Commodities outlook 2017: Opec shenanigans, dollar strength and all that doesn't glitter

Gold and silver could have contrasting fortunes over the next 12 months, while the direction of oil futures hinges on Opec's accord holding up.

The commodities market has had an interesting 2016 to say the least – whether we're talking safe haven calls, interventions by cartels, dollar strength, Donald Trump, Brexit and all the rest of it. However, of all the factors behind the market kerfuffle, it was the relative strength of the dollar that had a bearing to varying degrees on all natural resource contracts.

The greenback rallied to the prime position of being the best performing currency in 2016, after the US Federal Reserve, first indicated, and eventually carried out its proposed 0.25% interest rate hike towards the flag-end of the year. For all dollar denominated futures and spot contracts, the US currency's position of strength matters, and its weight reflected on much of the market in the months leading up to the decision on 14 December and in the days after the event.

It was particularly apparent for gold contracts, with investors left tearing their hair trying to reconcile downward pressure from the Fed's antics versus safe haven calls in a macroeconomic climate that had to contend with the run-up of the UK's 23 June Brexit vote, and its subsequent outcome, and first the possibility and eventual reality of a Donald Trump presidency.

Add to it eurozone woes, the never-ending doubts over the fate of the Italian banking system, and general concerns over the health of the global economy.

Precious metals likely to be fatigued and 'Fed' up!

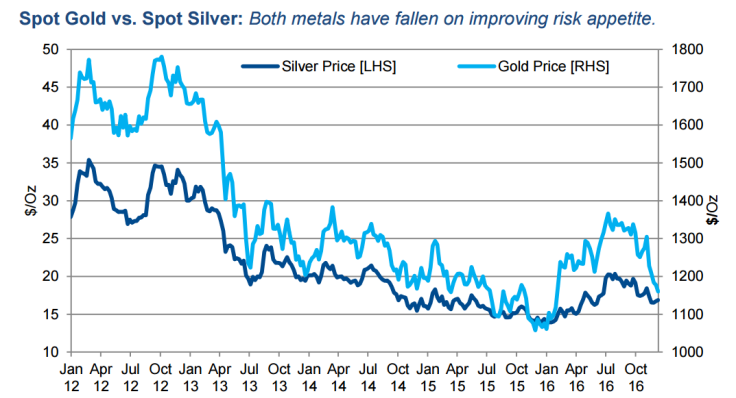

On the first full trading day of 2016 (4 January) the Comex gold contract, often considered the most watched futures contract in the precious metals market, stood at $1,075.20 an ounce. However, by August it had capped at $1,372 an ounce; and it turned out to be its peak for 2016. Marking a volatile year-end to 2016; it is lurking just above $1,131.40.

If we even out the volatility, the average net uptick for the said period still comes to a 5% gain on an annualised basis. Net gain it might well have been on a 12 month basis for 2016, but the Fed's current stance makes banking on the upside for the yellow metal all that much harder.

More so as Chairwoman Janet Yellen has opined that the US central bank could introduce another three rate hikes over the course of 2017. This for a central bank that has only hiked twice over the last decade.

Its a no-brainer that the Fed's stance constitutes bad news for precious metals in general, and gold in particular, according to FXTM Research Analyst Lukman Otunuga. "With markets expecting higher US rates in 2017 and the dollar set to appreciate further, gold could find itself vulnerable to heavy losses. As the year slowly comes to an end, traders may observe how the metal reacts to the intraday $1,125 support which if broken could open a path lower towards $1,115."

Veteran technical analyst and TipTV anchor Zak Mir reckons there is a realistic prospect of gold testing the $1,000 level. "It could be said that if you want a 'reliable' signal for a gold turnaround in 2017, a weekly close above the five-year resistance line would be the event to wait for. Otherwise, the risk is of a decline back to the support line drawn from the end of 2010, currently pointing at $1,000," Mir wrote in IBTimes UK.

Unlike gold, silver futures were at one point 39% higher on an annualised basis, with the Comex silver contract spiked from $13.841 an ounce on 4 January to $20.50 on 8 August. From there on, Fed sentiment and lower industrial demand knocked the stuffing out of silver bulls, taking the precious metal down to its current intraday range of $15.83 to $16.10.

However, Kash Kamal, senior research analyst at Sucden Financial, believes silver has a stronger fundamental outlook which may see the commodity strengthen towards its 200-day moving average at $17.76 an ounce.

