Treasury Secretary Bessent Warns: Government Shutdown Could Hit US GDP — Markets on Edge

Bessent says shutdown could hit GDP and growth — investors brace for economic fallout as political gridlock deepens

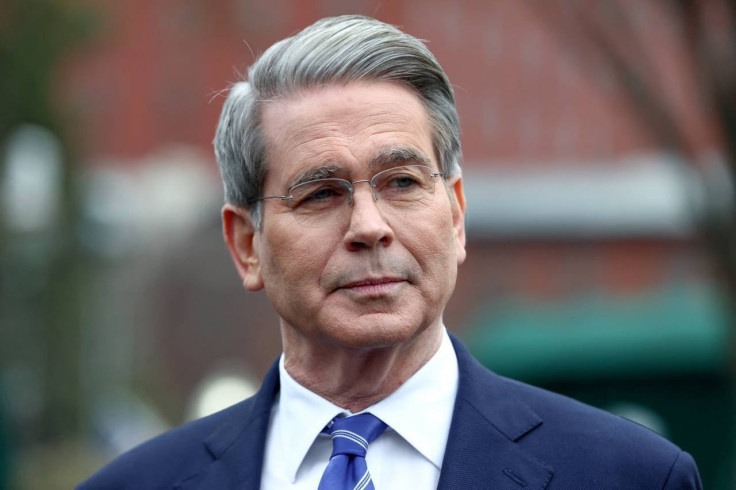

The United States faces a mounting economic threat as Treasury Secretary Scott Bessent warned that the ongoing government shutdown could deal a major blow to GDP and undermine working Americans.

Speaking on CNBC's Squawk Box, Bessent stressed that the impasse risks reversing recent economic momentum: 'This isn't the way to have a discussion, shutting down the government and lowering the GDP. We could see a hit to the GDP, a hit to growth and a hit to working America.'

The shutdown, which began at midnight on Tuesday, has already led to the furlough of thousands of federal workers and the suspension of key services.

Economists warn that if the deadlock continues, it could ripple through the broader economy, curbing consumer confidence, delaying critical data releases, and unsettling financial markets.

Political Gridlock Fuels Uncertainty

The shutdown stems from Congress's failure to pass a continuing resolution to fund government operations. Bessent placed blame on Democratic leadership, accusing them of blocking a clean funding bill while demanding $1.5 trillion (approximately £1.12 trillion) in new spending. He likened the proposed measures to the Inflation Reduction Act, which he claimed 'caused the worst inflation in half a century.'

President Donald Trump has reportedly considered mass layoffs of federal employees, a move that could exacerbate the economic fallout. Bessent dismissed the idea as a 'talking point,' but acknowledged that prolonged disruption could be more damaging than previous shutdowns, especially given the scale of the federal workforce affected, estimated at 750,000 employees.

Markets React as Investors Seek Safe Havens

Financial markets have responded nervously to the shutdown. The S&P 500 dipped slightly on Wednesday before recovering modestly, while bond yields edged lower and gold prices surged as investors sought safer assets. Analysts say the uncertainty surrounding the shutdown is compounding existing concerns about inflation and interest rate policy.

Despite GDP growth running at an annualised rate of 3.8% in Q2, with similar projections for Q3, Bessent warned that the shutdown could derail momentum. 'Growth in the US has been on an upward trajectory, but this kind of disruption risks reversing that progress,' he said.

The Bureau of Labour Statistics has already indicated that it may not release the September jobs report if the shutdown continues, and inflation data scheduled for mid-October could also be delayed. This absence of economic indicators could hinder decision-making for both policymakers and investors.

Federal Workers and Services Bear the Brunt

The immediate impact of the shutdown is being felt by federal employees across various agencies, including the CDC, the Social Security Administration, and the Department of the Interior.

Many have received warning emails about potential furloughs and job insecurity, with some reports suggesting that politically charged language is being used in internal communications, blaming Democrats for the funding deadlock.

Beyond the workforce, the shutdown threatens to stall infrastructure projects, delay health care funding, and disrupt services relied upon by millions of Americans. The Office of Management and Budget has already frozen approximately $18 billion (equivalent to £13.4 billion) in infrastructure funds earmarked for New York's subway and Hudson Tunnel projects.

Outlook: Prolonged Shutdown Could Have Lasting Impact

While previous shutdowns have typically had limited economic impact, experts caution that the current situation could be different. Congressional Budget Office Director Phillip Swagel recently told the Associated Press: 'The impact is not immediate, but over time, there is a negative impact of a shutdown on the economy.'

With no resolution in sight and Congress not expected to reconvene until next week, the pressure is mounting. Investors, businesses, and federal workers alike are bracing for further disruption and watching closely to see whether Washington can break the deadlock before lasting damage is done.

© Copyright IBTimes 2025. All rights reserved.