George Osborne's UK Budget 2012: Live as it Happened

Refresh the page for the latest updates.

Let us know your budget thoughts in the comments.

- Top tax rate falls to 45p in April 2013

- Alcohol, fuel duties frozen

- Stamp duty rises to 7 percent on residential properties worth £2m and over

- Personal tax allowance going up to £9,205 in April 2013

- Age-related allowances frozen/phased out; will raise £1.01bn

- Tobacco duty rises 5 percent above inflation - an extra 37p on a packet of cigarettes

- Treasury will explore 100-year/perpetual gilts sale

15:16 That's it for the IBTimes UK's rolling coverage of the 2012 Budget.

While some business leaders have welcomed things like the future reduction of the top tax rate from 50p to 45p, as well as the continued reduction of corporation tax, others say the chancellor's efforts to encourage growth and investment are thin on the ground.

Ed Miliband, the Labour leader, attacked it as a Budget for millionaires, not for middle and low earners.

Our business editor Martin Baccardax has given his own analysis of Osborne's Budget.

"The normally august chamber of the House of Commons was alive with pop culture references as chancellor George Osborne squared off against Opposition leader Ed Miliband over the small matter of the nation's finances.

"And while both men undoubtedly landed stiff jabs in the ritualistic sparring over tax and spend, it's hard not to think that Miliband's efforts to land the knock-out punch were somewhat in vain."

Read it in full.

Thanks for joining us.

14:48 Ed Balls, shadow chancellor, is on the BBC rejecting that the 50p tax rate is ineffective and that cutting it to 45p would help reduce tax avoidance.

Says millionaires are simply being handed a £10,000 tax cut.

"It's really important to be absolutely clear what the government is doing here. What they are doing, and the document confirms, they are cutting the taxes for 300,000 top-rate taxpayers," Balls told the BBC.

"It confirms the cost of that next year will be £3bn - they're giving £10,000 to every top-rate taxpayer.

"They're gambling that if they give £10,000 to the richest people who currently pay tax, they'll somehow be able to recoup £2.9bn from people who currently aren't paying tax because they're offshore or avoiding tax.

The problem is there's no certainty they'll get that money."

Also says that the changes to state pensions, which will see an effective real terms cut, and the savings being made from reducing Britain's role in the Afghanistan war are being used to fund tax cuts for the wealthy.

14:41 There were a group of protesters outside of parliament while Osborne made his speech. Here's a photo of them from Reuters:

14:33 Business lobbyists the Confederation of British Industry has welcomed the Budget.

John Cridland, the director general, said:

"Family budgets have been under great pressure, and by putting more money in the pockets of ordinary people, the Chancellor has provided a much-needed confidence boost.

"The Chancellor has also painted a clearer vision of how the UK will earn its living in the future and, by seizing the opportunity to make sure our corporate tax system is more internationally competitive, he has sent a powerful signal to companies to invest, do business and create jobs in the UK.

"An extra one per cent off corporation tax this year could make a big difference to investment intentions. Plans to reduce the top rate of tax to 45p by April 2013 will show our top and aspiring talent that this Government wants them to create wealth here.

"With many calls on the Chancellor to spend money he didn't have, the best news for businesses is that he stuck to his guns and delivered a fiscally neutral programme.

"If businesses were looking for more, it was in the area of deregulation. For smaller businesses, things may not feel very different on the ground. It would have also have been a huge relief if the Chancellor had taken the opportunity to get rid of the currently unworkable Carbon Reduction Commitment."

14:29 Culture, media and sport minister Jeremy Hunt welcomes the Budget's measures on the creative industries.

@Jeremy_Hunt - "Tax breaks for video games, TV and animation ind in the #budget. Labour only talked about helping video game ind but we're doing all three!"

14:27 Director general of the Institute of Directors, Simon Walker, said Osborne's Budget is lacking.

"While any tax reduction is welcome, the chancellor has not done enough to free business from the burdens and barriers that are holding economic growth back.

"Businesses dearly want the opportunity to invest, create and build, but George Osborne must go much further if he wants to fire up the engines of the economy. There was a bold move on corporation tax, but in the bigger picture this is still not far enough or fast enough."

