2023 Showed Lower Volatility for the Pound Sterling; But Will 2024 Be the Same?

2023 Showed Lower Volatility for the Pound Sterling; But Will 2024 Be the Same?

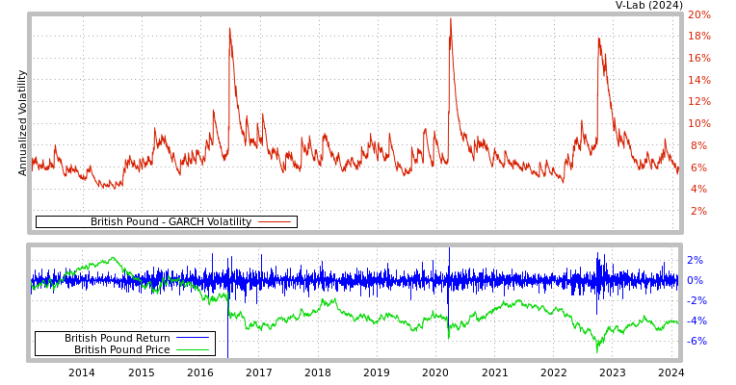

Ever since the announcement of the Brexit result, the pound has never been the same. It wasn't just the instant drop off in its value — and the attractiveness of the British monetary economy in general — but its clear rise in volatility. It was clear that the pound was suddenly worth less overnight, but how much less? This lack of certainty and ad-hoc assessment with the backdrop of Brexit negotiations, the pandemic, European war, and inflation is what created constant adjustments and reassessments in its value.

It perhaps wasn't until 2023 that it found its feet again and it began to stabilize. But, will this continue on into 2024 in the face of adversity and potential interest rate decreases?

GBP volatility in 2023

Since 2013, there have been three major peaks in volatility for the pound, along with a baseline increase. As the chart shows, the three peaks came in 2016 (Brexit referendum), 2020 (COVID-19 pandemic), and 2022 (war, energy supply shocks, and increased global central bank policy activity).

As we can see, 2023 brought back some stability. The more we contextualize, the further it has fallen against the dollar over time. However, many decision-makers do not have such long memories, nor does such context matter, when we consider that 2023 felt stable for the pound as it hovered around $1.25.

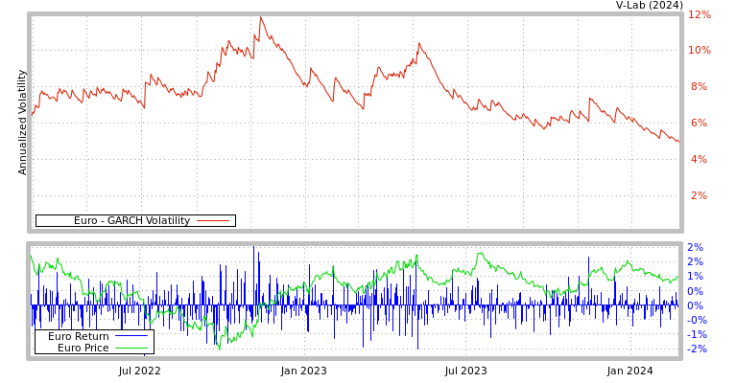

In fact, given the pessimism surrounding the UK economy, many consider the pound to be surprisingly strong — this is helped by the Euro suffering a worse fate than the pound in 2023, as it fell from 1.13 to 1.16 against the pound.

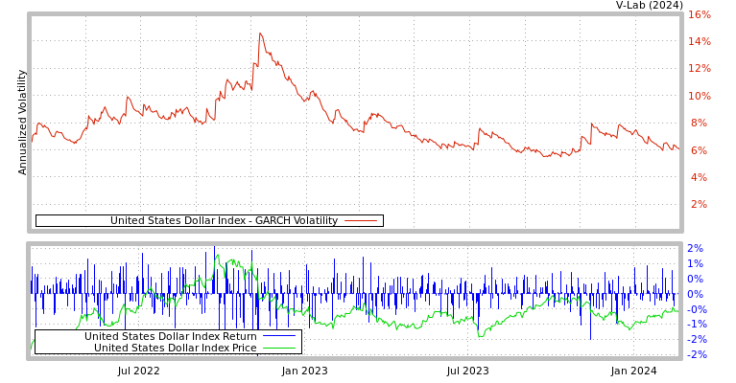

This is for several reasons, from unexpectedly outperforming some European economies like Germany, to maintaining higher interest rates comparatively. And while the US has a 0.25% higher interest rate, it is expected that the Federal Reserve will be the first to make a reduction.

