Close Brothers Faces Tough Market Conditions, Uncertain on H2

Close Brothers, the specialist financial services company, expects its first half performance may be affected by a lower

contribution from securities notwithstanding continued strong performance from banking; it is scheduled to report its 2012

interim results on Tuesday.

Financial market conditions have remained difficult in January and are uncertain for the second half of the financial year.

However, the group believes its businesses remain well-positioned and continue to see a strong performance in the banking

division.

The group's pre-close trading update reveals that its banking division, which provides specialist lending to small and

medium-sized businesses continued to deliver strong performance in the period. There has been good growth in the loan

book of 9% in the five months to 31 December 2011 to £3.8 billion (31 July 2011: £3.4 billion), reflecting ongoing good

demand across the portfolio. Looking forward, it expects the banking division to continue with good growth opportunities

across its businesses.

The securities division, which provides trading services to retail brokers and institutions has continued to be affected by the

ongoing difficult market conditions, whereas the asset management division has also continued to make progress on its

transformation and recorded a small loss in the period. Assets under management were £8.4 billion (31 July 2011: £9.6

billion) at 31 December 2011. Close Brothers expects the asset management division to enter the final stage of its

transformation with the aim of becoming a leading UK wealth and asset manager. and expects to report a small loss for the

2012 financial year.

With the strong financial position and good prospects for its businesses, the group may be on track to deliver solid full year

results.

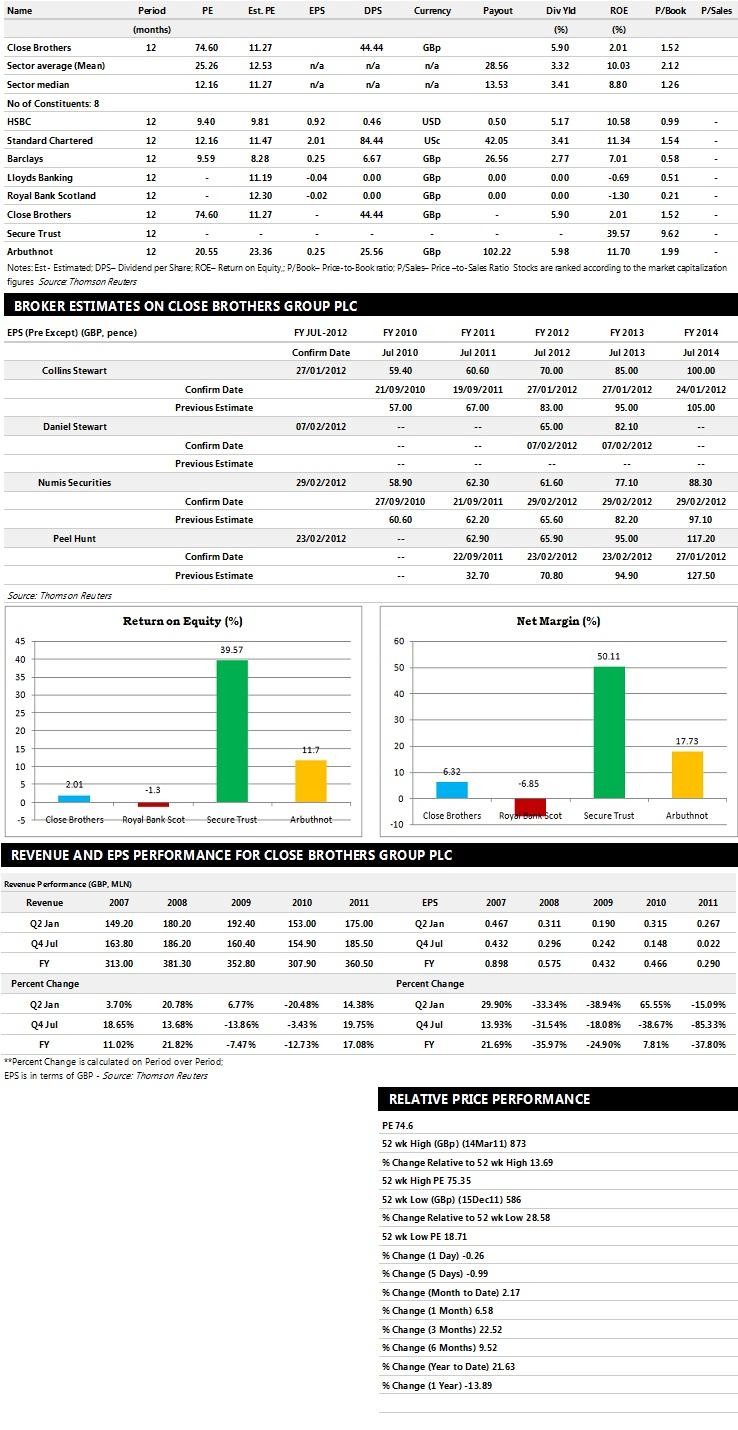

Brokers' Views:

- Numis Securities assigns 'Hold' rating on the stock

- Peel Hunt recommends 'Buy' rating with a target price of 899.50 pence per share

- Daniel Stewart assigns 'Buy' rating with a target price of 870 pence per share

- Collins Stewart recommends 'Buy' rating with a target price of 1180 pence per share

Earnings Outlook:

- Numis Securities estimates the company to report revenues of £502.10 million and £531.70 million for the FY 2012 and FY

2013 respectively with pre-tax profits (pre-except) of £123.40 million and £153.50 million. Earnings per share are projected at

61.60 pence for FY 2012 and 77.10 pence for FY 2013.

- Peel Hunt projects the company to record revenues of £553.80 million and £651.80 million for the FY 2012 and FY 2013

respectively with pre-tax profits (pre-except) of £137.50 million and £195.50 million. Profit per share is estimated at 65.90

pence and 95.00 pence for the same periods.

- Daniel Stewart expects Close Brothers to earn revenues of £593.00 million for the FY 2012 and £665.50 million for the FY

2013 respectively with pre-tax profits of £135.30 million and £171.30 million. EPS is projected at 65.00 pence for FY 2012

and 82.10 pence for FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields,

return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in

the sector. The table below represents eight companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.