Wise Favours US for Primary Stock Listing: Is This Goodbye for Its London Listing?

Wise reported robust full-year results for the year ended 31 March 2025

Amidst a handful of companies exiting their listing in London in favour of other markets, global financial services company Wise is also joining.

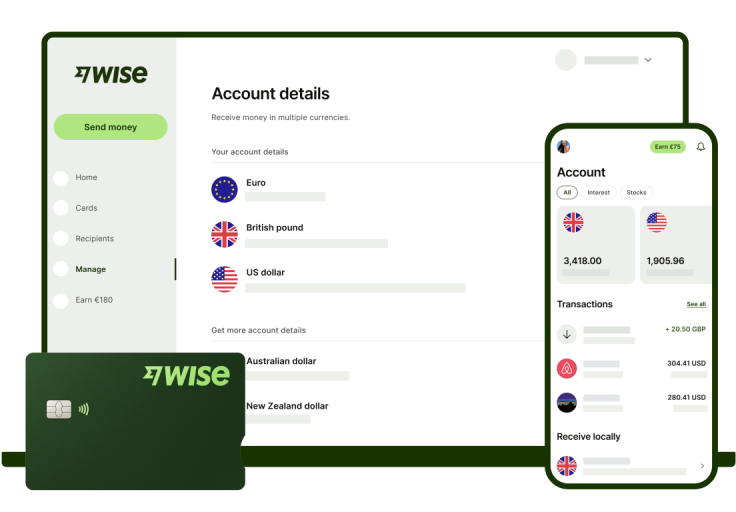

The company, widely used by enterprises to send funds to overseas banks, recently announced that it will be adding a US listing to its share listing and making it its primary listing moving forward.

Why Opt for a New Listing

In a recent update, Kristo Käärmann, Wise's Co-founder and Chief Executive Officer, stated that Wise plans to pursue a dual listing of its shares in the US and UK.

Kristo aims to accelerate its mission by gaining strategic and financial benefits, such as increasing brand awareness in the US—its largest market—and accessing deeper capital markets.

'We believe adding a primary US listing would help us accelerate our mission and bring substantial strategic and capital market benefits to Wise and our Owners. These include helping us drive greater awareness of Wise in the US, the biggest market opportunity in the world for our products today, and enabling better access to the worldʼs deepest and most liquid capital market,' he explained.

He stated why they would still retain their UK listing: 'The UK is home to some of the best talent in the world in financial services and technology, and we will continue to invest in our presence here to fuel our UK and global growth.'

What Does Wise's Full Year Results Look Like?

Wise reported robust full-year results for the year ended 31 March 2025. Revenue grew 15% to £1.21 billion, driven by a diversified income mix: cross-border transfers, card services (£219.8 million, +31%), other fees (£151.7 million, +71%), and interest income (£150.4 million, +25%).

Meanwhile, underlying income rose 16% to £1.36 billion, with a gross profit margin of 75%. Reported profit before tax climbed 17% to £564.8 million, with underlying PBT at £282 million, representing a 21% margin.

With this, Wise ended the year with 15.6 million active customers—a 23% increase—handling £145.2 billion in cross-border volume.

A Warning Sign for London's Stock Performance?

Aside from Wise, several high-profile companies have shifted their primary listings from London to New York, citing superior market liquidity and higher valuations.

For instance, construction equipment rental firm Ashtead revealed plans to shift its primary listing to the US last year, joining others like Flutter Entertainment and CRH, which had already made similar moves.

This week, drugmaker Indivior announced it would cancel its remaining secondary listing in London, having relocated its primary stock listing to the US in 2024. Meanwhile, metal investment firm Cobalt Holdings abandoned its proposed London IPO, which was expected to raise around $230 million (£170 million).

Will it Work: US or UK Listing?

Wise's plan to dual list in the US and UK highlights contrasting growth dynamics. The US offers greater investor awareness, deeper capital markets, and stronger valuations—making it the most promising market for Wise. By listing in New York, Wise aims to access more liquidity and expand its presence in its largest market.

In contrast, the UK remains strategically important but faces challenges retaining fast-growing tech firms. Wise will keep investing in its UK operations. Still, the move underscores London's struggle to compete with US exchanges in attracting and retaining innovative companies seeking global scale and financial flexibility.

© Copyright IBTimes 2025. All rights reserved.