Libor Scandal: SFO Expects 'Major Developments' in Case After Arrest Report

Britan's Serious Fraud Office said Friday there were "significant developments" in its on going investigation into bank rate manipulation after a report suggested arrests could be made within the month.

Bloomberg reporterd earlier today that traders from UBS and the Royal Bank of Scotland and Barclays could be arrested as part of the months-long probe into allegations of rate rigging in the bank rate known as Libor, which underpins the value of more than $500tn dollars of global bonds, loans and other securities. SFO Director David Green told the Daily Telegraph that he "was hoping for some developments in the investigation shortly" but would not comment directly on the banks named in the Bloomberg report.

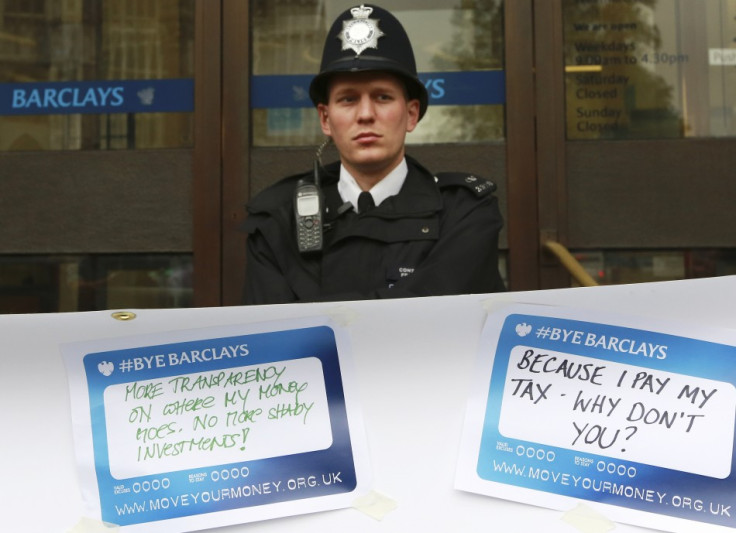

The issue of the accuracy and honesty of Libor submissions has dominated headlines in and out of the global financial markets for months following the record $453m fine paid by Barclays for admitted attempts to rig the inter-bank lending rate. Regulators and central bankers from Tokyo to Toronto have vowed to closely examine the method in which banks participate in so-called Libor panels and punish those found to have made false submissions or colluded with other banks to manipulate it.

Britain's chief financial watchdog called on bankers to fundamentally reform the world's most important interest rate market, calling it "not fit for purpose" in a paper that could lead to new alternatives in the benchmark as early as next April.

The Financial Services Authority's (FSA) managing director and the head of an independent review set up by the government plans an overhaul of the Libor structure in the wake of the Barclays Libor rigging scandal.

Global central bankers met in Switzerland in August to discuss the possibility of scrapping Libor, the controversial inter-bank lending rate that has been the epicentre of one of the year's biggest financial scandal.

Bank of England Governor Mervyn King and deputy Bank of England Governor Paul Tucker have been criticized for failing to heed warnings about potential fraud in the London rate that's managed by a British Bankers' Association unit know as Libor Limited. A memo published last week revealed the BoE governor was told of concerns related to inaccurate submissions as far back as 2008 by US Treasury Secretary Tim Geithner when he was President of the New York Federal Reserve. King told the TSC he only became aware of fraudulent activity in the benchmark two weeks ago.

© Copyright IBTimes 2025. All rights reserved.