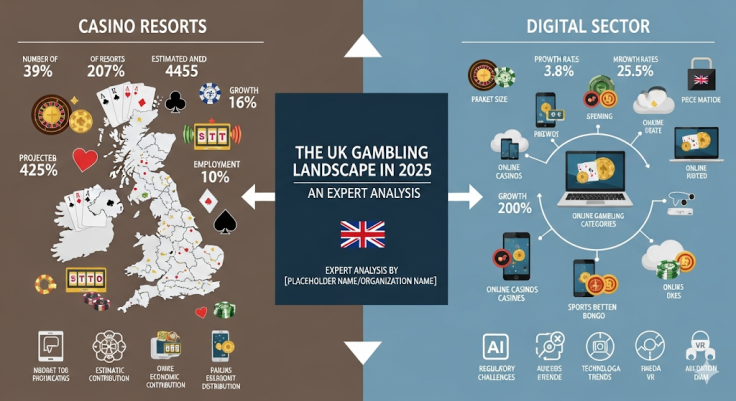

The UK Gambling Landscape in 2025: An Expert Analysis of Casino Resorts and the Digital Sector

Experts reveal how resorts and online betting are rewriting the rules of play

The UK gambling industry is undergoing an era of transformation in 2025, as it is marked by the active evolution of the physical and online landscape. The conventional bricks-and-mortar casino industry is in the active process of redefining its role, as an industry where the focus lies on pure gaming and is instead viewed as an integrated recreational and entertainment area. In the meantime, the gambling market grows at a decent rate online because of the development of technology, as well as the increased convenience of consumers.

This active growth, however, is taking place within a recently rebuilt, information-grounded regulatory regime focused on more protection of consumers and their sustainability. This analysis explores both of them, giving a concise summary of the top casino resorts to visit as a tourist and a closer examination of the state of the digital gambling market and its new regulatory paradigm.

The Modern UK Casino Resort: An Integrated Leisure Destination

The more integrated leisure experience is replacing the traditional model of a casino as a stand-alone gaming venue. In contrast to the purpose-built gaming-focused complexes of other international centres, the major casino resorts of the UK are included in a larger hospitality and entertainment package.

Gaming is an important, though not exclusive, aspect of a holistic destination that attracts a wide spectrum of visitors, including families on holiday and people on a business trip. The strategic change acknowledges that the new traveler wants the full package of a luxury hotel or resort, fine cuisine, upscale shopping, and recreation options, all in proximity.

Spotlight on Premier UK Casino Resorts

Casino resorts that have managed to integrate the best casino with a complete non-gaming facility are the most attractive to the travel enthusiast. These destinations are the reference point of a new, transformative model of leisure and entertainment.

Resorts World Birmingham: The UK's Premier Integrated Destination

First in this integrated destination concept is Resorts World Birmingham, a compound that has established itself as the prototype of a complete leisure experience in the UK. This resort lies within the base of the Genting Hotel and projects an outstanding combination of amusement and luxurious elements. The hotel has nearly 180 luxurious rooms and suites with a peaceful Asian-based spa.

The main feature of the complex is the Genting International Casino, which is proudly known as the largest casino in the UK. In addition to the large gaming floor, which features an assortment of table games and slot machines, the resort is an entire entertainment production.

The site also offers visitors an on-site cinema with an IMAX screen, a wide range of dining choices, and an expansive outlet shopping experience. It also has popular entertainment options such as the Hollywood Bowl and Escape Hunt, which offer numerous activities to all kinds of guests. Its strategic positioning also gives Resorts World Birmingham an added advantage of being able to access other areas of the city, including LEGOLAND Discovery Centre, national SEA LIFE Centre, Warwick Castle, and Cadbury World with ease, making it the best place to base a family vacation.

London's Crown Jewels: Diversity in Luxury and Convenience

The casino scene in London provides a wide variety of experiences, including both historic high-energy centres and elite luxury clubs. Both of them serve a different client base and offer a different ambiance.

The Hippodrome Casino: Located in the heart of Leicester Square, The Hippodrome is a vibrant fixture of London's entertainment landscape. The venue is home to the award-winning Heliot Steak House, a Chinese restaurant, rooftop terraces with outdoor gaming, and live shows, including the popular Magic Mike Live. Its central location provides travelers with easy access to London's most iconic landmarks, such as Westminster Abbey, the London Eye, and the British Museum.

