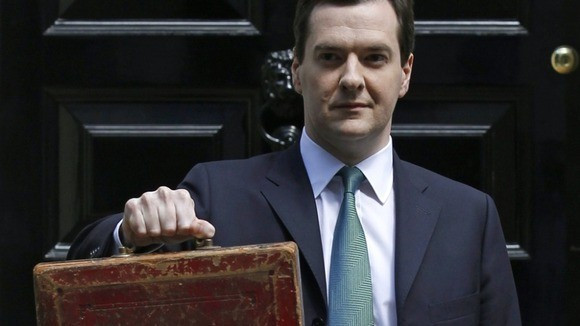

Osborne's Budget 2013: No Fireworks as Plan A Stays but BoE Mandate May Change

Analysts say deficit reduction still Chancellor George Osborne's main aim ahead of 2013 Budget

Follow @shanecroucher

Chancellor George Osborne is unlikely to pull hard on any fiscal levers in the 2013 Budget as he and the government stick stubbornly to their so-called Plan A of deficit reduction through public spending cuts.

UK finances lost their AAA status at Moody's in February, one of the world's three leading credit rating agencies, amid a worsening economic outlook, ever-bloating public debt, and continued weakness in global demand. Moody's said that the UK had to remain committed to medium-term fiscal consolidation.

"We aren't expecting any fireworks from Osborne," said Richard Driver, Caxton FX's currency analyst, in an email to IBTimes UK. "He and Cameron were quick to respond to Moody's debt downgrade with a pledge to 'stay the course' as far as austerity is concerned.

"The rating agencies have shown they are increasingly concerned with UK growth outlook so some meaningful growth-boosting measures would be nice to see.

"We'd like to see increased investment in infrastructure to boost the UK's longer-term growth prospects, but this may be a little too much to ask."

He said the Budget was likely to be a missed opportunity.

In the fourth quarter, the UK economy contracted by 0.3 percent and weak industrial data in the first two months of the New Year has kept the threat of a triple-dip recession hanging over the chancellor's shoulders.

Headline-grabbing tax allowance increases

UK public debt has continued to soar as the economy failed to meet past growth expectations, sending tax receipts down and forcing the government to borrow more in order to maintain its reduced spending.

Debt as a portion of GDP, excluding the cost of financial crisis bailouts, is 73.8 percent.

"We may see headline-grabbing increases in income tax allowances and even a further cut in corporation tax, but the macroeconomic implications of the budget should be small," said Simon Wells, HSBC's chief UK economist, in his Budget preview.

"Following last year's Budget [dubbed the 'Omnishambles'], when the chancellor had to backtrack from pasty and caravan taxes , he will probably want to play it safe."

Citi's Michael Saunders said he expected the Budget to have two main aims: "To defer some of the heavy near-term fiscal tightening without losing too much medium-term fiscal credibility and to pave the way for further monetary easing and credit easing without losing too much medium-term anti-inflation credibility.

"The overall effect will be to leave the UK with a modestly tight, rather than very tight, fiscal stance for the next year or two, looser monetary policy and a revamped framework of fiscal rules and inflation target."

RBS economist Ross Walker said the abandonment of Osborne's Plan A would be "self-defeating - economically [by forcing market interest rates higher and the currency even lower] and politically [tantamount to the government conceding it had been pursuing the wrong fiscal policy]."

FLS and infrastructure

Two of the Treasury's flagship stimulus schemes have been criticised in recent months for not having enough of an impact on the economy, leading to speculation that Osborne will use his budget to give them a boost.

One, the Funding for Lending Scheme (FLS), is backed by the Treasury and carried out by the Bank of England. Under FLS, UK banks are offered cheap loans tied to the value of their lending to the real economy.

It is hoped that this will incentivise an increase in lending to small and medium sized enterprises (SMEs) and first-time homebuyers.

So far it has helped bring down mortgage costs for borrowers but appears to have had very little effect on the cost and accessibility of SME finance - something many argue is crucial for economic growth and job creation.

