O, which is optimising finances. To get started, you need to set up your automation flow first. This means not having to constantly check apps for payments or wonder where your money is going.

When integrated, money should be flowing like water, automatically going into savings, investments, or even a budget for eating out. Here's an image of what this could look like below.

Usually, banks and related apps will let you set up deposits from your checking account directly into savings and more. Modern banking enables you to move your money flexibly with just a few taps, so make use of it.

Ramit says it best: automation is not just lazy, it's powerful. This allows people to let go of budgeting apps and tracking to make room for a system that works independently.

Building A Financial Moat

This concept is a safeguard for people dealing with unexpected costs like medical bills, car damage, or other urgent expenses. Ideally, this ensures you for 3-6 months of living expenses and can be retrieved from an easily accessible emergency fund.

Living expenses include rent, utilities, and groceries. Ramit also noted that the emergency fund should be able to earn a little bit of interest.

He added that it's all right if some people don't have the exact costs down to the dollar. He adds 15% to his fixed costs to handle things he didn't anticipate.

Ramit stressed that your emergency fund should not be invested. Investing suggests that you won't need it for years, which is counterintuitive for its purpose.

He says that emergency funds should be under savings as he understands that 'life happens.' Similar to how compound interest works, maintaining emergency savings will eventually lead to 12 months of insurance coverage for living expenses.

The whole idea is that having cash sit there, quietly liquid, guarantees you peace of mind. Once you go past a year's worth of living expenses, your money will have better places to go to.

Investing In The Right Things

Instead of pouring the majority of your portfolio into Bitcoin, Ramit recommends exploring index funds and target-date funds. These are simple, low-cost options that can generate a significant amount of money in the long term.

Essentially, index funds are just baskets of stocks that diversify your money for you. To support this, he noted that over 80% of managers lose to index funds, which can be found in major brokerages.

Meanwhile, target-date funds are a different matter altogether. These are one fund, and you pick it based on the year you plan to retire.

So, if you plan to retire in 2060, you have funds like Vangard Target Retirement 2060 Fund out there. What he likes about these funds is that they're automatically diversified, and it's a 'set it and forget it' investment.

This means that it becomes less risky as you get older. After all, your investments should be more conservative when you're 60-70 years old, as opposed to the aggressive approach you may have taken in your 20s-30s.

Build The Right Environment

This is the simplest tip in the bunch, but it requires you to stop asking less financially sound people for advice. It's simply surrounding yourself with people who normalise wealth-building and come with trustworthy financial guidance.

The key to this is finding people who discuss this in a way that is sustainable, long-term, and reasonable. In addition, you shouldn't limit yourself to your friends, as creators like him often have a YouTube channel for assistance.

In his words: 'Stop following the wrong money advice.' With the right mindset, systems, and support, building a six-figure net worth is not only possible—it's surprisingly achievable.

© Copyright IBTimes 2025. All rights reserved.