A Framework for Creating New Infrastructure Categories

How to spot and build infrastructure categories, not just better tech

The hardest part of building infrastructure companies isn't the technology; it's knowing when you have a product improvement versus a category opportunity, and then executing the completely different strategies each requires.

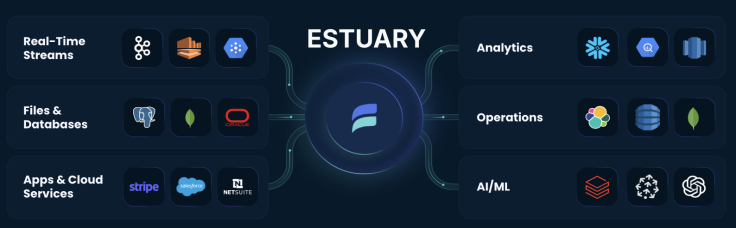

I'm working at the intersection of product strategy, technical architecture, and market positioning at Estuary, a data platform that eliminates the traditional batch-versus-streaming tradeoff through unified pipeline architecture. My focus has been on a problem that extends far beyond any single company: how do you bring genuinely new infrastructure to market when AI is fundamentally reshaping how enterprises think about their technical foundations?

What I've learned is that successful category creation in infrastructure markets isn't about building better features. It's about recognising structural inefficiencies that customers have accepted as inevitable, then reframing the entire problem space. Here's the framework that emerged, and what it reveals about infrastructure category creation.

Product to Category: Three Signals

Most startups struggle between 'better features' and 'new category'. They build meaningfully better technology, but position it within existing models, ultimately competing on performance metrics against incumbents with massive distribution advantages.

The key insight is that category opportunities emerge when the way customers currently buy and deploy infrastructure is fundamentally misaligned with how they actually need to use it.

Here's what I look for:

1. Inefficiency at scale: Pitchbook estimates that the data infrastructure market reached $150 billion (approximately £112 billion) in spending (Launchmarket Report: Data Analytics). Yet 44% of data engineers' time goes to manually building and maintaining data pipelines rather than creating value. Gartner identifies inconsistencies across data sources as the most challenging problem organisations face. When you see this pattern, you're looking at a structural problem, not a feature gap.

2. Defensibility: One of the strongest signals of category opportunity comes from understanding why incumbents can't solve the problem. If they could add a feature to compete with you, you don't have a category - you just have a head start. Our competitors' fundamental architectural decisions prevented them from delivering true unification without complete rewrites, giving us a defensible category position.

3. Timing: Category timing matters. The rise of AI created a catalyst moment for infrastructure. Organisations suddenly needed infrastructure that could deliver both historical context and real-time data to the right systems at the right time. The AI wave didn't create the underlying inefficiency, but it made existing fragmentation intolerable.

Building Platform Adoption

Infrastructure decisions are made by platform teams, data teams, or architecture groups who are accountable for reliability, security, and long-term maintainability. A single developer loving your tool is crucial but insufficient on its own.

The approach that worked for us focused on proving value to these decision-makers through a three-phase process.

1. Solve a hair-on-fire problem: We didn't lead with platform vision. We led with solving a specific, urgent problem: replacing fragile, high-maintenance pipelines. This gave us an entry point where we could prove value quickly. The key is choosing an entry problem that is:

- Painful enough that someone will champion a new vendor

- Scoped enough to deliver success fast

- Architecturally connected to broader use cases that you can expand into

This last point is critical, as the entry use case needs to be narrow enough to win quickly, but can naturally extend to other problems.

2. Demonstrate platform leverage: Once we had credibility from solving the initial problem, we could introduce the platform narrative. This meant showing customers how they could apply the same technology to adjacent problems they were already spending money to solve separately. Customers typically came for one specific use case, then expanded to multiple workloads within months.

3. Category positioning: Only after we had multiple use cases deployed could we effectively position the category. At this point, customers stopped evaluating us as a point solution and started asking whether they should standardise on our platform or maintain their fragmented approach. This signals category-market fit: when customers frame their decision as platform strategy rather than vendor selection.

Positioning for Category Creation

Infrastructure positioning is fundamentally different. Your buyers are technically sophisticated, skeptical of marketing claims, and burned by vendor promises before. Here's what works:

1. Lead with the structural problem, not your solution: We didn't talk about 'unified data platforms' initially; that's vague solution language. We talked about 'pipeline fragmentation' and 'infrastructure complexity'. These resonated because customers were living these problems daily, even if they hadn't named them. Customers need to recognise and name their pain before they can evaluate your category.

2. Make architecture your moat: Your technical architecture isn't just product differentiation, it's market positioning. We spent significant time explaining why our architecture enabled unification without compromise, and why bolt-on approaches from incumbents couldn't match it.

This requires creating content that's genuinely technical. Not dumbed-down metaphors, but architectural discussions that demonstrate deep understanding. Your champions inside customer organisations need to be able to defend your approach.

3. Align business model with category promise: We adopted usage-based pricing that scaled naturally with customer value, avoiding the pricing complexity that made legacy tools expensive and unpredictable. The business model itself became part of the category definition.

When you're creating a category, every signal matters. Pricing, packaging, contract structure, support model, these all either reinforce or undermine your category narrative.

The Category Evaluation Framework

If you're building in infrastructure and wondering whether you have a category opportunity, here's how to evaluate it:

1. Can you explain the architectural constraint that creates the inefficiency?

If not, you probably have a feature, not a category. Category opportunities stem from fundamental technical tradeoffs that previous generations of technology couldn't eliminate. You need to understand not just what is inefficient, but why. What architectural decisions locked the market into this state?

2. Would customers need to reconceptualise their problem to adopt your solution?

If they can fit you into an existing procurement category without changing how they think about their infrastructure, you're competing in an existing market. That's perfectly fine, but it's not category creation. Categories require customers to reframe their approach, not just swap vendors.

3. Can incumbents add your capabilities, or would they need to rebuild from scratch?

If it's the former, build faster and focus on execution. If it's the latter, you might have a category opening. But this only matters if you can clearly explain why the architectural difference creates customer value, not just technical superiority.

4. Is there a major technology shift making the old way unworkable?

This is the cherry on top. The strongest opportunities ride technology waves that make existing infrastructure boundaries feel obsolete. These shifts speed up adoption and create urgency that favors new approaches over established vendors.

Redefining What Infrastructure Can Be

At Estuary, we're working to establish what modern data infrastructure should deliver before the market fully matures.

But the broader lesson applies beyond any single company: the organisations that will define the next era of infrastructure aren't just building better technology. They're identifying where architectural paradigms need to shift, building the technology to enable those shifts, and executing strategies that help customers rethink what's possible.

© Copyright IBTimes 2025. All rights reserved.