Firms stepped away from hedging

Another way to measure volatility, and perceived volatility, which is also important because it influences real volatility, is to look at hedging activity. Ultimately, one of the main drivers towards a company or investor hedging a currency is because they're uncertain about its future. It's not about directional expectations (though it can be), but it's always concerning uncertainty. If there was no uncertainty, there would be no need to hedge any asset.

In 2023, we saw a considerable drop in British firms hedging foreign exchange exposure. This will drop from 89% in 2022, to 70% in 2023 according to a MillTechFX report. This included a reduction in firms that already hedge, as well as a reduction in firms looking to begin hedging.

Did the reduction in hedging pay off for firms?

The report also showed that almost 70% of companies surveyed had their bottom line impacted from currency swings. It's easy to forget just how tied even the smallest of companies are to overseas suppliers, customers, and partners, yet have to face the reality of using different currencies. This is less of a concern for American companies, where the US dollar is the currency (or pegged to) many countries around the world.

For firms that did reduce their hedging activity, they will have saved some money directly on fees and spread, which are the two primary forms of income from FX hedging services. For companies hedging the Euro or USD because of paying suppliers or juggling multiple treasury accounts, they will have benefited from this reduction because the pound slightly strengthened against them over the course of 2023. For companies hedging future GBP sales, they may have made the right call.

Ultimately, whether hedging pays off or not is about what direction a currency moves in, and by how much. But, this is notoriously difficult to predict, even for professional FX employees and hedge fund managers. Instead, companies look at how much the GBP is moving regardless of direction, and this can determine the amount they hedge. When volatility is reduced, as we saw in 2023 (though it did have a small peak towards the end of the year), the payoff or losses involved in this decision are also reduced. For many companies, this is enough to not dedicate time and resources to such an FX strategy.

A look at volatility in 2024

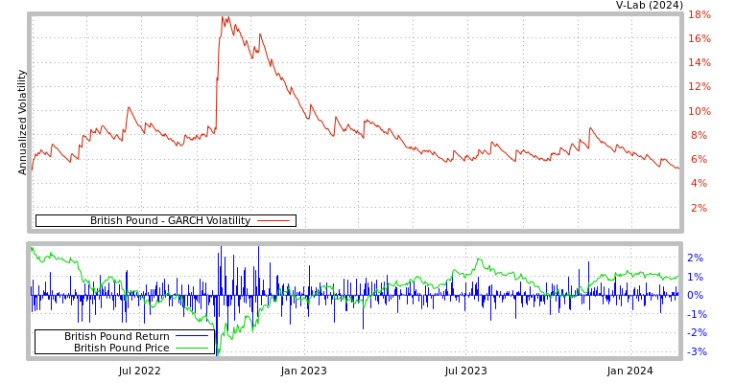

Being only a couple of months into 2024, volatility has been falling continuously and is currently very low relative to previous years. It's also clear to see that there is some level of correlation between the volatility (red line), and the value of the pound (green line). Here, it seems that volatility is currently low because the pound is appearing strong.

The reasons behind this strength are similar to those reasons stated early, namely that the UK's interest rates remain relatively high. In fact, the steadiness of the pound in 2024, despite recently falling into recession, caused the Bank of America to dub the currency as "the dollar of Europe".

Despite the recession, consumer confidence has been growing consistently since Q3 2022. Some of the causes behind this optimism include expectations surrounding a cut to national insurance, strong wage growth, easing of inflation, and future quantitative easing. Ultimately, unless there are shocks to the system or genuine surprises, such steadily improving confidence bodes very well for GBP volatility.

There's further good news for the pound, in that the Bank of England is giving positive signs regarding its 'digital pound' developments. While controversial among the British public, this controversy likely will not have implications over the pound, while the international market participants will be more likely to view it in a positive light, as it aims to improve its efficiency.

The pound is an outlier

Heading into the year, the FT's Roula Khalaf wrote a piece that, compared to the 9 other G10 currencies, the pound is simultaneously a safe haven and a sensitive asset to riskier markets. Given that the pound is the fourth most traded currency in the world, this is extremely relevant.

