Quantum Policy and IP: How RGTI's Global Deals Could Trigger Regulatory Scrutiny

Rigetti's cross-border quantum deals spark debate over intellectual property and national security risks

As Rigetti Computing (RGTI) accelerates its global quantum computing ambitions, the recent strategic partnerships have raised questions about intellectual property (IP) protection, cross-border technology transfer, and regulatory oversight.

With quantum computing poised to reshape industries from defence to pharmaceuticals, the stakes surrounding IP and policy compliance have never been higher.

Strategic Alliances with Global Implications

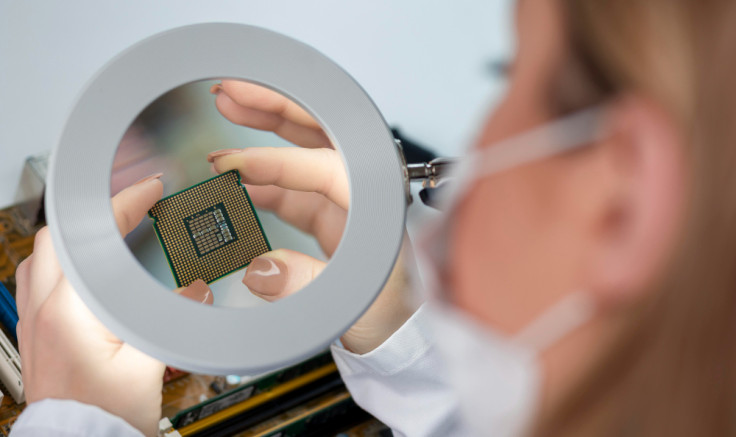

In February 2025, Rigetti announced a significant collaboration with Quanta Computer, a Taiwan-based Fortune 500 firm and global leader in server manufacturing.

The deal includes a $35 million equity investment from Quanta and a joint commitment of over $100 million to develop superconducting quantum technologies. While the partnership promises to accelerate commercialisation, it also introduces complex regulatory considerations.

Quanta will handle non-qubit hardware components, allowing Rigetti to focus on qubit innovation. This division of labour is designed to streamline development. Still, it also raises concerns about how proprietary quantum architectures and control systems will be protected across jurisdictions with differing IP laws.

Export Controls and National Security

Quantum computing is increasingly regarded as a strategic asset, prompting governments worldwide to implement stricter export controls aimed at preventing sensitive technologies from falling into adversarial hands.

In the United States, this shift has been formalised through the DOE Quantum Leadership Act of 2025, which earmarks over $2.5 billion for quantum research and infrastructure while simultaneously tightening oversight of foreign collaborations.

This heightened regulatory environment places companies like Rigetti Computing (RGTI) under growing scrutiny. Rigetti's recent partnership with Quanta Computer, a Taiwanese tech giant, and its involvement in UK-based initiatives such as Innovate UK's Quantum Missions, situate the firm at the crossroads of multiple national policy regimes, each with its own approach to intellectual property, data sovereignty, and strategic technology control.

According to the Centre for Strategic and International Studies (CSIS), quantum technologies are classified as 'critical and emerging,' with significant national security implications that justify enhanced export restrictions and foreign investment reviews.

As companies like Rigetti Computing (RGTI) pursue cross-border partnerships, they must navigate this complex policy landscape to avoid triggering compliance investigations or restrictions. The growing regulatory attention reflects a broader shift in how governments view emerging technologies, not just as commercial innovations, but as strategic assets requiring careful governance.

Intellectual Property in a Fragmented Landscape

A recent white paper from the QuIC IP & Trade Working Group highlights the fragmented nature of quantum IP protection. Europe, the US, and China each have distinct patent regimes, and the pace of filings is accelerating.

The report notes that 'the Quantum Technology domain is currently highly dynamic in terms of invention filings,' with significant growth in patent families across superconducting, ion trap, and photonic modalities.

Rigetti's open, modular architecture, designed to integrate third-party innovations, adds another layer of complexity. While this approach fosters collaboration, it also increases the risk of IP leakage or disputes over ownership. As Rigetti expands its footprint in Asia and Europe, ensuring robust IP safeguards will be critical to maintaining its competitive edge.

Regulatory Risk vs Commercial Opportunity

Despite these concerns, Rigetti's global strategy is seen by many investors as a calculated risk. The quantum computing market is projected to grow from $473.5 million in 2025 to $6.96 billion by 2034, with institutional adoption accelerating.

Rigetti's partnerships with Quanta and Riverlane, as well as its selection for DARPA's Quantum Benchmarking Initiative, position it as a frontrunner in the race to commercial viability.

However, regulatory missteps could derail momentum. If US authorities deem certain technology transfers as non-compliant, Rigetti could face fines, delays, or restrictions on future deals. Similarly, European regulators may scrutinise data sovereignty and compliance with the EU's Digital Markets Act.

What Comes Next?

As Rigetti scales its quantum operations globally, it must navigate a labyrinth of IP laws, export controls, and geopolitical sensitivities. The company's success will depend not only on technical breakthroughs but on its ability to manage regulatory risk without compromising innovation.

For investors, the question remains: is RGTI a buy, hold, or wait-and-see? Much will depend on how it balances commercial ambition with policy discipline in the months ahead.

© Copyright IBTimes 2025. All rights reserved.