Trading Has Never Been Easier to Enter

The Trading Revolution: How technology, lower costs, and accessible education are making financial markets open to all

Trading has always been one of the biggest financial mechanisms in the world. Trading goods, silver and gold as commodities between private people has grown considerably over the past few decades. Now, there are entire markets, industries and platforms that specialise in the trading of commodities around the world. You're no longer limited to what you can trade around you but rather, you have the whole world's trading industry at your disposal. It is reported that stocks have a global value of $127 trillion (global market cap in 2024), which is an astronomical figure. But it's not just about stocks. Take gold, for instance. The daily gold trading value is over $417 billion. Again, this is per day. This shows you how massive these markets are. Or the new kid on the block, cryptocurrency, which has only been around since 2012, is already worth hundreds of billions in trading value per day.

As you can see, the sizes of these markets are massive. How are they so big? Well, because billions of people across the world can access them almost instantaneously. Trading has honestly never been easier to enter and engage in than it is today. What was once something reserved for those with elite access has turned into something anyone with a little bit of digital access can have. The safety level is much easier and inclusive, as the digital world has become more sophisticated and more secure, which in turn has made trading even more enticing. If you'd like to learn more about the trading industry, its development and how it's become easier to access, then keep reading.

How Technology Has Become the Great Equaliser

Technology in online trading is the real reason barriers have fallen so quickly. It's not just that you can access online trading markets with your phone; it's that you now have intelligent tools, educational dashboards and data streams that you'd typically never be able to access. Think about it, your mobile phone or laptop used to be for the basics. You had to be part of a big company to get real data and analytics. But now, that's not the case anymore. Technology has made everything more accessible.

You can analyse price charts in real time, access news almost instantly, learn strategies from free content, practise through simulated environments and compare different assets without complicated software. As you can see, technology has had a serious impact. In the Forex market, a massive 92% of trades were performed by algorithms as of 2019. In the US stock market, automated trading makes up more than 50% of the volume. This clearly shows the hand and role that technology has in trading.

That kind of accessibility makes a massive difference when you're just starting out. Instead of needing a mentor or years of trial-and-error, you can learn as you go and understand the basics far more quickly. Technology has also made the markets feel more human. You're not staring at a wall of numbers; you're interacting with interfaces that are designed to teach you along the way.

Lower Costs Mean You Can Start Without Heavy Pressure

One of the biggest reasons more first-time traders are joining the markets is the reduction in financial pressure. You no longer need a large amount of capital just to test the waters. It's not about being a big spender anymore and in fact, that is actually discouraged.

Lower entry costs allow you to experiment without risking too much, learn through experience rather than theory, understand your personal risk tolerance and make mistakes without devastating financial consequences.

In the past, the mere idea of trading came with a sense of risk that outweighed potential benefits. Now, you can start small and get more involved when you feel comfortable. That gives you room to grow at your own pace. The more manageable the costs are, the easier it becomes to take that first step. And once you do, you often realise the markets aren't nearly as intimidating as they used to seem.

Education Is No Longer a Privilege Reserved for Experts

Another massive factor behind the surge in first-time traders is the rise of accessible education. Learning the basics used to require expensive courses, thick textbooks or financial degrees. Now, you can access guides, tutorials and in-depth explanations for free. You can genuinely just hop onto YouTube and you'll see tutorial after tutorial explaining how you can best approach trading. The one thing to keep in mind here, though, is that these guides are not necessarily vetted. This means that you shouldn't follow them to a tee. Diversify your research so that you can get a better picture of what's going on.

This kind of educational availability means you can:

- Learn market terminology in plain English (or a language of your preference).

- Find step-by-step explanations for complex topics.

- Understand risk before you take it.

- Explore different trading styles to see what suits you.

- Build confidence before investing a single pound.

All of these steps will allow you to be better equipped to deal with learning. Education creates knowledge and the more you know, the longer you'll likely stay on trading sites. Approximately 80% of day traders lose money within the first year and nearly 40% quit within the first month because it's not an industry built for everyone. After three years, only about 13% of day traders remain active in the market and only around 4% of day traders manage to make a living from trading.

