Scottish Independence: Scotland Faces 'Unprecedented Austerity' and Junk Credit Rating

An independent Scotland's credit rating would be junk if it was deemed not to have taken its fair share of UK debt, according to a group of leading economists.

This is because it would be seen by the investment community as opportunistic and interpreted as a default, argues the National Institute for Economic and Social Research, leading to "unprecedented austerity" because Scotland would be effectively shut out of the capital markets for some time.

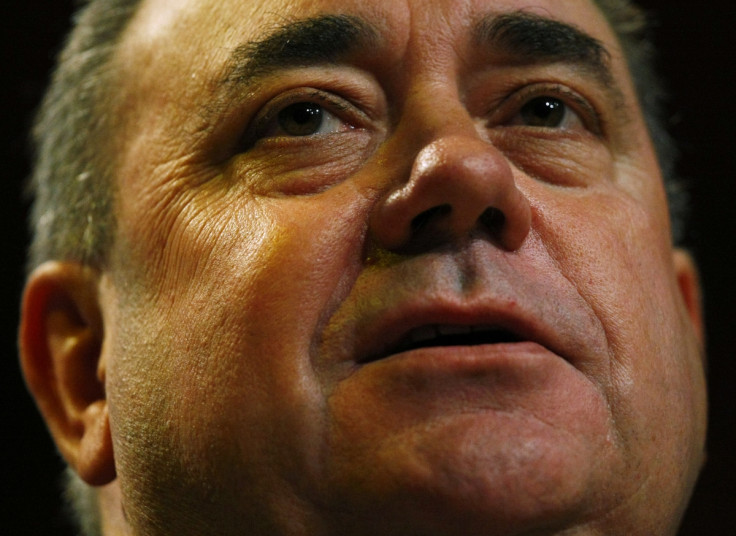

The institute believes that Alex Salmond's "Plan B" on an independent Scotland's currency is to keep using sterling informally but to renege on any UK debt.

As it stands, the three main Westminster parties have all said there is no guarantee – and it is in fact unlikely – that Scotland could enter a formal currency union with the rest of the UK if it were to split off after the knife-edge 18 September referendum.

Salmond, leader of the Scottish National Party (SNP) and Scotland's first minister, has repeatedly said his preference is to keep the pound and that this is the likeliest outcome.

But he faces the prospect of "Sterlingisation" – using the pound informally and backed up with foreign exchange reserves, of which Scotland would probably inherit around £7bn ($11.3bn, €8.76bn) from the UK. Salmond said Sterlingisation would be a viable "transitional option".

"International investors are likely to see walking away from debt as 'opportunistic' and charge very high borrowing premiums or exclude Scotland from international capital markets," the institute said.

"This would imply an immediate return to a fiscal surplus and unprecedented austerity. Whether citizens of Scotland would accept this policy simply to hold onto sterling would become a source of speculation.

"We would expect the currency arrangement to fail and Scotland would be forced to introduce its own new currency within one year. Introducing a new Scottish currency has always been the most sensible option.

"We would recommend this is carried out before losing £7bn of foreign exchange reserves rather than after."

And this would also present a problem for Scotland joining the European Union (EU), as Salmond hopes he would be able to do if the country went independent.

"If the EU were to admit a country – any country – which had just seceded and walked away from its debts, it would be creating an extraordinary precedent with potentially far reaching consequences," said the institute.

"In Realpolitik terms, the highest hurdle for any Scottish bid for EU entry would be obtaining Germany's 'yes'.

"Germany is the main creditor nation, the most economically powerful country in the EU. If Scotland were allowed to set a precedent for EU membership after secession, despite debt repudiation, Germany would be highly exposed to any other ensuing post-secession insolvencies."

© Copyright IBTimes 2025. All rights reserved.