Australian Dollar Down Amid Weak China PMI, Ahead of RBA Rate Decision

The Australian dollar moved lower early in Asia on 5 August as traders preferred to stay light on the currency ahead of the policy review by the Reserve Bank of Australia (RBA) while weak Chinese data added to the concerns.

The better-than-expected trade numbers from Australia may have helped to limit the drop.

AUD/USD dropped to 0.9317 from the previous close of 0.9314, partly reversing the gains over the past two sessions.

The pair had touched a two-month low of 0.9275 on Friday before a weaker-than-expected US jobs report pushed the greenback broadly lower, and helping a 0.7% rally in the Aussie dollar by Monday.

The RBA is widely expected to keep the main interest rate at 2.5% at the announcement at 4:30 GMT but the statement will be watched for the regulator's take on the direction of the economy and the health the Aussie dollar exchange rate.

Data on Tuesday showed that the China services PMI dropped to 50.0 in July, the lowest in the near nine-year series history, from 53.1 in June. Composite PMI fell to 51.6 from the fifteen-month high of 52.4.

"The weakness in the headline number likely reflects the impact of the ongoing property slowdown in many cities as property related activity, such as agencies and residential services, see less business," said Hongbin Qu, HSBC's China chief economist.

"In the coming months, we think the service sector may get some support from the recovery in investment. But today's data points to the need of continued policy support to offset the drag from the property correction and consolidate the economic recovery," Qu said.

Australia's trade deficit narrowed to $1,683mn in June from $2,043mn in May, better than analysts' estimates of $1,900mn, as per the data release at 1:30 GMT.

Also, according to the data released two hours earlier, the AiG performance of services index rose to 49.3 in July from 47.6.

Data on Monday had shown retail sales rebounded in June with a 0.6% growth compared to the 0.3% drop in the previous month. The consensus was for a 0.4% rise.

But overall, Australian data releases since the last policy review were largely on the negative side, hence the bearish sentiment on the Aussie dollar ahead of the policy.

In its latest report, Australian unemployment rate has increased to 6.0% in June from 5.9%, while the consensus was for a steady reading.

The challenges in the labour market is likely to influence the policy decision in a major way.

The local dollar is another major subject for the export-driven economy, and therefore, the fact that it is the most rallied major currency over the year to date with a 4.45% jump will also reflect in the policy statement.

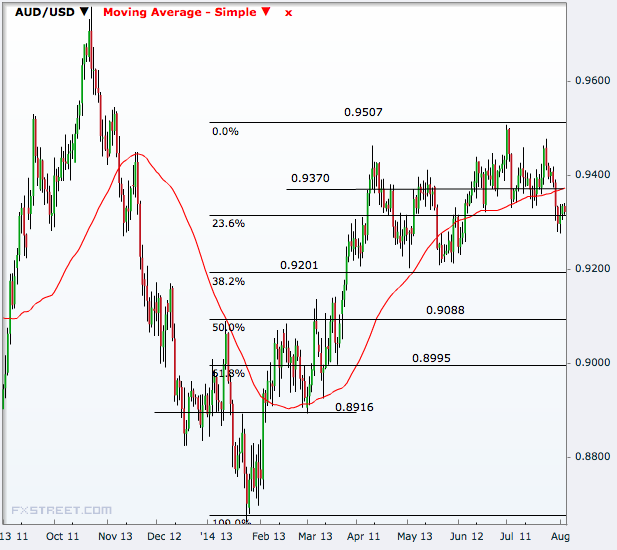

Technical Outlook

AUD/USD has its first support at 0.9275 and then at 0.9200, near the 38.2% Fibonacci retracement of the January-June rally.

The next support is the 50% level of 0.9088 and then the 61.8% mark of 0.8995.

On the higher side, the pair will have its first target at 0.9370, the level coincides the 50-day simple moving average on Tuesday.

Further north, 0.9411 and 0.9463 are important levels to watch ahead of the 1 July high of 0.9507.

© Copyright IBTimes 2025. All rights reserved.