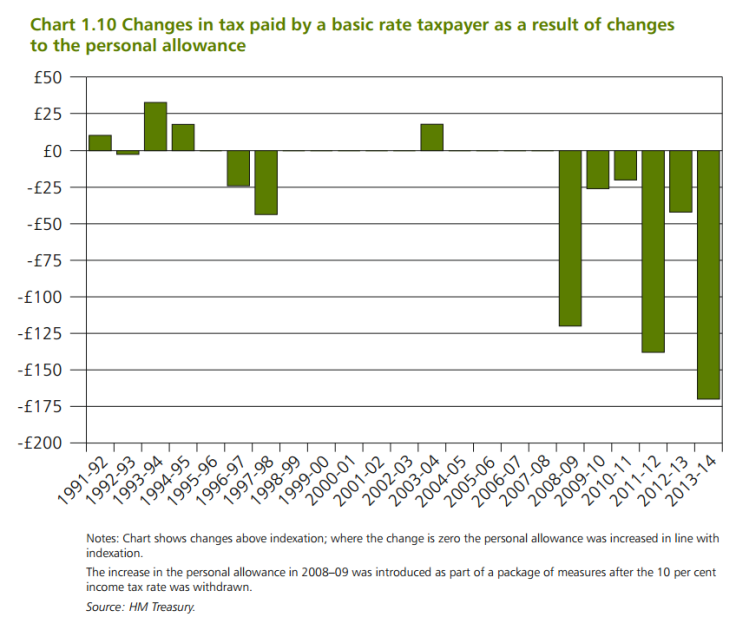

14:22 This chart from the Budget red document shows how much the government says people will save on income tax payments because of their changes to the personal allowance, lifting it from £8,105 in 2012/13 to £9,205 in 2013/14.

14:17 This Budget is for the "millions, not millionaires" insists Danny Alexander, the Lib Dem chief secretary to the Treasury.

"This budget increases, overall, the tax burden [on the wealthy]," he said on the BBC.

14:11 Osborne has missed his chance to get the economy growing, according to a public policy thinktank.

Reacting to the Budget, Nick Pearce, director of the Institute for Public Policy Research, said: "George Osborne has missed the opportunity to jump start the economy. Rather than raise the personal allowance and lower the top rate of income tax, he should have cut employer national insurance in the same way the Barack Obama has boosted the US economy with a consumer stimulus.

"US unemployment has fallen for nine months, while UK unemployment has been rising for nine months. The UK still desperately needs a 'jobs guarantee' to ensure that more than 800,000 people who have been out of work for more than a year get back to work or risk losing their benefits.

"There are better ways of helping low income families than raising the personal allowance and cuts to Working Tax Credits will really hit working families.

"Closing the loop hole for foreign buyers using companies to purchase homes is a welcome move, but he should have gone further and introduced a mansion tax. Stamp duty at 7% on £2 million mansions will help but more action is needed to prevent the super-rich from using the London housing market as a 'global reserve currency' and to tax housing wealth, not just transactions.

"The child benefit 'cliff edge' move is simply tinkering at the edges. The Chancellor should have gone back to the drawing board. It would have been better and bolder to invest in universal childcare by freezing child benefit for 10 years.

"The big surprise was the £1bn raised by the freezing pensioner tax allowances, which is a controversial but welcome move to spread the burden of deficit reduction to include pensioners."

13:59 If you have the time or the inclination, here is the Budget document in full.

13:53 Some reaction from Caxton FX in the City of London.

Richard Driver, an analyst, said: "As expected the Chancellor reiterated the UK government's "unwavering commitment" to reducing the country's public debt and he's quite right, the UK's triple-A rating and low borrowing costs are absolutely essential.

"Importantly, the budget is "fiscally neutral," so it is a case of staying on course rather than ramping up austerity and the OBR's upward revision to its 2012 UK growth forecast is supportive of this. The five-year plan to eliminate the budget deficit remains realistic.

"As ever, the key risks to the UK economy come in the form of the eurozone debt crisis and recession, as well as high oil prices. The OBR downgraded its eurozone growth forecasts, which is in line with our projections for a long and painful eurozone recession.

"All in all, it was a budget with few real surprises. Sterling hasn't responded and the markets are firmly in wait and see mode with regard to the UK economy."

13:50 RMT General Secretary Bob Crow has given his reaction to the Budget:

"This is a budget of the rich for the rich. The tax changes mean that a banker on half a million pounds gets a kick back from George Osborne of £17,500, money robbed from our public services and the neediest in our divided society.

"The tinkering at the lower end of the tax scale will be swallowed up by increased utility bills and travel costs while the rich will just engage another army of accountants and lawyers to dodge the so-called clampdown on tax avoidance by inventing another barrage of scams.

"This budget unleashes savage cuts to jobs, wages, welfare and services in the public sector while pandering to the private greed of those same people who dragged us into this economic crisis. It will spark an upsurge in protest and resistance across the country as the vast majority realise that they have been mugged by this government of the wealthy elite."

