What 4G Will Mean for the Economy

We look at what 4G will mean for the UK in terms of economic and commercial implications.

The UK's regulatory body, Ofcom is today (2 October) in make-or-break talks with all the major UK mobile phone networks at the ministry of media, culture and sport, with the meeting being mediated by the new culture secretary, Maria Miller.

These talks are expected to resolve the on-going issues surrounding the roll-out of 4G networks in the UK, something which is already years behind the likes of the US, Germany and Japan.

Whatever the outcome of the talks, it is likely that by the middle of next year, smartphone and tablet users in the UK will be able to connect to a much faster mobile broadband service, with theoretical download speeds of up to 100Mbps available - ten times those available on 3G networks.

The 4G network could also help solve the problem of poor broadband connectivity in rural areas around the UK, and therefore help drive more economic growth in those areas.

In order to see what impact 4G will have on the UK's economy, we spoke to experts to see how 4G will changes things for people in the UK.

Economy

As we said, the UK lags behind other countries when it comes to getting 4G networks up-and-running. In the US for example, the 4G LTE [long term evolution] network has been available since 2010, but according to Lyn Cantor, CEO of Tektronix Communications, this is because customers demanded the upgrade:

"The US has enjoyed a head start with LTE because the operators have had to meet the demand for wireless data access driven by the proliferation of new smart phones and tablets in the U.S. market. Another driving factor has been the need for operators to reduce the cost of the delivery of mobile broadband."

In Europe things were a little different. Ten years ago, European mobile networks bet big on 3G, with the licences being auctioned off in the UK for a huge £22.4 billion, dwarfing the expected £4bn windfall from the 4G auction.

This is, in part, the cause of the delay in getting 4G networks working in the region, according to Cantor:

"In Europe you have a different environment where the operators have made a significant investment in 3G licenses and spectrum. The operators are not under pressure to commit extensively to LTE. These economic factors combined with spectrum allocation by regulators will lead to a different rate of market expansion for LTE in the region."

Huge effect

While the amount of money initially provided by the 4G auction will be tiny in comparison with the 3G auction, in the long run, experts believe that 4G will have a huge effect on the economy.

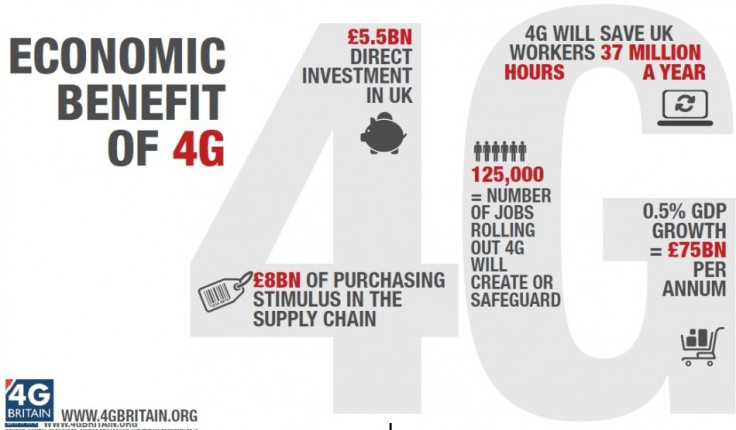

Back in April, independent research by Capital Economics said the introduction of 4G networks has the potential to "unlock £5.5bn of direct private investment into the UK economy by 2015" and provide access to mobile superfast broadband to at least 10 million people who will be unable to get fixed line broadband of a similar speed.

The report suggests that if a viable industry-wide 4G network rolls out by 2013, it would add 0.5 percent (equivalent to £75bn today) to the UK Gross Domestic Product (GDP) by the end of the decade. It would also ensure the safeguarding or creation of 125,000 jobs across the UK.

Doug Suriano, CTO of network signalling company Tekelec, agrees with the research, and believes the roll-out of 4G will be a boost for providers and networks:

"Entertainment brands and [content] providers will be in a position to successfully monetise services delivered over mobile networks; and enter into lucrative revenue share agreements that will benefit themselves and the operators."

© Copyright IBTimes 2025. All rights reserved.