Wolseley to Deliver Improved H1 Margins; Credit Suisse Assigns 'Outperform' Rating

Wolseley, the specialist trade distributor of plumbing and heating products, is expected to report increased half-yearly earnings with a more bullish outlook for the US housing market on March 27.

The group is well placed to exploit the significant growth opportunities for the future in its chosen distribution markets. The performance of the business is improving and it is now getting good visibility down to a branch level across all key performance measures.

Wolseley has continued to grow well with strong growth in the USA offset by lower growth in some of its European businesses. The group expects conditions to get tougher in the coming months, acknowledging continued macroeconomic uncertainty. It will remain alert on costs and continue to drive performance improvements, strong cash conversion and better customer service. The group is well positioned to continue to invest selectively with its healthy balance sheet, where it can generate good returns.

"As a result of the improved organic sales growth forecasts we also envisage a step-up in operational leverage and thus improved margin performance," Credit Suisse says and advises investors to "Stay Positive into Q2 result" and reiterated its "Outperform" rating on the stock.

Wolseley's stock price rose 2.8 per cent on March 21, the top gainer on the 0.2 per cent-stronger FTSE 100. Credit Suisse's bullish note helps in attracting investors ahead of second-quarter results on Tuesday supported by strong US homes sales data. The bank also raised its price target on the stock to 2,850 pence from 2,400 pence.

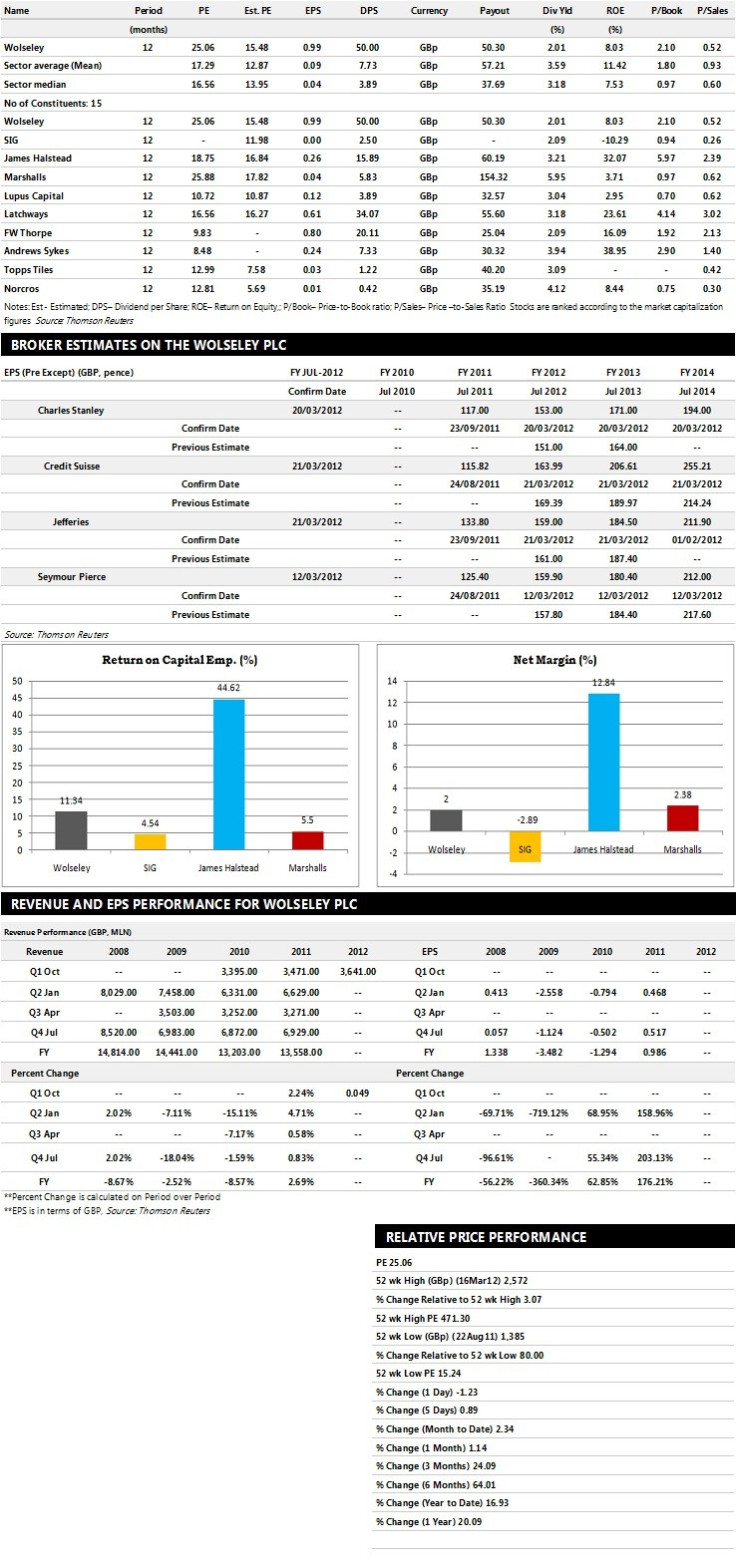

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- Credit Suisse recommends 'Out Perform' rating on the stock with a target price of 2850 pence per share

- Numis Securities recommends 'Hold' rating on the stock

- Jefferies assigns 'Hold' rating

- Liberum Capital gives 'Buy' rating with a target price of 2680 pence per share

- Charles Stanley assigns 'Out Perform' rating

Earnings Outlook:

- Credit Suisse estimates the company to report revenues of £12,943 million and £14,176 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £552 million and £710 million. Earnings per share are projected at 163.90 pence for FY 2012 and 206.61 pence for FY 2013.

- Jefferies projects the company to record revenues of £12,883 million for the FY 2012 and £13,359 million for the FY 2013 respectively with pre-tax profits (pre-except) of £616 million and £714 million. Profit per share is estimated at 159 pence and 184.50 pence for the same periods.

- Seymour Pierce expects Wolseley to earn revenues of £12,976.00 million for the FY 2012 and £13,786.40 million for the FY 2013 respectively with pre-tax profits of £587.30 million and £662.70 million. EPS is projected at 159.90 pence for FY 2012 and 180.40 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.