Forex news: Singapore dollar falls to 4-year low vs dollar, rises to 20-month high vs euro

Disappointing Q4 GDP data from Singapore offset by euro weakness

Much weaker than expected GDP data from Singapore pushed the island's currency to a four-year low against the US dollar, which has been already rallying broadly.

But despite the negative local data, the overall weakness of the euro led the Singapore dollar through a key resistance line, taking it to a 20-month high against the European currency.

Singapore GDP grew only 1.5% from 2013 in the fourth quarter of 2014, down from 2.8% in the third quarter, and compared to consensus of 2.5%, data showed on 2 January.

The December manufacturing PMI data due on Monday will be the next data point in focus from Singapore.

In USD/SGD, the upside break of the isosceles triangle pattern in September has led to the making of a broad up-trend dating back to July 2011, and the channel resistance being targeted now comes at 1.3650, some 2.5% above the current level.

On the way up, 1.3535 may offer some resistance. However, the pair has to hold the 1.3000 support in order to keep the upward momentum intact.

In case that level is broken below, then the pair will aim 1.2850, a break of which will weaken the up-trend significantly and resume the down-trend aiming levels like 1.2350 and below.

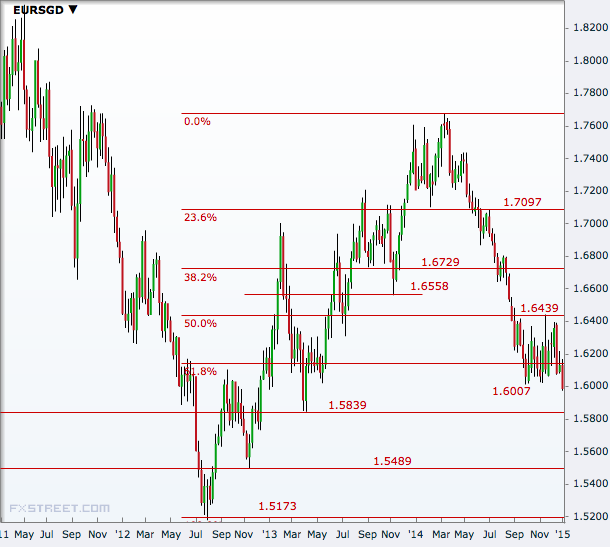

EUR/SGD

The sharp slide in euro against the dollar on Friday weekend the single currency broadly, helping the Singapore dollar break the 1.6007 resistance being held since October.

The cross has fallen 0.25% on Friday, which was the sixth straight day losses for the common currency. The next level downside is 1.5839 ahead of 1.5489 and then the 2012 low of 1.5173.

On the higher side, 1.6439 is first resistance level for the cross, which is the 50% Fibonacci retracement of the 2012 August to 2014 March rally.

Further up, 1.6558 may offer some resistance but a major one will be the 38.2% level of 1.6729 ahead of the 1.700 mark.

© Copyright IBTimes 2025. All rights reserved.