UK House Prices: Landlords Cash In on Tumbling Buy to Let Mortgage Charges

Landlords are making a lot more money from their properties as greater competition is driving buy to let lenders to cut their charges and fees, as well as to offer longer-term fixed rates.

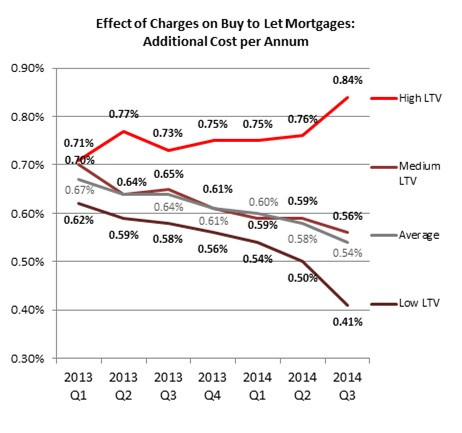

According to the Buy to Let Mortgage Costs Index from Mortgages for Business, the glut of products on the market has led to lenders driving down fees and prices and therefore meaning more cash in the pockets for landlords [Figure 1].

"Healthy competition is good news for landlords, who can now choose from a pool of in excess of 700 different buy to let mortgages," said David Whittaker, managing director of Mortgages for Business.

"Meanwhile, the wider benefits of more buy to let funding are being felt by everyone in the private rented sector – including tenants who have seen a growing supply of homes to let this year.

"This is a vote of confidence in landlords, at a time when lenders remain under serious pressure to maintain the safest possible loan books.

Earlier this month, Mortgages for Business data showed that at the end of the third quarter this year, the number of available buy to let mortgages on the market stood at 707 separate loan products.

This is a hike from the previous record high of 637 in the second quarter of 2014.

One year ago, there were only 458 available mortgage products at the end of the third quarter 2013.

Now, Mortgages for Business say that five year deals now make up almost one in five fixed rate mortgages on the market, at 19%, up rapidly from 15% in the second quarter of this year.

"As we predicted at the start of the year, buy to let lending looks set to total at least £25bn in 2014," said Whittaker.

"However, as the industry starts to look ahead to 2015, the most positive signs aren't from the headline figures – but in the detail of how lenders are responding to demand for longer-term deals.

"Intrinsically, all landlords tend to have a long view. Careful buy to let borrowers will not be thinking about the precise timing of the first rise in Bank Rate but rather what variable mortgage rates might look like in two or three years' time. So looking ahead, we may see a further increase in longer term fixed rate mortgage products as lenders respond to an increased demand for products that provide more stability."

© Copyright IBTimes 2025. All rights reserved.