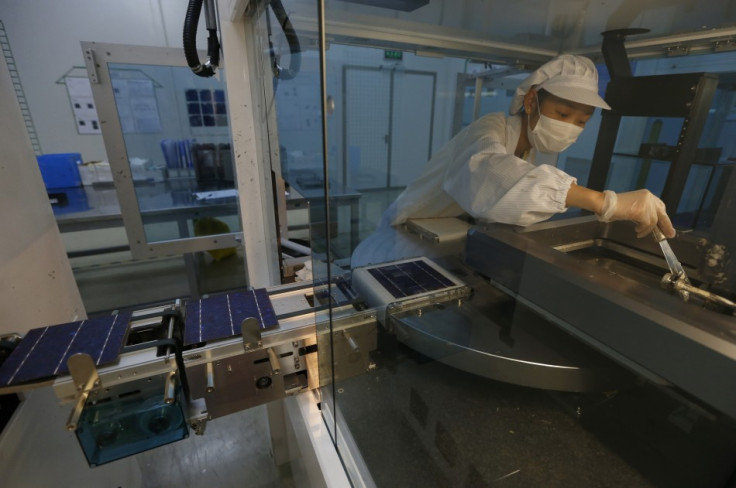

Chinese Solar Exports to Decline on EU Trade Restrictions

Chinese solar exports to the European Union are projected to fall in the July-September quarter following buoyant shipments in the previous three months, as the restrictions on exports set by the single-currency region are due to take effect.

Canadian Solar Inc., which has operations in China, had earlier forecast lower shipments for the current quarter due to market-share shrinkage in the EU, which is planning to cap imports of solar panels made in China.

Canadian Solar expects to ship between 410 and 430 megawatts (MW) of solar panels in the third quarter, down from the 455 MW shipped in the previous one.

Total Chinese solar exports to the EU have already reached 6.5 gigawatts (GW) in the first half, as many panel makers tried to increase sales ahead of the restrictions, according to analysts. In 2012, Chinese solar panel sales to the EU reached €21bn ($27.9bn, £18bn).

Canadian Solar's rivals Trina Solar Ltd and Yingli Green Energy Holding have projected above-forecast second-quarter shipments and gross margins due to a jump in sales in Europe.

Chinese manufacturers are on track to ship a total of 22-23 GW of solar modules in 2012 across the globe. That covers of the majority of the total estimated global demand of 35 GW.

"Given last month's EU-China trade deal, needless to say the pre-buying has come to an end," Raymond James analyst Pavel Molchanov told Reuters, referring to the agreement on regulating Chinese panel imports.

Given the restrictions in the EU, Chinese solar makers' future is now dependent on how rapidly they can expand in growing markets such as the US and Japan, according to analysts.

Trade Dispute

The EU and China had earlier agreed to resolve a dispute over the alleged dumping of solar panels by Chinese companies in Europe, following six weeks of talks.

As per the agreement, shipments from China, the world's dominant solar panel supplier, will be capped at 7 GW per year, around half of the EU's 2012 demand of about 15GW. The deal also sets a minimum price for China's solar panel exports to Europe.

Subsequently, the European Union decided against imposing preliminary anti-subsidy tariffs on Chinese solar panels, opting to wait another four months to assess the industry.

The deal was hugely important to China, which feared a trade war would hit demand for Chinese solar products. China's solar production quadrupled between 2009 and 2011 to exceed global demand, and the EU accounts for around half of China's solar exports.

Eurozone regulators had earlier accused Chinese solar panel makers, including Trina Solar, Yingli Green Energy and Suntech Power Holdings, of damaging the European solar industry by selling their products at below cost price, a practice known as dumping.

The spat between China and the EU worsened, after the latter had imposed anti dumping duties on China's solar exports.

In retaliation, China launched an anti-dumping and anti-subsidy probe into various imports from Europe, including chemicals and wine.

© Copyright IBTimes 2025. All rights reserved.