The Mayfair Elite: London has casinos in its Mayfair district, which are the best in terms of luxury experience. There are clubs such as Wynn Mayfair or Park Lane Club, which work in collaboration with the surrounding hotels and are elaborate with old-fashioned table games such as Baccarat and Roulette. These facilities focus on privacy and flawless service, which will appeal to a client base that desires a refined and relaxed atmosphere.

The Urban Oasis: St Giles London Hotel is a good and easy alternative in the Soho district with direct and 24/7 access to the Grosvenor St Giles Casino. This arrangement is best suited to the traveler who wants to stay in central London and have easy access to gaming amenities at their convenience without losing the essence of urban life.

The State of the UK's Online Gambling Scene in 2025

The UK's online gambling market remains a powerful force, and it is set to keep growing at an alarming rate in 2025 as it firmly entrenches itself as a market leader in the digital industry. The market size of the entire UK gambling industry is around £11.67 billion ($15.65 billion), and the online market segment contributes a large percentage of this amount and is estimated to be around £8 billion ($10.7 billion). This sector is expected to experience a compound annual growth rate (CAGR) of 5.4% between 2025 and 2029, which is a credit to its robustness and flexibility.

This growth is facilitated by extensive digital connectivity; 97.8% of the UK population is users of the internet. Mobile gambling has become the platform of the day due to the continued use of smartphones, and it controls an overwhelming 59.8% of the market. Consumer interaction has been greatly intensified by the ease and availability of mobile applications and in-play gambling. As the online market booms, it is also characterised by its segment concentration, where online sports betting commands a very high market share of 56.6% due to the cultural connection that the UK has with sports.

The Regulatory Revolution of 2025: A New Era of Proactive Oversight

The gambling market in the UK in 2025 has seen a paradigm shift, working within a newly strengthened regulatory framework based precisely on the radical remedial action taken by the Government in its 2023 White Paper. This era represents a clear shift by the UK Gambling Commission (UKGC) towards a proactive, data-driven, and highly interventionist policy, the exact opposite of the former, reactive and industry-led policy.

The new system includes a compulsory statutory levy as one of its pillars, making research, education, and treatment services sustainable and ring-fenced to fund this new model rather than a voluntary formerly used funding system.

Additionally, the industry experienced the implementation of compulsory online slot stake limits, where players aged 25 and above are subject to the £5 ($6.71) per spin limit and young adults to a stricter £2 ($2.68) per spin limit; this is in direct reaction to the evidence that younger adults are more susceptible to harm. These security features are widespread across the online gaming scene; the new regulations on the remote design of games, including the prohibition of gimmicks such as 'turbo' and 'slam stops' and the requirement of real-time reporting of net spend, pertain to a large variety of online products. This also encompasses popular casino games, where the experience of playing a game such as blackjack online is now defined by these new safety requirements.

In addition to these changes, there are new financial vulnerability and risk checks, which also rely on publicly available data to determine individuals at risk but do not impact their credit ratings. The sweeping changes are an indication that the UK is dedicated to developing a safer and fairer market, and its regulations of gambling are a sophisticated and evidence-based endeavor to balance consumer protection and the sustainability of the whole industry.

Corporate Strategies and Performance in 2025

The online betting market has been characterised by major players that have been manoeuvring through a dynamic and changing environment with a diversified approach. Key players' annual reports are the most important sources of information on recent trends in the betting industry.

The performance of Flutter Entertainment in Q1 2025 revealed positive revenue growth, which was mainly driven by its US business. Nonetheless, its UK and Ireland (UKI) business experienced a Q2 downturn, even though its iGaming segment increased by 27% and performed very well. This variability in sportsbook turnover, at least partially due to poor sports performances and comparisons to previous years, underscores how essential the product diversification and the ability to withstand a fluctuating market are.

By comparison, Entain PLC has performed well in the half-year, with UK&I Online Net Gaming Revenue increasing by an astonishing 21%. This growth directly correlates with the company reporting a positive recovery in market share and a more robust player base in the wake of the recent regulatory changes to the betting industry, implying that in a well-regulated environment, sustainable growth can be achieved.

In the meantime, Bet365 is back to profitability in the 2023-24 financial year, which it attributes to strategic international growth and product development. Competition has been intense, and operators have distinguished themselves based on cutting-edge technological capability, loyalty programmes, and strategic mergers and acquisitions to broaden their market share and product lines. These new financial performances indicate that we are in a market that values innovation and strategic response to regulatory and competitive forces.

© Copyright IBTimes 2025. All rights reserved.