"Physical demand remains strong and as only a quarter of silver is produced from dedicated silver mines, supply prospects remain weak. Nonetheless, despite a strong fundamental outlook, we may see silver soften in the first few months of 2017 as the commodity suffers from a strong dollar and a US interest rate increase."

'Crude' question of Opec and non-Opec cuts holding firm

If anything quite beats the volatility seen in the case of precious metals, its oil - the poster commodity that catches most speculators' fancy. A combination of lacklustre demand projections, macroeconomic uncertainty and oversupply sent the global benchmark Brent tumbling down to $27.10 per barrel at one point in January.

For crude producers' cartel Opec, increasingly involved in a war of attrition with North American unconventional oil producers, especially US shale players, the situation was getting desperate.

In February, the cartel proposed that a coordinated action be taken between Opec and non-Opec producers, and roped in the Russians for talks. However, talks faltered, only for another price decline to prompt yet another round of talks in April which faltered as well.

Finally, with Opec's November summit approaching, and Brent lurking well below $50, talks between Opec and non-Opec producers picked up pace again. On 30 November, at its third attempt to address the situation, Opec agreed to cut its headline oil production by 1.2m barrels per day (bpd) to 32.5m bpd at the conclusion of its meeting in Vienna, Austria.

The bulk of the reduction, pencilled in for 2017, would come from Saudi Arabia, which would account for 486,000 bpd, while Iranian output will rise by 90,000 bpd with the Islamic republic consenting to keeping its production level below its stated ambition of 4m bpd.

Kuwait and United Arab Emirates would lower their production by 131,000 bpd and 139,000 bpd respectively, while Iraq would lower production by 210,000 bpd. However, Indonesia has suspended its Opec membership after expressing its inability to cut production given that it is a net importer of oil.

Opec also said non-Opec producers would lower their output. Barely 10 days on from Opec's announcement, selected non-Opec producers, excluding US, Canada and Brazil, but including heavyweight Russia, announced 558,000 bpd in production cuts, after talks with Opec counterparts in Vienna.

While the non-Opec cut fell short of a previously proposed 600,000 bpd cut, many in the market deemed it to be substantial, especially as Russia committed to a 300,000 bpd cut. However, not all market participants were convinced, with many analysts doubting the impact of the cuts in an oversupplied market.

Brian Coulton, chief economist at Fitch Ratings, said the cut "should help" accelerate market rebalancing and increase the chances of more rapid oil price recovery in 2017 than previously expected.

"But implementation risks remain, including Opec's adherence to the agreement and the willingness of other participants, notably Russia, to cooperate fully. These issues and US oil production dynamics will be key drivers of the oil price direction in the medium-term."

Others question whether the move, especially by non-Opec players, even constituted a real-terms cut. In a note to clients, investment bank Goldman Sachs said: "Despite the smaller-than-preannounced cut, the agreement is nonetheless noteworthy as it lifts the uncertainty on the potential participation of non-Opec producers to the Opec cut... Ultimately, this remains a short duration cut in our view, targeting excess inventories and not high oil prices."

With dust settling on Opec and non-Opec announcements, few believe there to be much by way of expecting the oil price to climb above $60. For starters, global demand growth remains stunted with many forecasters including Barclays and Morgan Stanley suggesting the figure could be well shy of 1 million bpd.

Geordie Wilkes, research analyst at Sucden Financial, reckons oil will trade between $50-60 in 2017. "Prices will nudge towards $65 per barrel if stocks are drawn down in a material way."

However, with US shale exploration proving to be more resilient than Opec, and in fact many other market participants, stable oil prices in such a range would only bring back additional barrels into the market, yet again applying downward pressure on the oil price trajectory.

With a new pro-oil US President-elect Trump in the White House, most expect a boost for the country's oil and gas business. If any proof was needed, ExxonMobil chief executive Rex Tillerson is Trump's nominee for the post of Secretary of State; the country's top diplomatic office, and Governor Rick Perry of the oil rich state of Texas is tipped to be Energy Secretary.

Of course, much of the discourse on price direction would be meaningless if Opec's commitment to cutting output does not hold, and price aggregators continue to record rising oil cargo dispatches from its producers early in the New Year. Were that to happen, the Opec-supported oil price bump to $50-55, would fizzle out as quickly as it bubbled up in a precariously positioned crude market.

© Copyright IBTimes 2025. All rights reserved.