13:47 Lots of attacks on the "same old Tories" from Ed Miliband, but a failry poor performance in response to the Budget.

13:40 Miliband says the Budget tells us how Osborne thinks: "The poor will only work hard by making them poorer, the rich will only work hard by making them richer."

13:35 Osborne's Budget statement in full is available here.

13:34 "Growth down last year, growth down this year, growth down next year - every time he comes to the house he tells us he has failed," says Miliband of Osborne and the OBR's growth froecasts.

13:33 Miliband points out the favoured phrase of the chancellor, that "we are all in this together", is glaring in its ommission from his Budget speech.

13:30 And that's that from Osborne. Now it is time for Labour leader Ed Miliband's reply.

13:26 Personal tax allowance - i.e. the threshold at which someone starts paying tax - going up to £9,205 from April 2013.

13:21 50p top tax rate may raise "nothing at all". Drops top rate to 45p.

"This tax rate is the highest in the G20 - higher not just than America but countries in Europe such as France and Germany.

"It's harming the British economy. Like the previous chancellor I've always said that it would be temporary.

"A 50p tax rate, with all of the damage that it can do will only be justified if it raises significant sums of money. The top rate of tax will be 45p

"No chancellor can justify a tax that damages our economy and raises next to nothing. It's as simple as that.

"Thanks to the changes we have made to taxes on the rich we will be getting five times more money each year from the wealthiest in our society."

13:15 Stamp duty on residential properties worth more than £2m rising to 7 percent.

For properties bought through companies, which many people do to avoid stamp duty, they must pay 15 percent stamp duty on properties over £2m.

13:14 No change to fuel duty plans, will still go up by 3p in August.

13:13 No change in alcohol tax - cheers! Though smokers will pay 37p more on a packet of cigarettes, a 5 percent rise above inflation for tobacco duty.

13:08 Corporation tax rate falling further, to 24 percent this year, before hitting 22 percent in 2014. Bank levy rising to 0.05 percent.

13:06 Confirms that taxpayers will get statements telling them exactly where the tax they pay goes, breaking it down into welfare, NHS, defence, etc.

13:02 Need to give Britain a "modern tax system for the modern world". Refers to the political philosopher Adam Smith's four principles for tax.

Removing loopholes and anomalies in VAT system, but keeping broad exemptions - food, children's clothing, etc.

13:01 Declares the National Planning Policy Framework the "biggest reduction in business red tape ever undertaken".

12:59 Want to "make the most" of the Olympic and Paralympic Games and "put up a sign to say Britain is open for business" so relaxing Sunday trading laws, as many events take place on a Sunday, for the eight sundays during the Games.

12:59 Funding ultra-fast broadband for 10 of the UK's largest cities.

£15m will be available for smaller cities, too.

12:55 Tax credits for video games development, animation, and TV production.

"We want to keep Wallace and Gromit exactly where they are," says Osborne, to roars of approval from the Commons benches.

Wants to develop UK's technology sector to make Britain a leader in the world.

12:53 Rail improvements to the north.

"For years transport in the north of England was neglected - not under this government."

12:51 Extra funding to build new houses.

South east aircraft capacity study will take place.

12:50 "We have the national resolve to say no, we will not be left behind, we want to be out in front and that's this government's resolve."

12:49 Government looking to developing and emerging economies, like India, China and Brazil for exports. Says in a decade government wants to double UK exports to £1tn.

12:46 Government looking at if it can issue gilts with unlimited maturity date "something we have not been able to do for six decades", says Osborne, as he points out that borrowing is getting cheaper and cheaper for the UK while it remains expensive elswhere across the EU.

12:45 Automatic review of the state pension age.

Afghanistan costs to be £2.4bn lower than previouslay anticipated.

Double the families welfare grant to provide additional support to families when people deploy.

Will increase council tax relief to 100 percent for those serving.

12:45 £36bn saved on government's debt interest payments compared with before because of its action, says Osborne.

12:43 Nick Robinson, BBC Political editor, tweets: #BBCBudget Was PM hinting at Afghan end of war dividend next year? Troops clearly coming home starting in 2013."

12:42 Govenrment took control of £28bn Royal Mail pension fund. Osborne says will use this "windfall" to pay back debt, not spend.

12:41 Declares a "fiscally neutral" Budget. No more cutting, he promises, but "no deficit funded" spending either.

"Defecit reduction plan is on course and we will not waver from it. To do so would risk a sudden loss of confidence and a sharp rise in interes rates and we will not risk that."

