Commodities outlook for 2017: Gold could be in for a whole lot of pain

Crude oil market isn't really firing up, but gold could be in for an even rougher ride over the next 12 months.

In the commodities sphere, it's been a volatile year for the crude oil market. Light crude plummeted to a low of $27 per barrel at the start of 2016, yet has rallied past $50 as the year-end approaches, helped in no small part by Opec and non-Opec producers announcing their first production cut pact in 15 years.

For its part, gold soared on safe haven demand, but is not looking quite so smug now as the dollar strengthens. Here's a look ahead to what I expect in 2017.

Gold: The Trump trap could lead to a retest of $1,000

I am going for the worst, first, in terms of the yellow metal. While it may be argued that no one looking at the price action of the major markets in the early hours of 9 November could really have got the directions wrong, they were admittedly rather counter-intuitive.

It was supposed to be the case that stocks would crash and gold rally after a Trump presidential victory. This theory was brought to us by people who did not necessarily want the man to win. Yet, at least from the perspective of the weekly chart, it can be seen how the failure above $1,330 an ounce was a predictable one technically.

It was predictable on the basis that the 2011 resistance line at just under $1,340 was, and remains, a hefty hurdle for a market to cross. Indeed, it could be said that if you want a "reliable" signal for a gold turnaround in 2017, a weekly close above the five-year resistance line would be the event to wait for.

Otherwise, the risk is of a decline back to the support line drawn from the end of 2010, currently pointing at $1,000. It can be assumed that under normal circumstances we shall not see the floor of the mildly converging price channel broken. But if it did, it would almost certainly be accompanied by the "normalisation" of interest rates which people are now associating with the President-elect.

WTI crude oil: An Opec, and a non-Opec boost

If Brexit and Trump were a 2016 combination this year that few people were expecting, for the oil world it could very well be said that deals to cut production from Opec and non-Opec countries was equally unlikely. But it has happened, and although cynics might suggest it may not last, so far the reaction from the markets has been enthusiastic.

Indeed, it could be argued, that even if one does not fully wish to embrace the idea of black gold being under control by its producers, an element of order does seem to have been established. As far as the technical outlook for the first part of 2017, as derived from the weekly chart, we can see the top of a relatively obvious trend channel from the start of 2016 heading for $60.

This was the peak area for 2015, and while it may appear to be a boring target, and with a relatively limited upside, from a supply-and-demand perspective it makes sense. At this stage, only a figure well below the 50-week moving average at $43.23 would begin to suggest that the recovery of 2016 was going to end in tears.

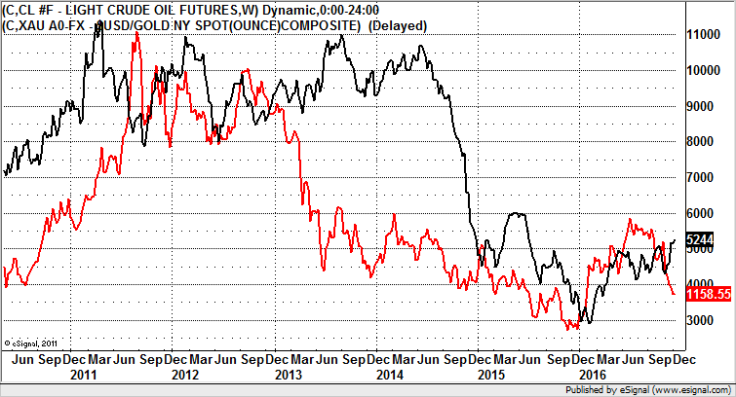

Gold versus crude oil: The crude oil buy flip

One of the less intuitive aspects of the recent recovery for crude oil, the Opec/non-Opec deal notwithstanding, is the massive divergence we have seen between the gold and oil markets. Interestingly enough, when you compare the traces of the two markets over the recent past you can see how there have been periods when they flip, and stay that way for quite some time.

The start of December has seen the push for crude oil back above that of gold, something which suggests that its period of strength versus the metal may not endure. But, if the example of 2013 is anything to go by, gold could suffer quite painfully, even after the sharp losses of autumn 2016.

Zak Mir has been involved with most areas of the City of London finance space for the best part of 30 years, as a stockbroker and derivatives dealer in the 1990s and then a financial analyst and commentator since 2000 appearing on Bloomberg, CNBC and the BBC. He is currently involved with expanding internet TV and production group TipTV. Follow Zak on Twitter.

© Copyright IBTimes 2025. All rights reserved.