PC Market in Longest Ever Period of Decline [VIDEO]

An 11% drop in the second quarter of 2013 marks the fifth consecutive quarter of decline in PC market.

We all knew the PC was in trouble and the latest figures from research firms Gartner and IDC relating to the second quarter of 2013 only serve to reinforce this belief.

Both sets of figures show PC shipments slipped 11% compared to the same period last year. According to Gartner, it was the fifth consecutive quarter of decline in shipments - "the longest duration of decline in the PC market's history".

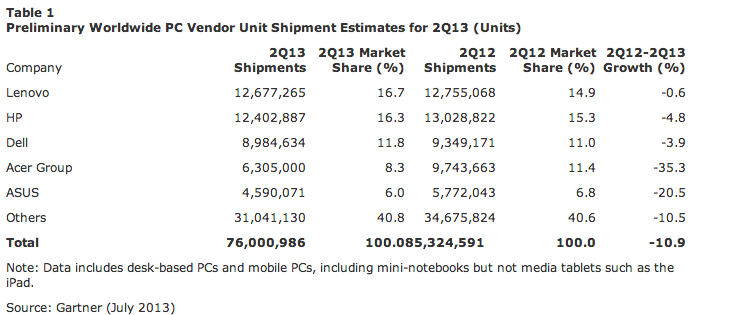

The second quarter of 2013 also marked the first time when Chinese manufacturer Lenovo was listed as the No 1 PC manufacturer by both Gartner and IDC. In October 2012 Lenovo was briefly said to have overtaken HP at the top of the list by Gartner, but IDC still listed the American company as No 1.

Lenovo is now undisputed king of the troubled sector with over 16% of the global market, just ahead of HP. The Chinese company also recorded a drop in shipments compared to the same three-month period in 2012.

Cheap tablets

Lenovo's drop was much smaller than that of HP, Dell and particularly Acer, which recorded a fall of over 30% over the 12-month period.

The main reason for the steep decline in PC shipments? According to Gartner the blame lies entirely at the feet of cheap tablets.

"We are seeing the PC market reduction directly tied to the shrinking installed base of PCs, as inexpensive tablets displace the low-end machines used primarily for consumption in mature and developed markets," said Mikako Kitagawa, principal analyst at Gartner.

"In emerging markets, inexpensive tablets have become the first computing device for many people, who at best are deferring the purchase of a PC. This is also accounting for the collapse of the mini notebook market."

IDC on the other hand puts some of the blame on the fact we are in a transition period, moving from traditional desktop PCs to more touch-based devices running Windows 8.

"The numbers reflect a market that is still struggling with the transition to touch-based systems running Windows 8 as well as justifying ultrabook prices in the face of economic pressures and competition from tablets and other devices," said IDC.

Signs of recovery

The one region showing signs of recovery, according to IDC, was the United States, which recorded a decline of just 1.6% over the period, "a substantial improvement from double-digit declines in three of the past four quarters".

While HP and Dell account for almost 50% of the shipments in the US, Lenovo - which traditionally has focused on its home territory of China - continues to gain market share in North America too, gaining 20% in the last year to now hold 10% of the PC market there.

Things are not looking so rosy in the Europe, Middle East and Africa region where PC shipments were "weakened" in the three months to the end of June, with a 16.8% decline (according to Gartner) over the same period last year, marking the fifth consecutive quarter of decreasing shipments.

© Copyright IBTimes 2025. All rights reserved.