12:40 Osborne says he will write to the governor of the Bank of England to reaffirm the 2 percent inflation target and to maintain its programme of quantitative easing.

12:35 Osborne said the eurozone is still in crisis and impacting Britain, says Osborne, and poses a major risk to recovery.

Also says high oil prices hindering us.

OBR growth forecast 0.8% for 2012, 2 % next year and 2.7 % 2014. and 3% 2015/1016.

Claimant count to drop by 100,000 each year. 1.6m this November.

12:32 "This budget rewards work. Britain is going to earn its way in the world," says Osborne, opening the Budget statement.

"There's no other road to recovery.

"This is a budget that supports working families and values those looking for work and unashamedly backs business."

Promises to lift millions out of tax while increasing the tax on the richest.

12:26 The political editor of the Independent on Sunday, Jane Merrick, is fuelling speculation about an unexpected announcement in the Budget.

She tweeted: "Think you've read all of #budget2012 in the papers? There will be a surprise. Friend of Osborne: 'George loves a rabbit'.

12:20 If anyone needs reminding of Osborne's 2011 Budget statement, you can find it here.

12:15 A statement from Labour's opposition chief secretary to the Treasury, Rachel Reeves, calls Osborne's borrowing "wildly offtrack".

"Whatever claims he makes in his Budget speech the Chancellor is wildly off track on his borrowing plans.

"The autumn statement showed George Osborne is set to borrow £158 billion more than planned at the time of his spending review because of the higher unemployment and slow growth his failed policies have delivered. And today's figures show he borrowed £6 billion more in February than in the same month last year.

"By choking off the recovery, pushing up unemployment and so borrowing billions more to pay for economic failure, cutting spending and raising taxes too far and too fast has backfired. This Government's pledge to balance the books by 2015 is in tatters.

"Bringing the Royal Mail pensions funds onto the Government's books may give an artificial boost to the public finance figures. But whatever smoke and mirrors the Chancellor tries to use in the Budget, this is a future burden on the taxpayer - not a windfall - as the pension fund is in deficit and the Government is taking on the liabilities too.

"The accounting trickery of the Royal Mail pension funds transfer will need to be stripped out in order to see how much more the Chancellor is borrowing, compared to his plans in his spending review, because his economic policies have failed."

12:10 While Prime Minister David Cameron and Labour leader Ed Miliband joust at Prime Minister's Questions, ahead of the chancellor's 12:30pm Budget statement, let's look at the polls around the Budget.

From UK Polling Report:

The budget comes under a background of deep public pessimism about the state of the economy. Only 4% of British people think the economy is in a good state, compared to 75% who think it is in a bad condition. Only 10% expect their financial position to get better over the next year. The government's cuts are unpopular, are still seem as unfair by 60% of people, too deep by 45%, too fast by 50% and bad for the economy by 49%.

However, the public have largely accepted the government's argument that they are necessary (55% agree) and that they are largely the fault of the last Labour government (63% blame the last Labour government compared to 51% for the current government, including 27% who blame both).

On scrapping the 50p top tax rate:

YouGov's polling has consistently shown widespread opposition to the abolition of the 50p rate, with only 27% supporting the abolition of the 50p tax rate.

Support for the 50p rate would not be much diminished even if it was shown that it was not raising much money, one of the arguments that has been made for its abolition.

Asked what should happen if it was shown the tax was not raising extra money, 41% of people would support its abolition, but 40% would still want to retain it anyway for moral reasons.

On fuel duty:

A cut in fuel duty remains overwhelming popular. 77% of respondents would support a decrease in the level of fuel duty on petrol and diesel, 16% think it should be kept the same with only 4% supporting a rise.

Asked to pick priorities for tax cuts, a reduction in fuel duty came top on 34%, making it more popular than an increase in personal tax allowance (31%) or a cut in VAT (23%).

12:05 A big smile on George Osborne's face as he left Number 11 Downing Street to make his way to the House of Commons - the complete opposite of previous years when he and other ministers were told to look solemn and keep a straight face so they did not look happy or complacent about the swingeing cuts they were making.

12:00 The BBC business editor Robert Peston is pouring cool water on the rumoured Budget plan to close stamp duty loopholes:

Vast numbers of expensive properties have been transferred into the ownership of offshore companies - where the stamp duty charge is just 0.5 percent when the offshore company is purchased.

HMRC thinks it can abolish the loophole which allows this much lower charge on offshore companies.

