US Inflation Hits 3% — How Will It Affect Your Grocery Bill, Rent and Savings?

Rising prices continue to squeeze households across the United States

Inflation in the United States ticked up to 3.0% year-on-year in September 2025, according to the latest data from the Bureau of Labor Statistics (BLS), marking a slight but significant increase from previous months.

The rise was largely fuelled by persistent costs in food, shelter and energy, raising fresh concerns about the Federal Reserve's ongoing struggle to stabilise prices and ease consumer burdens.

The Consumer Price Index (CPI) data, released after a brief delay due to a partial government shutdown, showed that prices rose 0.3% month-on-month. While this figure came in slightly below economist expectations, the annual inflation rate underscores the challenges US households continue to face.

Food Prices Still Climbing

According to the BLS, the food index rose by 3.1% over the past year. Grocery costs, tracked under the 'food at home' category, increased by 2.7%, with some staples soaring even higher.

Products such as meats, poultry, fish and eggs recorded the steepest hikes, exceeding 5%. Non-alcoholic beverages also contributed to rising basket totals. Although dairy prices fell slightly by 0.5%, analysts say this has done little to ease overall grocery expenses for American families.

'A slower-than-expected inflation reading is a welcome sign,' said Wells Fargo economists in a client note, 'but consumers are still seeing pressure in day-to-day essentials.'

Shelter Remains Key Pressure Point

Housing continues to be the most stubborn and significant component in the inflation equation. The shelter index climbed 3.6% year-on-year, reflecting ongoing rent and mortgage strain across major US cities. Month-on-month gains were smaller but continue to add cumulative pressure, particularly for tenants locked into short-term leases.

With housing supply tight and demand steady, economists warn that relief is unlikely unless new housing developments significantly increase. 'Shelter costs remain sticky,' said KPMG's chief economist Diane Swonk, referencing ongoing challenges in moderating rent-related inflation.

Real Savings Take a Hit

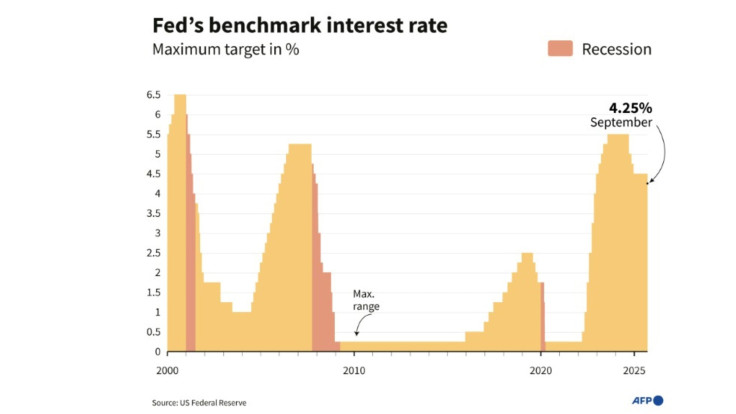

While interest rates have improved from near-zero levels in previous years, inflation still outpaces most high-street savings account returns. At 3% inflation, savers earning 2% interest effectively lose 1% of their purchasing power each year.

Financial experts advise households to monitor real returns — the net gain after accounting for inflation — when evaluating savings or investment decisions.

'Maintaining cash in low-yield accounts is no longer a neutral decision,' said personal finance consultant Rachel Tomlinson. 'It can actively erode your financial position.'

Energy and Global Risks

Energy costs, particularly petrol prices, saw a notable rise in September. According to AFP, gasoline prices jumped 4.1% month-on-month, becoming a key driver of overall inflation.

Despite the rise, core inflation, which excludes volatile food and energy items, also hit 3.0%, falling slightly below expectations and sparking speculation about the Fed's next move.

Futures traders now place a 97% chance on a 25 basis point rate cut at the Federal Reserve's upcoming meeting, according to CME Group data. The move would lower the benchmark lending rate to between 3.75% and 4.00%, in an effort to balance inflation control with sluggish job growth.

What's Next for Consumers?

Consumers are urged to pay close attention to three core areas: grocery prices, rent changes and savings yields. Adjusting household budgets in response to inflationary trends can help mitigate the impact of rising living costs.

Though some officials have framed the current CPI numbers as encouraging, analysts caution that price volatility, especially in energy and housing, may continue into late 2025.

For now, while headline inflation remains below its mid-2022 peak, the 3% rate still presents a tangible cost-of-living challenge for millions of American households.

© Copyright IBTimes 2025. All rights reserved.