George Osborne and UK Austerity: Why Gilt Yields Are Near Record Lows

Britain's borrowing costs haven't been this low since Queen Anne and the War of Spanish Succession but a Royal row still brews today as to whether the record low Gilt yields currently helping fund the country's budget deficit are the result of Chancellor George Osborne's controversial austerity measures.

Austerity, namely the coalition's billions of pounds of painful cuts to vital public services across the country, is driving down Britain's borrowing costs, asserts Osborne.

Without low borrowing costs, he claims, the UK has no chance of reducing its deficit, servicing its debt, or maintaining any meaningful amount of public services.

But what drives the borrowing costs lower?

"The main reason for the sharp drop in UK debt yields to historic lows is the fall-out from the European debt crisis and so called 'safe-haven' demand for instruments seen less under stress," said Daniel Baker, head of fixed income for Europe at Informa Global Markets, a leading investor intelligence business.

"Of course there are other pluses for UK debt, i.e. more political stability, flexibility in terms of policy - fiscal and monetary - but the bottom line is that gilts may not be outperforming on merit, but are benefiting indirectly or by default almost as better by comparison."

The Chancellor's would respectfully disagree.

"Mr Deputy Speaker, our commitment to reduce the deficit is keeping interest rates low," Osborne declared in his Budget 2012 speech to parliament. "There have been times the Treasury has been borrowing money more cheaply than at any previous time in that 400 year history. Few countries in Europe could say that. This reflects the confidence investors have in Britain's ability to pay its way."

Gilt yields have dropped lower and lower in recent months, with 10-year bonds hitting a 300-year low of 1.439 percent on 1 June. They may fall further still.

You would be forgiven for thinking that the government's stalwart commitment to austerity is the reason gilt yields are so low, but there are a number of factors helping to depress returns.

Eurozone crisis and investor safe havens

"Despite the UK's own fiscal position and excessive deficit issues, the problems are not seen as bad relative to the worst EMU peripheral sovereigns," Baker said.

The crisis-mired Eurozone continues to scream uncertainty to the markets, with a megaphone being held up by the credit rating agencies, who have made sweeping downgrades of banks and states across the area.

Its sovereign debt crisis still looms like a black cloud and has thundered for two years, with no signs of a positive conclusion to the single currency area's issues any time soon.

Greece is looking to renegotiate its bailout terms as it struggles to cope, both politically and economically, with the strict austerity required by the EU and IMF for it to get the emergency cash.

Spain's borrowing costs continue to flirt around the consensus level for unsustainability of 7 percent, as serious doubts surround the robustness of its financial institutions, whose €100bn recapitalisation may still not be enough to shore them up against the current crisis, as well as rapidly falling house prices.

Bond investors fear that one of the Eurozone's 17 member states will default on its debts, sending a shockwave through the rest of Europe and the world, and dragging other economies down with them.

The risk of losing cash is much more real across the Eurozone than in the UK.

A lack of fiscal and political integration across the region means there are quarrels and differing economic interests between the member states over the role that the European Central Bank (ECB) should play.

In theory the ECB could print all the euros Greece needs to repay its debts, but other states that are not in such a fiscal quagmire, such as Germany, are understandably hesitant to devalue their currency and urge austerity over an increasing amount of quantitative easing that could ignite inflation.

This inability to reach agreement and for the central bank to take swift, decisive action unsettles investors.

Currency sovereignty means that the UK could never default on its debts because, painful though devaluing would be, the Bank of England acts autonomously under the guidance of one government - further adding to the country's position as a safe haven.

Bank of England QE skewing the gilt market

The Bank of England's quantitative easing programme, known as the asset purchase facility, saw it buy up £325bn of high quality assets from the markets, which were mostly gilts.

There is a strong possibility that the Bank will fire up the printing presses again for an extra £50bn of stimulus later this week.

"On balance, most members judged that some further economic stimulus was either warranted immediately or would probably become warranted in order to meet the inflation target," said the minutes from its monetary policy committee meeting in May.

