Tipping Point: Bitcoin Passes Value of an Ounce of Gold

The decentralised digital currency bitcoin briefly passed the value of gold as its drive for legitimacy continue.

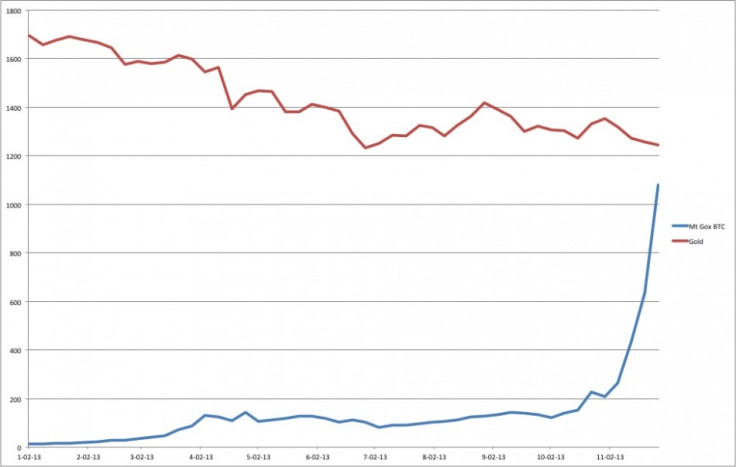

On Friday the decentralised crypto-currency Bitcoin,which passed the $1,000 (£611, €735) mark earlier this week, was briefly worth more than an ounce of gold, which will be seen by many supporters of the currency as a symbolic tipping point in the rise of the digital currency.

Bitcoin today hit a high of $1,242 on Mt Gox, the world's biggest bitcoin exchange, beating the price of gold which was $1,241.98 at the time. At the time of publication, bitcoin's value on the exchange has dropped back to around $1,160 while an ounce of gold remains relatively steady at $1,247.

The mysterious currency, which is not governed or regulated by any central bank, has gained widespread media attention this year due to its surging value - along with multi-million dollar thefts of the digital coins - and its associations with the darker parts of the web.

While bitcoin has seen its value surge 4,000% since the start of the year, the symbolic achievement of passing the value of an ounce of gold has also been facilitated by the falling price of gold, which has dropped from $1,700 an ounce at the beginning of the year.

Bigger than Google or Apple

Erik Voorhees, an early entrepreneur in bitcoin, told the CoinDesk website: "For believers, it means bitcoin is really becoming a 'respectable asset'. Clearly, bitcoin is no longer a penny stock. It's playing in the big leagues - a share being worth more than a share of Google or Apple, and even more than an ounce of gold."

In what now seems like a prophetic statement, bitcoin was recently described by the Winklevoss twins, famous for their disputes with Mark Zuckerberg over the creation of Facebook, as "Gold 2.0" and they expect to see its value rise 40-fold to achieve a market cap of $400 billion - it's value has already more than doubled since the twins made this comment just three weeks ago.

Created in 2009, bitcoin is mined by computers solving complex mathematical equations; over the years, the equations have become more difficult, requiring computers to work together to solve them. Once mined, the bitcoins can be exchanged online with participating retailers, or exchanged for fiat currencies like pounds and dollars.

Bitcoin is not the new gold

While an ounce of gold and one bitcoin may currently be valued around the same, there are significant differences between the commodity and the virtual currency.

For one, we know exactly how many bitcoins have already been mined, and more crucially, how many remain to be mined. There will only ever be a total of 21 million bitcoins in circulation, with just over 11 million of those mined so far.

With gold, we only have a rough idea of how much of it remains in the ground, yet to be discovered and mined.

Stable

Stability is also a big differentiating factor between the two. Gold is a relatively stable commodity which has been used for thousands of years. It is well-understood and is immune to bugs, hackers and power-cuts.

As we have seen with bitcoin in the last 12 months, it is the antithesis of stability.

We have seen huge peaks and troughs in the value of the crypto-currency throughout 2013, and the fact it is yet to be formally recognised by any government as a currency shows just how young and uncertain this platform is.

We have also seen that it is vulnerable to cyber-criminals and once stolen, the anonymous nature of bitcoin means retrieving it is virtually impossible.

© Copyright IBTimes 2025. All rights reserved.