Fiat Chrysler Could Sell Stock Worth $830m Post NYSE Float

US listing of Fiat Chrysler Automobiles (FCA) scheduled for 13 October.

Fiat Chrysler Automobiles (FCA) could sell up to $830m worth of shares, to boost its finances and enhance trading in the stock, post its 13 October New York Stock Exchange (NYSE) floatation.

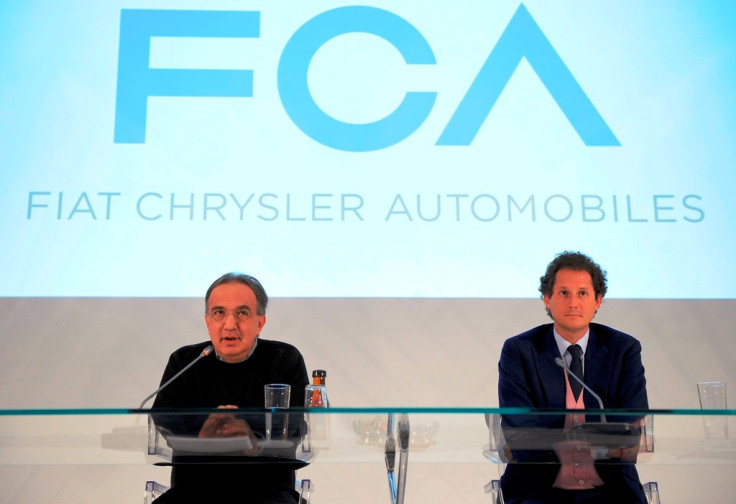

Chief Executive Sergio Marchionne has said he could "get the machine rolling" by selling to American investors the shares Fiat owns in itself, or so-called treasury stock.

The firm could also sell shares to compensate for those that were purchased – and then cancelled – from investors who decided not to participate in the Italian automaker's merger into FCA, Reuters reported.

Fiat on 9 October said that it was left with around 53.9 million shares from investors who decided to cash out and not be part of its merger into FCA.

Existing shareholders had purchased a little over six million of the roughly 60 million shares offered directly to them from the stock bought back from dissenting shareholders, according to a Fiat statement.

Residual shares will not be offered on the market. Instead, Fiat will pay the cash exit price of €7.727 ($9.845) for each of those shares, the statement added.

Under Italian law, those remaining shares have then to be cancelled, but could be reissued, Marchionne has said.

The carmaker owns another 34.6 million shares in treasury stock. The combined 88.5 million shares would be valued at €650m euros (£511m, $830m) at 9 October's opening price, Reuters calculated.

© Copyright IBTimes 2025. All rights reserved.