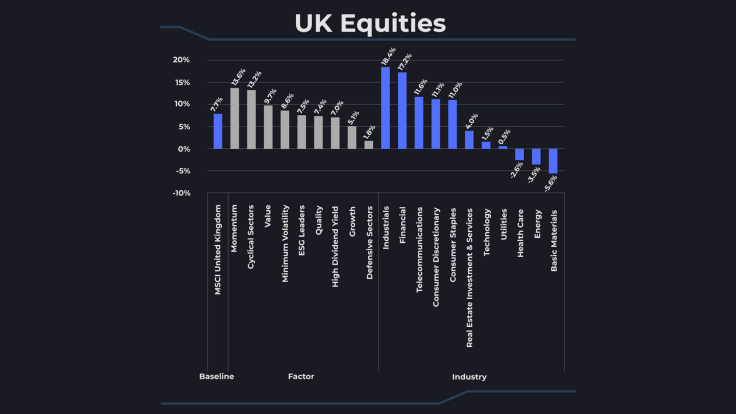

Education also includes understanding the UK market around you and how this could impact the trades you're about to make. This includes a lot of the graph below:

Why Convenience Plays a Bigger Role Than You Think

Convenience is often overlooked but it's one of the most powerful reasons new traders are entering the markets today. Your daily life has probably shifted online in countless ways and trading has followed the same pattern.

You can now track the markets while you commute, make decisions during lunch breaks and manage your positions without a desktop setup. Plus, you can react to news within seconds and fit trading naturally into your existing routine.

Flexibility makes the entire process feel far less intimidating. You don't have to carve out hours of dedicated time or rearrange your schedule. Instead, you can explore trading on your own terms, whenever it suits you.

The Psychological Shift: Trading Doesn't Feel Out of Reach Anymore

One of the most interesting changes happening today isn't technological or financial; it's psychological. The image of a trader has evolved dramatically. You no longer have to picture yourself as some high-flying exec who lives and breathes Wall Street. You can literally just be someone at home who knows a fair amount about financial markets and patiently makes some trades off their laptop while sitting at home.

This has honestly made accessing trading a lot bigger because it feels familiar and manageable. Plus, it feels like something others like you are doing and it doesn't carry a sense of elitism.

The markets feel more open because the culture around them has changed. You're no longer expected to fit a stereotype or commit your entire life to trading. You can engage as you please.

The Rise of Personal Finance Awareness Is Fueling Curiosity

People today are far more aware of personal finance than previous generations. Conversations about money, investing and long-term planning are more common. You're encouraged to think about your financial future earlier and more openly.

Because of this, you might feel more motivated to explore investing options, curious about building wealth, interested in long-term financial stability and eager to learn how markets work in real life.

The more you hear about financial independence, side income or passive growth, the more trading becomes a natural area of interest. It's no longer something people avoid talking about; it's something they actively research.

The Danger of Easy Access: What You Still Need to Watch For

Lower barriers are great but they also come with risks you shouldn't ignore. The easier something is to start, the easier it is to underestimate.

Some of the main dangers include trading without a real plan and taking risks you don't fully understand. This will put you in deep waters that are not ideal for you. It could also mean assuming speed means opportunity, which everyone should know it doesn't and making the mistake of letting emotions overrule your logic. You should never fall into habits formed by guessing rather than by strategy.

Just because you can trade doesn't mean you should rush into it. The key is to use the accessibility to your advantage, not as a shortcut.

Turning Accessibility Into a Long-Term Advantage

If you approach this new era of trading thoughtfully, you can turn the lowered barriers into something meaningful and long-lasting. You don't have to become a full-time trader or aim for unrealistic returns. You simply need to understand that the tools available to you today give you the power to manage your financial future in ways that used to be far more restricted.

You can grow at your own pace and build your own style. You can make decisions based on your own priorities instead of someone else's expectations. And you can learn through practice without feeling punished by the system.

You Don't Need Permission to Begin

The markets are more open than they have ever been and you don't need a particular background, a huge amount of capital or a set of insider skills to get started. You simply need curiosity, patience and a willingness to learn.

The barriers that once stopped so many people from even trying have fallen away and that means the path forward is clearer than ever. If you've been thinking about exploring the markets, there has never been a more welcoming moment than now.

© Copyright IBTimes 2025. All rights reserved.