In Q4, bank lending fell by £2.4bn despite FLS.

"We expect that the Budget will contain measures that aim to make the FLS more effective, perhaps by setting a lower interest rate on borrowing under the FLS and easier collateral terms, or introducing specific requirements that part of the money borrowed from the BoE must be used to expand lending to SMEs. At present it is meant to be used to support general lending to UK households and businesses," said Citi's Saunders.

"Or, as the BoE Ggvernor recently argued, the UK government could simply expand its large stakes in several major banks into full nationalisation, and then order the state-owned banks to increase lending on normal commercial terms [i.e. at a spread close to the pre-crisis norm]."

HSBC's Wells said that FLS had helped blur the lines between fiscal and monetary policy so another scheme similar to this could be announced by Osborne.

"Any new scheme would probably be aimed at the smallest of SMEs," he said.

"These appear to be the companies that have the most acute problems in accessing finance. Existing schemes already seem to be helping households and larger firms.

"Despite the FLS having limited success in boosting lending so far, it has reduced banks' wholesale funding costs substantially and appears to be contributing to a nascent recovery in the housing market."

A second Treasury stimulus effort, the £40bn UK Guarantees Scheme (UKGS), underwrites major, nationally significant, infrastructure projects that are shovel-ready but struggling to secure finance.

Recently the Treasury defended itself against a perceived lack of progress in the scheme, with very few applicants rubber-stamped despite it having been in place since November. The Treasury said it was still early in UKGS's life.

A spokeswoman said that a number projects were expected to be given the green light throughout 2013.

Many have called for a renewed focus on infrastructure investment as a route to recovery for the struggling economy.

"While there may be a few new small-scale infrastructure announcements, we would not expect the chancellor to unveil a wave of new major infrastructure projects. He really cannot afford this within the constraints of his fiscal boundaries," said Investec's pre-Budget note.

Monetary policy framework

As inflation has remained stubbornly above its medium-term 2 percent target, Bank of England policymakers have been keen to point to the flexibility of their mandate.

Some have questioned whether the notion of an inflation target is outdated because the Bank of England has not managed to hit its own since November 2009.

Instead, they argue, a nominal GDP target (NGDP) could be a better framework, especially in difficult economic times.

Mark Carney, the incoming Bank of England governor who will take up the role in June, has said he is open to a review of the monetary policy framework, but is unconvinced that NGDP is better than an inflation targeting regime.

Another option for Osborne is to extend the time in which the Bank of England should ideally reach its inflation target.

"If this were to be the case the options could range from granting the MPC explicit room to hit the existing inflation target over a longer period, thus effectively legitimising the committee's current strategy, to a Fed-style dual mandate with the inclusion of a measure of economic stability as well as an inflation goal," said Investec.

In effect, Osborne could give the green light for even looser monetary policy from the Bank of England, which already maintains record-low interest rates and has bought up £375bn of gilts under its asset-purchasing quantitative easing programme.

"Would this have much effect? It might. We are not convinced that a more aggressive period of asset purchases would in itself improve recovery prospects," said Investec.

Citi's Saunders said that if a flexible inflation target were set it would be most likely for a 1-3 percent band and the MPCwould be tasked with keeping it around the middle 2 percent mark over the longer term.

"The MPC's remit is set annually in the Budget but can be changed at other times. So if the chancellor does change the remit, this could occur in the Budget, or the chancellor might leave the remit unchanged in the Budget and launch a review of the remit, with a new remit announced subsequently to coincide with or immediately follow the start of Mark Carney's term as BoE governor," he said.

RBS's Walker said such a move would simply formalise a flexible inflation targeting regime, which the MPC already adheres to.

"A more radical step would be the launch of a consultation on more fundamental changes to the policy framework [eg, a US Fed-style dual mandate of a formal NGDP target]," he said.

"The mere launch of such a consultation process - the outcomes are highly asymmetric - would provide further dovish impetus for markets."

---

Follow @shanecroucher

© Copyright IBTimes 2025. All rights reserved.