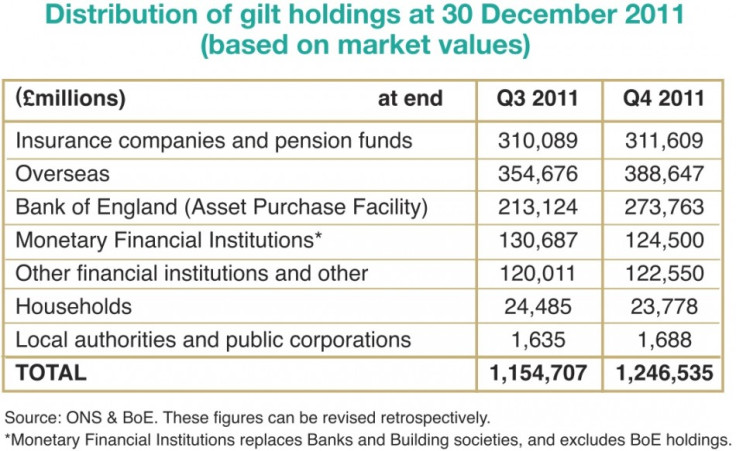

In the last quarter of 2011, when the last set of figures are available from the government's Debt Management Office (DMO), the Bank held almost 22 percent of the total value of the £1.25tn gilt holdings available on the market because of its asset purchase facility.

"A £50bn increase in asset purchases on the 5 July meeting is the expected outcome from lower inflation risks and downside risks from the on-going euro crisis," said Societe Generale strategist Michala Marcussen.

Inevitably this skews the most fundamental aspect of a market: supply and demand.

By hoovering up hundreds of billions in gilts at their face value, the asset becomes easy to sell at a price that does not necessarily reflect the market's view, pushing up gilts' value.

Gilt investors also knew that there asset would always be in demand while the Bank's quantitative easing continued.

On top of this the Bank of England has its base interest rate at the record-low of 0.5 percent for over three years, with talk of cutting it further to induce spending over saving.

This helps hold yields down, as the base rate influences interest rates across the economy.

As well as the Bank of England, other central banks from across the world have been investing in safe haven gilts.

Indeed foreign investors, made up mostly of central banks and sovereign wealth funds, account for the largest portion of UK debt holders, according latest data from the DMO, with a total of £389bn in gilts.

These price insensitive buyers allow yields to drop further.

Why investors choose gilts

"Demand for gilts is strong from pension funds primarily because they are seen as a good match for pension liabilities, which by the nature of pensions are long-term," Julian Le Fanu, policy adviser with the National Association of Pension Funds (NAPF), told International Business Times UK.

NAPF represents those with retirement money invested in workplace pensions and its members hold assets worth £800bn.

Of those members 70 percent have investments in index-linked gilts.

"There has also been a flight to safety into gilts from equities as pension funds look to lower their exposure to risk, particularly in the wake of the credit crisis," Le Fanu said.

"At the moment gilt yields are low so they are not offering a good income compared to what they were a few years ago, but nonetheless demand for them remains buoyant, partly because the accounting rules around pension funds encourages take-up of gilts."

Le Fanu added: "Insurance companies are being pushed into buying gilts by official solvency requirements."

When asked if NAPF members consider Osborne's austerity measures when investing in gilts, NAPF said it does "not see a correlation between those factors".

"Clients invest in gilts as a hedge against further turmoil in Europe, and the risk of debt deflation that could ensue," Mike Amey, managing director and portfolio manager at investor services firm Pimco, told IBTimes UK.

"Whilst nominal gilt yields are already low, in a world of deflation gilts would still provide a positive real return."

Pimco manages $1.77tn (£1.13tn) worth of assets across the world.

When it comes to Osborne's austerity, Amey said that "clarity of the fiscal position" is important, "but so is the willingness of the Bank of England to buy large quantities of gilts".

© Copyright IBTimes 2025. All rights reserved.