But accountants warn it won't be easy: the government dare not introduce a 7 percent stamp duty charge on purchases of shares in all companies; and if the higher stamp rate is restricted to companies whose only asset is a house, proving that's the case won't be easy for companies registered in secretive tax havens such as the Cayman Islands.

11:55 Oh dear. Just as the data was looking good for George Osborne ahead of his Budget, he is dealt a blow.

From our business editor Martin Baccardax:

The UK Government borrowed a record £15bn in February, according to the Office of National Statistics, an increase of more than £6bn compared to last year.

The figures will complicate the ambitions of Chancellor George Osborne as he prepares to deliver his third budget statement to the House of Commons later today.

Osborne has planned to reduce government borrowing, along with public expenditures, in an effort to eliminate the country's budget deficit by 2017.

However, the sharp increase will no doubt provide fodder for the Chancellor's Opposition critics, who have accused his austerity drive - the steepest since the Second World War - of stunting economic growth and adding to a decades-high rate of unemployment.

11:45 Here are a couple of other views from the public, gleaned from Twitter.

@jamesjohnson252 - The 2012 Robin Hood is about to make an appearance.There's a twist however. This time he will rob the poor to give to the rich. #Budget2012

@maiphay - #budget = struggling to make ends meet. Enough said.

@M_A_Doherty - Don't bother with the tax allowance change drop the fuel duty instead!

11:30 YourNewsUKtv has been out and about speaking to the public about their views on Osborne's Budget and uploaded the video to YouTube:

11:10 There is an interesting piece over on Bloomberg that points to a rise in demand, and so prices, of luxury homes in London, driven by wealthy foreigners who want to invest in low-risk assets, away from economic and political strife in their home nations.

Most of these properties are valued at higher than £2m, said to be the new threshold for a higher rate of stamp duty that is a rumoured part of this budget.

The government is also reportedly trying to close stamp duty tax loopholes.

It will be interesting to see whether this stamp duty increase would yield more revenue for the Treasury from London's luxury homes, or if it will be enough to dampen demand and so lower house prices, lessening the Treasury's overall yield.

Then again, the new threshold may have little effect at all. If you have enough money to buy one of these properties an extra one or two percent tax is unlikely to hurt your wallet.

10:45 As ever, the Sun had some strong words for Osborne and the other politicians in parliament ahead of the Budget:

Motorists are being priced off the roads as the Treasury takes an eye-watering 60p in every pound spent at the pumps.

The very least Mr Osborne can do is scrap the August tax hike.

What the British public really NEEDS is a duty CUT.

Privileged aristocrats like the ones that populate this government don't understand the difficulties faced by ordinary people. They don't have to worry about fuel or energy bills.

They know nothing about budgeting to put food on the table and struggling through to pay day.

These men drink bottles of wine that cost more than the average family's weekly shop.

We have pulled together comments from other sections of the press, too.

10:40 Late yesterday our business editor Martin Baccardax pointed to the data emerging that may give Osborne some confidence as he delivers his Budget:

UK Chancellor George Osborne can step up to the despatch box in Parliament on 21 March to deliver his third Budget statement with just a bit more confidence following a solid stretch of economic data that might signal Europe's second-largest economy is finally emerging from its slumber.

In what could be a defining week for the Chancellor's ambitious plans to balance the nation's books by 2017, Osborne will at least have some hard numbers to back-up his rhetoric: inflation is slowing, industrial activity is improving and maybe, just maybe, the economic growth is beginning to improve.

10:30 Welcome to the IBTimes UK's live coverage of Chancellor George Osborne's Budget statement for 2012.

With all of the press coverage in the build up to the main event, which kicks off in the House of Commons at 12:30pm right after Prime Minister's Questions, it feels like we already know everything to expect from the chancellor - though there may yet be a rabbit yet to come out of the hat.

The top tax rate looks set to be dropped from 50p in the pound to 45p, controversially, though it won't come into effect until April 2013.

A rise in the income tax threshold - the point at which you start paying tax - looks set to come in. It stands at £7,475, but will imminently increase to £8,105 for this year - will Osborne shunt it up another notch now, or next year?

It would appease his coalition partners, the Liberal Democrats.

Speaking of appeasing the Lib Dems, we are also expecting a nod to their please for a mansion tax, with a stamp duty increase on properties worth over £2m from 5 percent to 7 percent.

We have a round-up of the expectations of this budget - a good place to get a picture of how this afternoon's announcements will likely look.

Earlier in the week the Centre for Economics and Business Research said that this is Osborne's last chance for growth because action taken after this point will not take effect until after the next general election.

© Copyright IBTimes 2025. All rights reserved.