Ex-Google Employee has Proof of UK Tax Avoidance

A former Google employee says he has material proof the search giant has been disguising sales made in the UK in order to minimise its tax liabilities.

Barney Jones, who worked for search giants Google between 2004 and 2006, told The Sunday Times he had a record of more than 100,000 emails and documents proving Google sales staff closed advertising deals in its London offices, despite claiming that all sales were made in Ireland, where corporation tax is much lower.

The documents held by Jones allegedly show deals finalised between Google's London headquarters and large clients such as eBay and Lloyd's TSB. However, he says the sales were processed through the search engine's offices in Dublin where the corporation tax rate is only 12.5% compared to the UK's 23%:

"[Google] uses a concocted scheme to avoid tax. It's a smoke-screen to distort where the substance of its economic activity is really taking place."

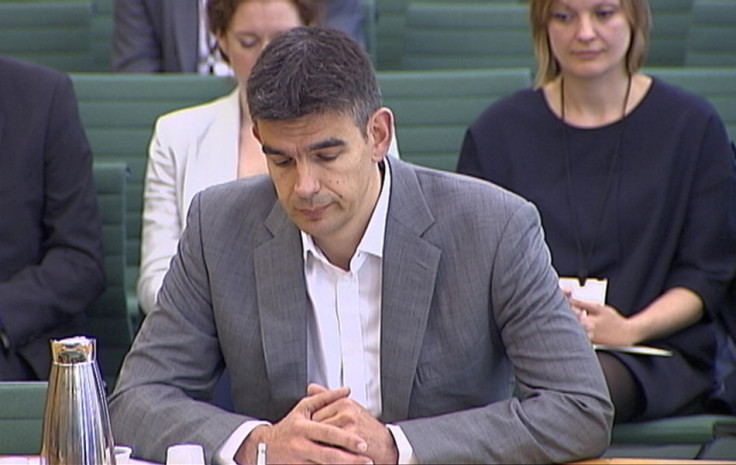

Jones is now planning to hand the documents to Her Majesty's Revenue & Customs (HRMC). He has already testified before the Public Affairs Committee (PAC) which has launched a second hearing into Google's possible tax avoidance.

In November, 2012, Matt Brittin, Google's vice president for northern and central Europe, told the PAC that "nobody in the UK is selling."

However, an investigation by Reuters discovered several job listings on Google's official website advertising sales-based positions in London, prompting the PAC to recall Google to "explain itself" at a second hearing held on 16 May.

Responding to the accusations from Jones, Peter Barron, Google's director of external relations said:

"As we said in front of the public accounts committee it is difficult to respond fully to documents we have not seen. These questions relate to Google's business in the UK going back a decade or more. None of the allegations put to us change the fact that Google pays the corporate tax due on its UK activities and complies fully with UK law."

As reported by CNET, a filing Google made to Companies House in 2012 showed that, the year before, Google paid only £6m in tax on £395m revenue, a rate of less than 2%.

"You are a company that says you do no evil, and I think that you do evil," PAC chairwoman Margaret Hodge told Matt Brittin at the second hearing on Thursday. "You use smoke and mirrors to avoid paying tax."

Along with representatives from BAE Systems, Tata Group, GSK, Vodafone and John Lewis, Google chairman Eric Schmidt is scheduled to meet with Prime Minister David Cameron to discuss possible business tax reforms.

"Given the intensity of the debate, not just in the UK but also in America and elsewhere, international tax law could almost certainly benefit from reform," Schmidt wrote in The Observer. "Our hope is to move the debate forward, with everyone engaged constructively in developing a clearer, simpler system."

© Copyright IBTimes 2025. All rights reserved.