Why young people should invest in Nutmeg, not Kickstarter

Is investing now a dirty word? And are young people today incapable of thinking for the long-term? I only ask these questions, as it is clear that millennials (today aged 16-35) have radically different saving behaviours from older generations, like Generation X or the so-called post-war baby boomers.

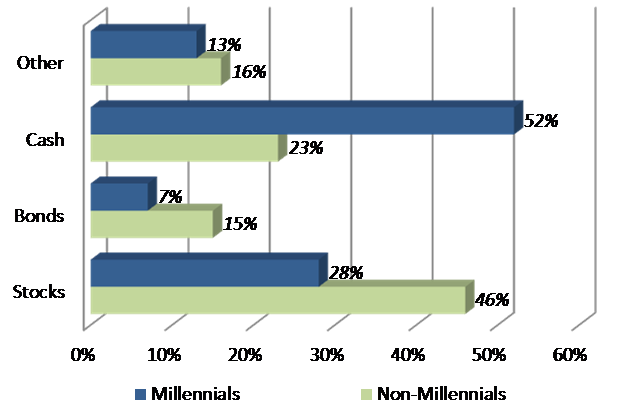

The private bank UBS undertook a survey of the savings and investing habits of the millennial generation back in 2014, and revealed that this younger generation overwhelmingly prefer to keep their savings in cash (more than half of their total wealth) rather than in any form of longer-term investment (Chart 1).

This tallies with the fact that UK home ownership in the 25-35 age group has nearly halved since 1991, from 66% back then to just 34% today. Clearly millennials, in most cases I am guessing including you reading this article, are not keen on locking up money for the long-term in shares, bonds or property, preferring the flexibility of cool hard cash.

To some extent, this is understandable. Many millennials exit the education system with a hefty student loan on their backs, usually in the tens of thousands of pounds.

Repayments on these loans then start once the magic figure of an annual £21,000 income is reached, at a rate of 15% of your monthly salary deducted at source at each month-end, before it even gets as far as your bank account. No wonder it is difficult to think about taking on another big loan in the form of a mortgage, in order to buy your own first home.

But cash is no longer king

The major problem with this savings strategy is that cash savings just don't earn like they used to, in this world of zero interest-rate policies of central banks like the Bank of England.

If anything, these ultra-low interest rates should be encouraging people to borrow more, as money is effectively very "cheap" versus history.

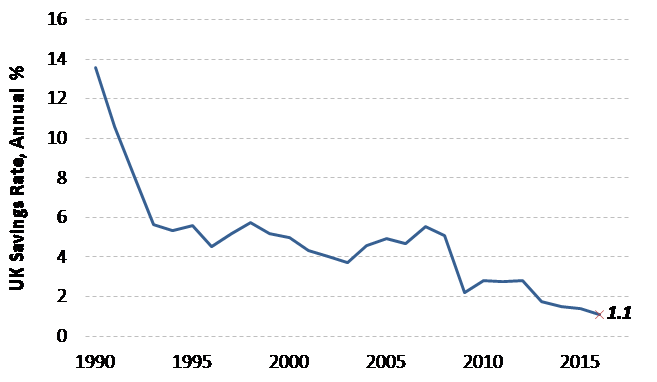

Just look at how savings rates in instant-access bank and building society accounts have crashed over the last couple of decades. Back at the beginning of the 1990s, you could get a double-digit interest rate on your cash savings (Chart 2).

But today, the best instant access savings rate you can get on the High Street is offered by the Nationwide building society, a paltry 1.1% (in a cash ISA account). Yes it is possible to get a little more, but only by agreeing to lock up your money for a year or longer, thus forgoing a lot of flexibility.

So the old financial maxim that "cash is king" no longer seems to be true.

New, online but higher-risk investment options attract millennials

New online forms of higher-risk investment have tended to appeal to the under-35 age group, such as crowdfunding (think websites such as kickstarter.com) and peer-to-peer lending offering higher interest rates than cash savings (such as Zopa, Funding Circle and Ratesetter).

Yes, higher interest rates may be possible via these routes; but do millennial savers really understand the full extent of the far higher risks they are taking in these investment vehicles?

I personally remain sceptical of these forms of online investment, which may seem seductive, but savers would always do well to remember the phrase that, "there is no free lunch in investing".

So yes, you may well get a higher interest rate over time, but only by risking losing some or all of that money.

Financial Services companies struggle to reach millennials

Clearly, the financial services industry is struggling to convince millennials to put their savings in investments that could, over a period of years, grow a lot faster than cash savings.

I think that one of the main problems is that asset management companies simply do not speak the right language to this younger, internet-savvy and somewhat cynical generation.

Easy ways for millennials to invest in stocks and bonds

I am a big fan of keeping forms of investment as simple as possible. One online investment website that does this admirably is Nutmeg, a so-called "robo-adviser".

This website allows you to invest as little as £500 in an ISA (or other savings accounts) and choose a level of investment risk that you are comfortable with.

Nutmeg will take this risk level and then do the work of choosing a number of different low-cost investments in shares and bonds (via exchange traded funds), thus freeing you from having to make the choice of which investments to put your savings in.

Other similar simple online investment websites targeted at millennials include Money On Toast, Wealth Horizon and Fiver A Day.

© Copyright IBTimes 2025. All rights reserved.