Government to 'Name and Shame' Wealthy Tax Avoiders

Millionaires and celebrities who try and use complex schemes to avoid paying tax could be named and shamed by their accountants, ministers will reveal.

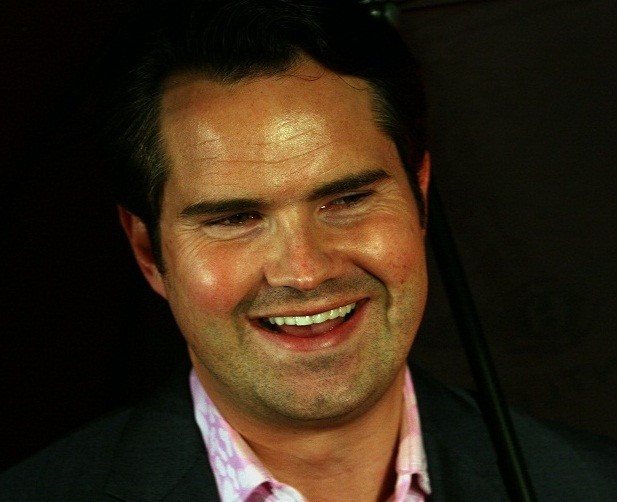

Following the controversy surrounding comedian Jimmy Carr's use of the legal; K2 scheme, Treasury Minister David Gauke will propose the HMRC should have more powers "to demand more information from scheme promoters".

The prime minister Daivd Cameron called the aggressive but legal tax avoidance Jersey-based scheme used by Jimmy Carr - where he paid one percent tax on his income - as "morally wrong".

Mr Gauke will say in a speech to the thinktank Policy Exchange: "We are building on the work we have already done to make life difficult for those who artificially and aggressively reduce their tax bill.

"These schemes damage our ability to fund public services and provide support to those who need it. They harm businesses by distorting competition.

"They damage public confidence. And they undermine the actions of the vast majority of taxpayers, who pay more in tax as a consequence of others enjoying a free ride."

Under the HMRC's plans, companies using tax avoidance schemes will be forced to provide details of their wealthy clients who use these legal schemes as Officials often hit a dead-end when investigating ones that are based off-shore.

Companies could face fines of more than £1m if they flout the new rules.

The treasury reports that 14 percent of all unpaid tax is due to avoidance schemes.

Carr last month said he made a "terrible error of judgement" regarding his use of the K2 scheme.

© Copyright IBTimes 2025. All rights reserved.