Alibaba Stock: Shares Rocket 9% in US Premarket After CEO Pledges to Pour Cash Into AI

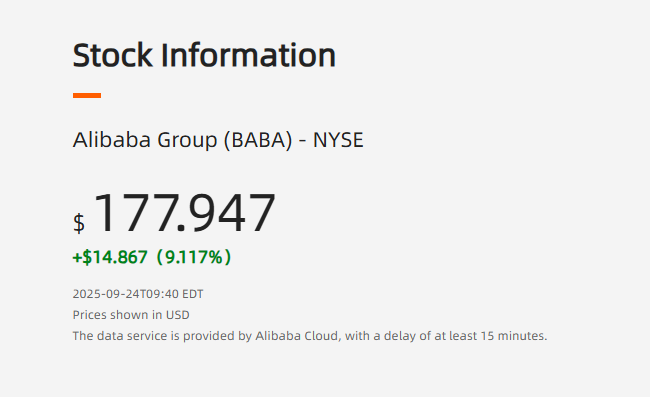

Alibaba Group shares surged nearly 9% in US premarket trading on Wednesday after Chief Executive Officer Eddie Wu announced the company would boost its investment in artificial intelligence (AI) and cloud infrastructure beyond its earlier three-year pledge of 380 billion yuan (about US$53bn).

The announcement, made during an Alibaba tech and cloud event in China, reinforced investor confidence that AI will play a central role in the company's future growth.

Market Reaction to the AI Spending Pledge

Alibaba's US-listed stock surged immediately following Wu's remarks, reflecting strong investor appetite for technology firms expanding into AI.

The Hangzhou-based group, which operates globally through its e-commerce and cloud arms, has already committed to AI and cloud computing as central to its strategy since Wu took the helm in 2023.

Analysts said the fresh pledge signals Alibaba's determination to solidify its position in China's increasingly competitive AI race, which is dominated by rivals such as Tencent and Baidu.

The announcement was made at an Alibaba technology and cloud event in China. Eddie Wu, who became CEO in 2023, has made AI and cloud development a central part of his leadership strategy.

How the Investment Strategy Drove the Surge

The latest commitment goes beyond Alibaba's existing three-year plan and signals higher near-term capital spending. Investors interpreted the move as a sign that the company is accelerating AI development, particularly in generative AI, enterprise AI services, and cloud-based applications.

According to recent financial disclosures, Alibaba's AI-related revenues have grown at triple-digit rates, while its cloud division continues to record double-digit year-on-year gains. Although precise figures vary by reporting period, analysts view the trend as evidence that AI is becoming a meaningful contributor to overall sales.

The company also revealed a new collaboration with Nvidia, aimed at integrating advanced AI tools into Alibaba Cloud. The partnership is expected to support applications requiring heavy computing power, sometimes referred to as 'physical AI'. The combination of internal investment and external alliances has strengthened investor sentiment.

Why the AI Pivot Matters for Alibaba's Future

Alibaba's share price reaction illustrates how investor sentiment toward major technology firms is increasingly tied to artificial intelligence.

For years, Alibaba's identity was rooted in e-commerce growth; however, the company has now pivoted to position itself as a leader in AI infrastructure and services.

Eddie Wu's pledge builds on earlier commitments and underscores the scale of competition among Chinese technology giants, which include Tencent and Baidu, as well as international players. Analysts suggest that Alibaba's subsequent earnings reports will be closely watched for evidence that AI and cloud revenue growth can be sustained at scale.

The outcome of Alibaba's collaboration with Nvidia will also be closely monitored. While the partnership signals an intent to strengthen its technical capacity, execution will determine whether the company can translate capital spending into profitable products and services.

Global Market Implications

The sharp share price reaction illustrates the extent to which AI announcements now shape investor sentiment toward major technology stocks.

As competition intensifies both within China and globally, Alibaba's willingness to increase spending shows the strategic importance of AI infrastructure in global markets.

© Copyright IBTimes 2025. All rights reserved.