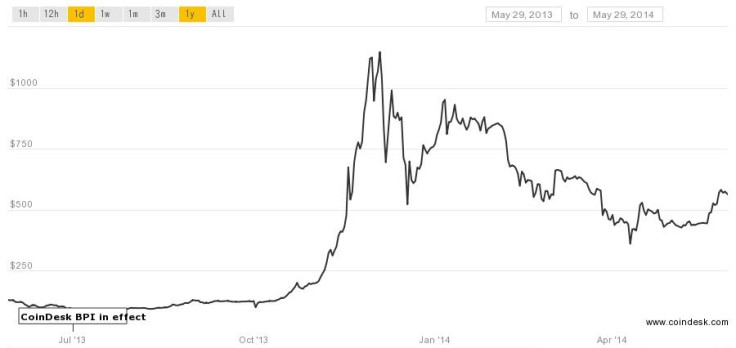

$1000 Bitcoin Bubble Blamed on Fraudulent MtGox Bots

Two computer algorithms have been blamed for fraudulent trading that artificially inflated the price of bitcoin through the MtGox exchange, according to a new report.

The algorithms, named Markus and Willy, bought up 650,000 bitcoins in the final months of the beleaguered exchange, causing the price of bitcoin to soar above $1,000 in November 2013.

"There is a ton of evidence to suggest that all of these accounts were controlled by MtGox themselves," the anonymously published Willy Report claims.

"So if you were wondering how bitcoin suddenly appreciated in value by a factor of 10 within the span of one month, well, this may be why."

The MtGox exchange subsequently collapsed in late February, claiming that it had lost approximately 650,000 bitcoins to hackers. According to the report's author, however, these lost bitcoin can be traced back to the Markus and Willy bots operating from within MtGox.

The Willy Report examined leaked activity logs to uncover the bot's activity, which revealed that they operated without paying regular fees and continued to do so even during periods when the site went down for half an hour in January.

High-value traders

However not everyone believes these bots were the sole cause of the bitcoin bubble last year.

It has been speculated by some bitcoin analysts that the two bots were operating on behalf of "high-value" traders.

"I've worked for two large Wall Street banks, and I can tell you flat out that high value clients have access to products and services that 'normal' people do not," said Reddit user watabme. "Willy didn't pay fees or fiat because it operated outside the purview of what a normal trader would have to do.

"Also, does anyone really think that Willy could really single-handedly incite an entire bubble when there were at least two or three other similarly sized exchanges? The truth is that Willy was just one form of high value clients entering the market onone exchange."

In response to such theories and criticism that the report's conclusions were too opinionated, the anonymous author of the Willy Report added an update.

"I stand by the most significant conclusion made: Willy was the cause for the November bubble," the update reads.

"Sure, it didn't do it all by itself, but it was the catalyst, and prevented price from coming down by effectively removing all selling pressure with its extremely constant buying."

© Copyright IBTimes 2025. All rights reserved.