EU Banking Reform: RBS and Barclays say Ring-Fencing Costs to Hit Consumer

- Senior executives at Barclays, RBS and Lloyds face questioning

- Hearing is to determine what impact European proposals will have on the UK

- Proposals for an EU directive on bank recovery and resolution were published in June

1228 BST: The Hearing ends

Thank you for joining us.

1227 BST: Comparisons between the Euro implementation in 1999 and the EU banking union.

Kibble outlinessimilar concerns about the UK and the Euro in 1999 and how the UK thrived off the separation from the Euro currency.

1218 BST: "EU banking union timeline needs to be looked at carefully"

Kibble: "We've got the signal to put this banking union concept in place but putting something in place that is not fit for purpose would be unfortunate."

1214 BST: The risks of UK marginalising itself

Harding: "The risk of marginalisation is obviously is a significant concern, not just because of this process but actually in addition to everything else. We need a constructive relationship with the EU going forward. It is in our interests that the banking supervision is put in place. If we are seeing as standing in the way of the EU proposals could hurt the UK."

1210 BST: Harding: "The more that the powers of the EBA enshrined in successful pieces of legislation, the harder it will be empty the EBA of substance. There is a complex cocktail of political issues."

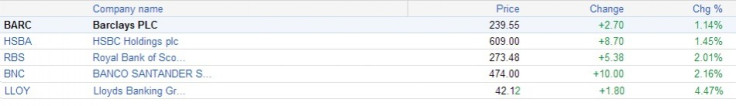

1209 BST: Quick Stock Update

1202 BST: "Spanish banks will be the guinea pigs for new supervisory regime?"

Kibble responds to the House of Lords suggestion that the reason why there is a new EU wide supervisory regime, is mainly because of the health of the Spanish banks. However, Kibble says that while the Spanish banks are "currently in the foreground", the reason why the new proposals are in place is to prevent any other banks following suit.

1200 BST: EBA to still set the rules?

Harding: "We will still have EBA setting the rules. I think what will happen over time, that there are a whole collection of differences in the way rules are interpreted across member states. In practice, the way rules are implemented across member states are very different."

1158 BST: On ECB banking supervision.

Kibble: "The man power is there but the determination around this is not there."

1156 BST: House of Lords: "The fact that the ECB is meant to supervise 6000 banks in the EU area is absurd"

1152 BST: Key design flaws of EU proposals?

Harding: "I think most of the issues are in the accountability area and is enabling in the way it is written. I think what we will be moving to is a system which replaces some form of appeal or judicial mechanism. I personally would like to see more inclusion and participation from EU member states over ECB accountability."

1146 BST: Concerns over ECB?

Kibble: "To use an example, look at our subsidiary Ulster Bank. Much like how it is separate to RBS, we see how a separation between prudential and conduct will be the same for the UK regulators and the ECB."

1142 BST: Costs will rise

Harding: "It will add to cost of funding of the bank as a whole and this will trickle down eventually to the retail and wholesale side and will increase the costs. This is not so much because of the avoidance of direct subsidy but because of the funding costs that would naturally rise from ring-fencing."

Kibble: "I agree. There will be a a removal of cross-subsidy benefits and therefore this will trickle down to the retail and wholesale market."

1140 BST: Will ring-fencing work?

Kibble: "So we are talking about what is specificied is? The spirit of this is to prevent funding flows from retail deposit base to investment banking activity. We are underway how that will work. That aspect of ring fencing is perfectly workable."

1138 BST: Barclays' Harding on Structural reform

"Since they (Liikenen and Vickers) are not anything more than proposals, we have to wait to see if the two are made compatible. Where we are on the ICB, there is a question over whether this will be useful for lessening risk, we are just waiting to get on with things."

1134 BST: RBS' Kibble on Structural reform....

What problems?

"On Likkenen and Vickers - from a structural standpoint, they are aiming for the same thing - a partition of retail deposits and investment banking. Broadly equivalent."

RBS' Kibble does highlight how there will be challenges for a bank like Barclays and RBS to be able to install the ring-fencing, considering it's US operations.

1132 BST: Barclays' Harding: Theory and practice may converge

Harding: "I think there is an obvious caveat that theory and practice may converge to my evidence."

"We do need checks and balances in order for the two being compatible. In principle, the two can work together, although there will be pressures. For example, there maybe situations that it would be in the interest of some members in adopting rules that are giving advantages to those regions and will facilitate business within that zone, [at the detriment] of regions outside that zone."

1128 BST: "Design has to be right"

Speakers are concerned over the implementation of the EU banking reforms and the lack of time left on installing changes.

Harding: "One of the problems between now and implementation is to the Uk over what it does to the EBA and understanding of the powers will be, voting arrangements, and member states to ensure the binding mechanisms will not necessarily operate against the interests of the UK. The risks, the timetable available is the question of, from a political point of view, about signing up for something that they don't fully understand."

1126 BST: Hearing starts....

Harding: "We are running short on time, the important thing for us is the sequence of events that looks credible and how it is constructed."

1116 BST: Some of the topics coming up:

- What more needs to be done to provide the inspired leadership in the EU necessary to make effective and efficient decisions in solving the crisis

- Will the ESM (European Stability Mechanism) firewall be large enough to secure Italy and Spain's position, as their bond yields continue to rise

- Does the European Central Bank (ECB) have sufficient financial resources and tools to act as an effective backstop to the euro area? Would a treaty change be required to widen the ECB's role

- What contingency planning are the UK Government and the European Commission taking to deal with the consequences of a potential Greek exit from the euro?

1110 BST: Session running late

According the press officers, the hearing has not started yet and is running 30 mins late.

1054 BST: Prior to the start of the evidence sessions ....

It is important to note the concerns parliament have had over the EU banking reformation proposals.

At the end of July, Chairman of the EU Sub Committee for Economic and Financial Affairs, Lord Harrison said:

"Whilst the 17 euro area Member States are making decisions in smoke-free rooms, the UK could be left outside fuming. Although the UK remains outside the euro area, it needs to ensure that it remains at the very centre of the EU and its single market.

"As the crisis unfolds, the need for decisive EU leadership in Brussels and wise UK leadership in London grows ever more acute."

In a letterpublished at the end of July, the Committee voiced serious concerns that the Government have not fully appreciated the consequences of their decision not to take part in the fundamental elements of a banking union:

"There is a risk that the UK could lose its ability to maintain influence on the EU and other Member States. The Minister is asked what the Government are doing to make sure that the UK is not marginalised from debate through the shifting of discussions outside the main EU channels to forums where the UK has no voice."

"The Committee asks the Minister if the euro is likely to survive and how long euro area leaders can be expected to remain committed to providing such significant financial support to Greece. With regard to a potential Greek exit from the euro, the Committee stress the need for UK authorities to have plans in place to protect UK markets, entities and citizens from the turbulence that would result."

1050 BST: A quick recap

We are currently awaiting the committee hearing. Here is the list of attendees that will be questioned by the House of Lords:

- Mark Harding, Barclays - Group General Counsel

- Richard Kibble, Royal Bank of Scotland - Group Director (Strategy and Corporate Finance)

1040 BST: Welcome to the Live Blog

Good morning and welcome to a special live blog on banks facing the House of Lords of European Union (EU) banking reform proposals.

Lianna Brinded, senior business reporter at IBTimes UK, will be blogging in the run-up and during the hearing that is set to commence at 1100 BST on what impact the EU directive on bank recovery and resolution will have on the UK.

© Copyright IBTimes 2025. All rights reserved.