According to Khalaf, the pound has been reacting inconsistently to variables unlike most currencies. For example, when US and European equities rally, the pound does well, insinuating it has positive risk signals. Meanwhile, it appreciates when interest rates rise, insinuating it's a safe-haven currency. This phenomenon has been more prevalent since the Brexit referendum, showing that it has never been quite the same since. Even worse, it shows that geopolitical events — of which there are many in 2024, not just with the many elections around the world, but with US' position in NATO potentially compromised, along with various wars — can and will have a long-lasting impact on currencies.

Another consideration is that the pound has outperformed the USD and EUR in low-volatility environments. This is important for businesses, because when volatility and currency risk are high, it appears there's a heightened chance of depreciation, which is an added risk that not all currencies have.

Looking further into 2024... And the EUR-USD

When it comes to FX risks and volatility, the pound is only one-half of the coin. If there are major swings in the USD or EUR, then these swings manifest in the GBP pair, regardless of its own performance. For businesses, this may mean vast changes in the price they pay for their imports.

So, it's important for British firms to closely track all of the currencies that they deal in.

It's clear that both the Euro and USD are following a similar trend to the pound in that their volatility has been declining in 2024, and both are in a similar situation.

There are many concerns in 2024 which may have an impact on all the major currencies, however. First and foremost, this is a year with a considerable number of elections. In fact, around a third of the world (64 countries), are due to have an election. Though, it's much more than a third of the world when weighted by GDP, as there will be elections in the US, almost every country in Europe, India, South Africa, and much of Asia and the Middle East.

The US elections alone will be destabilizing, with Trump already encouraging an attack on NATO countries that do not pay enough. For the pound, it's difficult to predict how it would fair under a Trump win, but concerns around volatility would increase, as well as for the USD.

Will firms begin hedging again?

Going back to the original GBP volatility graph, it's clear that the extreme peaks in volatility come every few years. Past results are not an indicator of future performance, but many will be more concerned about volatility later in the year than they are currently, which could see a rise in hedging.

It's also not a complete surprise that all three currencies (GBP, USD, EUR) began to stabilize more when central bank monetary policy began to stabilize. However, this will be short-lived, as most experts expect interest rates to begin falling in 2024, though it could be towards the end of the year.

It could then be a moment of increased central bank activity, coinciding with a change of leadership for most major economies around the world. While it's difficult to predict volatility, UK business confidence is lackluster, while Credit Suisse recently stated that exchange rate risk remains a big factor for companies. Just because it decreased in 2023, it doesn't mean it's low. Far from it, 55% of companies believe the EUR-CHF will dip below 1.00 in 2024. Credit Suisse also shows that service sector companies have a higher hedging ratio than industrial companies, proving it is sector-dependent. Almost 4 in 10 firms said they actively hedge against currency risk in 2024, and it's unlikely this will decrease.

The evergreen approach to hedging

Hedging against currency risk is the main way to minimize the amount your bottom line can be impacted by the FX market. However, it is too much to ask for all companies (particularly non-financial companies) to invest too much time into constant adaptations to their FX approach. Instead, an evergreen approach can be taken.

This approach revolves around taking a measured approach and not over-committing to hedging, because our need for it can sometimes wade. Instead, hedge forward with a low premium, and with around a 10% deposit where possible, which may seem quite low. For firms where less than 25% of their revenue comes from foreign currency, it may be possible to avoid hedging entirely.

What really matters: Saving on costs

CFOs can often get very caught up in thinking about hedging currency, such as how the market is changing and strategising accordingly. Often, though, the key message is lost: saving money. And, to save money, hedging isn't always the priority.

Instead, currency transfers themselves are fundamental to how much a business spends on FX, often neglecting that the transfers they are making are at a premium. This is often obscured by companies that use a spread as profit, yet do not clearly state the spread. When treating the spread as a form of commission, as it sometimes runs up to 3% and above, it's clear that finding the lowest-cost option is what really matters. When finding said lowest-cost option, it's surprisingly simple to compare money transfer rates in real-time, though this can often be a revelation to CFOs when they are too reliant on banking.

Summary

While the immediate outlook for the pound appears somewhat stable, it's clear that the currency has never been the same since Brexit. It suffers from oxymoronic behavior, making the upcoming geopolitical events of 2024 difficult to predict in how it will react. Instead of trying to invest too much time into forecasting this, CFOs should instead focus on the basics: finding an evergreen and conservative approach to hedging, as well as minimizing the costs of their current exchanges.

© Copyright IBTimes 2025. All rights reserved.