Americans Are Paying Hidden 'Doorstep Taxes' on Their Deliveries — And Probably Don't Even Know It

As online shopping and food delivery skyrocket, states facing budget shortfalls are experimenting with new 'retail delivery fees'

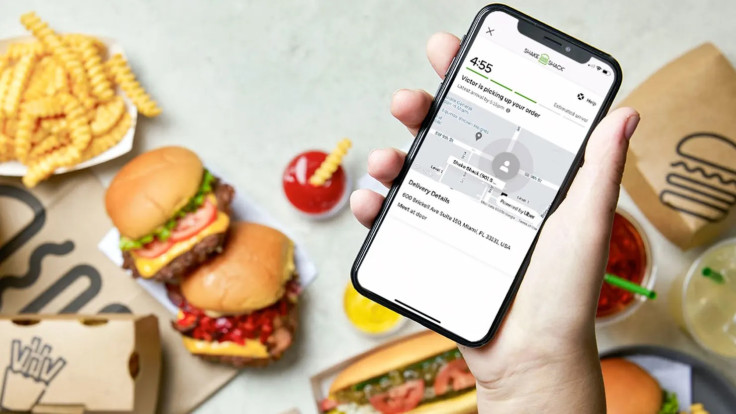

If your Amazon order or DoorDash dinner seems pricier lately, it may not just be corporate markups at play. Some states are now quietly imposing government delivery surcharges, sometimes called 'doorstep taxes', that get added at the very end of a transaction. These aren't extra shipping fees from the retailer — they're tax or fee mandates from state or local governments, emphasizing how revenue models are adapting to the digital economy.

Colorado was one of the first to adopt such a fee. Beginning in July 2022, Colorado levied a retail delivery fee initially set at 27 cents per delivery; the rate has since risen to 28 cents, 29 cents, and is then scheduled to revert to 28 cents in a subsequent fiscal year. The fee is not subject to state and state-administered local sales taxes, though home rule jurisdictions.

Minnesota followed more recently. As of July 1, 2024, Minnesota imposes a 50-cent retail delivery fee on transactions of $100 or more that include tangible goods. Retailers can either collect the fee directly from buyers or absorb it themselves. The legislation explicitly excludes the fee from being taxed again if it's itemized separately on the receipt.

These two states are not alone. Other states — such as Nebraska, Ohio, Hawaii, Maryland, Mississippi, Nevada, New York, and Washington — are exploring similar measures, considering delivery-based fees in the range of 25 to 75 cents per transaction. In Washington, for instance, state lawmakers are actively debating a retail delivery fee to help plug shortfalls in transportation funding.

The logic underpinning these fees often links to infrastructure funding. As more consumers turn to delivery instead of driving to stores, states claim they're losing fuel tax revenue that traditionally helped pay for roads. Some lawmakers argue it's justifiable that deliveries — driven by trucks and vans — bear a share of that burden. But critics see it differently: for many households, especially lower-income families or people with limited mobility, delivery is not a luxury but a necessity. Those same critics warn that these fees are regressive, effectively adding hidden costs to everyday goods.

In Washington, opponents have flagged the regressive nature of such fees. During legislative hearings, Rep. Jim Walsh questioned whether the burden would fall heaviest on those who rely most on delivery services. Meanwhile, a state-commissioned report has examined whether a 30-cent retail delivery tax could work, weighing both projected revenue and the administrative challenges.

The broader debate raises deeper questions about tax design, transparency, and fairness in a shifting economy. As such fees proliferate, consumers may begin to see 'free shipping' as less literal — and more of a front to hide government charges. Without clear disclosures or uniform rules, delivery taxes risk eroding trust and disproportionately impacting those least able to absorb them.

© Copyright IBTimes 2025. All rights reserved.