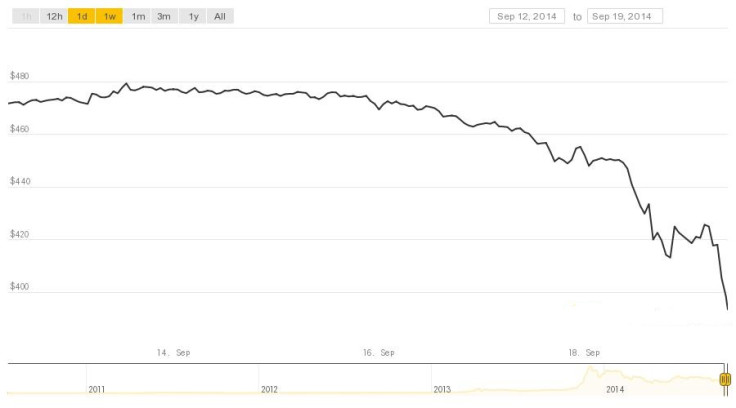

Bitcoin Price Crashes Below $400 to Lowest Level Since April

Bitcoin has fallen to its lowest price since April 2014 following a turbulent 24 hours for the world's most valuable cryptocurrency.

According to CoinDesk's price index, the price of one bitcoin dropped to as low as $390 (£238, €303). At the time of publication bitcoin's price remains hovering at around the $400 mark.

The price crash has been blamed on a variety of factors, with some analysts citing market traders setting their lowest bound exit point at $450. When the price dipped to this point, it would have therefore sparked a mass sell-off.

Other speculation centres on the idea that wider bitcoin adoption from retailers has meant that bitcoin is constantly being exchanged for traditional fiat currencies as soon as a transaction takes place.

Bitcoin advocate Charlie Shrem, a well-known figure within the cryptocurrency community, has dismissed this idea, referring to it as a "bearish" argument.

"People constantly keep citing this as an example of constant downward pressure but it is simply not true," Shrem wrote in a recent post on Reddit. "BitPay and Coinbase DO NOT sell Bitcoin on exchanges."

Shrem also said that the price fall should not be attributed to a proliferation of bitcoin mining operations. It has been suggested by some within the community that such operations dump bitcoin for cash after mining it in order to stay in business.

"Most large miners and mining corps that I know (which is more than half of them) have contracts and deals with brokers," Shrem said.

"These miners sell to brokers for 1% to 5% (sometimes more) under spot every day for cash/wire transfers. Large miners simply don't use exchanges, its too cumbersome, takes days to get your money out and risky."

A recent poll has suggested that the price of bitcoin could continue falling, at least in the short term, with 28% of respondents predicting bitcoin will remain in the $350-$450 price bracket. 52% of those who answered predicted that it would fall even lower than this.

© Copyright IBTimes 2025. All rights reserved.