Is Now the Perfect Time to Buy Spotify Stock? SPOT Slides After CEO Announces He Will Step Down in 2026

SPOT stock reacts to CEO exit plan—analysts debate buy timing

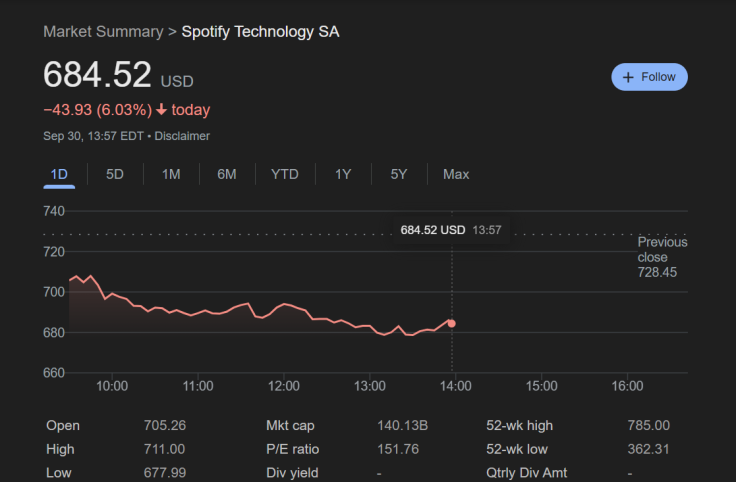

Spotify Technology S.A. (SPOT) shares dropped around 5% after co-founder and CEO Daniel Ek revealed he will step down in 2026, raising questions about leadership and strategy at the world's largest music streaming platform. Yet, beneath the short-term sell-off, the company's fundamentals remain resilient, with expanding margins, record operating income, and technical signals that suggest opportunities for long-term investors willing to stomach volatility.

The 42-year-old founder, who launched Spotify in 2006, will hand operational control to co-CEOs Gustav Söderström, currently chief product and technology officer, and Alex Norström, chief business officer. Both executives have effectively co-led operations since 2023, making this announcement a formalisation of the existing management structure rather than an abrupt leadership overhaul.

Ek's Exit: A Sign of Maturity or Cause for Concern?

Daniel Ek's decision to relinquish the CEO role after two decades at the helm came as a surprise to many. Ek emphasised that he will remain on the board and assist with the transition to ensure smooth continuity.

'I've spent twenty years, nearly my entire adult life, as Spotify's CEO,' says Ek, 42. 'I'm ready to go from a player to a coach,' he said.

Under Daniel Ek's leadership, Spotify grew to nearly 700 million monthly active users and achieved a record operating income in Q2 2025, reflecting plausible gross margins and disciplined cost management, driven by strong growth in premium subscriptions and advertising revenue.

While founder successions often signal corporate maturity, investors have grown cautious about whether new leadership can maintain product innovation and fend off intensifying competition from Apple Music, Amazon Music and YouTube Music.

Market Reaction: Temporary Dip or Start of Downturn?

Since its 52-week high of $785 in July 2025, Spotify (SPOT) has experienced a pullback to approximately $684.52 as of 30 September 2025. The pullback appears more a function of headline risk than structural weakness:

- Q2 revenue rose to €4.2 billion, representing a 10 per cent year-on-year increase, with podcasts and audiobooks contributing to margin expansion.

- Operating income was positive for the second time in the company's lifetime, reflecting tighter cost control.

Technical Analysis: Chart Signals and Speculative Outlook

A close inspection of Spotify's price action and momentum indicators reveals potential entry and exit points as of this writing.

Key Moving Averages

- 50-day moving average (MA): ~$694.24, above current levels, signalling short-term bearishness.

- 200-day MA: ~$618.32, below current price, indicating the underlying uptrend remains intact.

Momentum Oscillators

- RSI (14-day): ~50.51, in neutral territory between oversold (30) and overbought (70).

- MACD: The MACD line sits below its signal line, indicating a short-term bearish cue, but the narrowing histogram suggests a fading downward momentum.

Support and Resistance Levels

- Support: $715.25, marking a key demand zone.

- Resistance: $717.87, acting as a ceiling for upside moves.

Volatility and Volume

- Volume: Spiked 236.15 per cent, compared to average volume in the last 30 days, after the CEO announcement, suggesting heightened trader interest.

- Implied Volatility (30d): 41.04 per cent, up from 22.06 per cent historical volatility, underlining elevated intraday swing risk.

Chart Patterns

Spotify's recent price action shows signs of consolidation with pressure from lower highs. Technical analysts note that a clear breakout above the current downward-sloping trendline would suggest a potential bullish reversal, while a decisive move below recent support could accelerate selling momentum.

Interpreting the Technical Signals: What Spotify's Charts Reveal

Spotify's stock is currently sending mixed signals, offering both caution and opportunity depending on your investment horizon. The share price is currently below its short-term 50-day moving average ($694.24), indicating recent weakness.

However, the share price remains above its long-term 200-day average ($618.32), suggesting that the broader uptrend remains intact. This combination often points to a consolidation phase, where the market is waiting for a fresh catalyst before committing to a new direction.

Momentum indicators reinforce this view. The Relative Strength Index (RSI) is hovering around 50.51, placing it in neutral territory—not oversold enough to trigger a bounce, nor overbought enough to warrant profit-taking. Meanwhile, the MACD line has dipped below its signal line, a mild bearish cue, though the narrowing histogram suggests that downward momentum may be fading.

Price action since late August has formed a descending channel—a pattern marked by lower highs and lower lows. This signals short-term weakness, but also sets up a potential turning point. A breakout above the channel's upper boundary would be a bullish reversal signal, while a drop below the lower boundary could prompt accelerated selling.

Volume surged 236.15 per cent following CEO Daniel Ek's announcement that he will step down in 2026, reflecting heightened investor interest and uncertainty. At the same time, Spotify's implied volatility has climbed nearly twice the historical volatility, signalling increased volatility. This means investors should be cautious, use protective stop-losses, and consider entering gradually rather than all at once.

Looking ahead, analysts outline three speculative scenarios for the next six months:

- Bullish: If Spotify delivers strong earnings, executes a smooth CEO transition, and sustains momentum in podcasts and audiobooks, shares could advance toward $700–900, in line with the upper range of current analyst targets.

- Neutral: If results are steady but unimpressive, SPOT may trade broadly within the $650–$ 800 range, consistent with consensus expectations.

- Bearish: If leadership changes falter or broader tech sentiment weakens, the stock could retreat toward $500–600, below the analyst average but above extreme downside cases.

Ultimately, the stock's next move will hinge on upcoming earnings reports, the announcement of Ek's successor, and how effectively Spotify expands and monetises its content ecosystem. For investors, the current setup presents an opportunity to act strategically—whether by buying near support, waiting for a breakout, or holding off until the picture becomes clearer.

Disclaimer: Our digital media content is for informational purposes only and not investment advice. Please conduct your own analysis or seek professional advice before investing. Remember, investments are subject to market risks, and past performance doesn't indicate future returns.

© Copyright IBTimes 2025. All rights reserved.