Cobham Uncertain on Defence and Security Market; 2012 Trading Dismal

Cobham, the engineering group, anticipates that the US defence and security market will remain challenging with constraints over government spending, uncertainty over the size, timing and allocation of federal budget cuts. As a result, the company sees poor visibility for 2012 trading.

The group which specialises in data connectivity, bandwidth in defence, security and commercial environments, is scheduled to release its preliminary results on March 8, 2012.

In the first nine months of the year, the group has seen marginally negative revenue growth, consistent with the board's full year expectations. The defence and security market environment remained challenging, while commercial activities have continued to grow. Excellence in delivery programme continues to give good performance and remains on track to achieve expected £21 million of annualised year-on-year savings, which will drive some underlying growth in the year.

The group is positively reacting to this uncertain economic environment by making important efficiency savings through operational development and by improving the robustness of the portfolio through acquisitions and divestments. As well as the group's focus on winning programme positions, Cobham is increasing further cost reduction initiatives which will be put into practice, as necessary, to adjust to upcoming changes in the market situation.

Commenting on the group's half year results, Andy Stevens, its Chief Executive said: "Despite the challenging backdrop for defence, we have leading positions in attractive commercial markets, technically differentiated products and services in the more attractive and resilient segments of defence and security, together with a strong and flexible balance sheet. We are investing in the future of Cobham with the Excellence in Delivery programme which is rapidly generating efficiency savings and customer benefits and also reconfiguring Cobham to take advantage of the many opportunities in the years ahead. We also continue to rigorously examine our portfolio of companies and acquisition opportunities to further enhance the Group's potential and profile. The Board is actively responding to market conditions and is confident that the Group will continue to make progress over the medium term."

On Tuesday, FB Heliservices Ltd, a joint venture of Cobham and Bristow Helicopters, won a 4-year contract for £193 million with 2 possible one year extensions by the UK Ministry of Defence to provide helicopter flying training at RAF Shawbury, RAF Valley and AAC Middle Wallop, together with support services at RAF Shawbury and AAC Middle Wallop. The contract will begin on April 1, 2012.

In January, the Cobham Mission Equipment has been selected by Boeing to provide Body Fuel Tanks in support of the US Air Force's KC-46 Tanker Programme. The Body Fuel Tanks enable KC-46A mission capability by providing additional fuel for offload and increased range. The engineering manufacturing development (EMD) phase began in January 2012, with low-rate and full-rate production through 2028.

The other deals signed by Cobham in the last three months include a contract from Embraer Defense and Security to design and supply the aerial refueling probe for the KC-390 Tactical Military Transport and Tanker Aircraft. Projects totalling more than US $72 million during the next six years through Trivec-Avant, which was acquired by the group in October, for a cash consideration of US$126 million on a debt and cash free basis. An additional cash consideration of to US$18 million will be payable between 2013 and 2014, contingent on future performance. In October, FB Heliservices Ltd has signed a deal for €45 million with the Netherlands Ministry of Defence to provide helicopter air reconnaissance capacity to the Dutch Caribbean Coastguard.

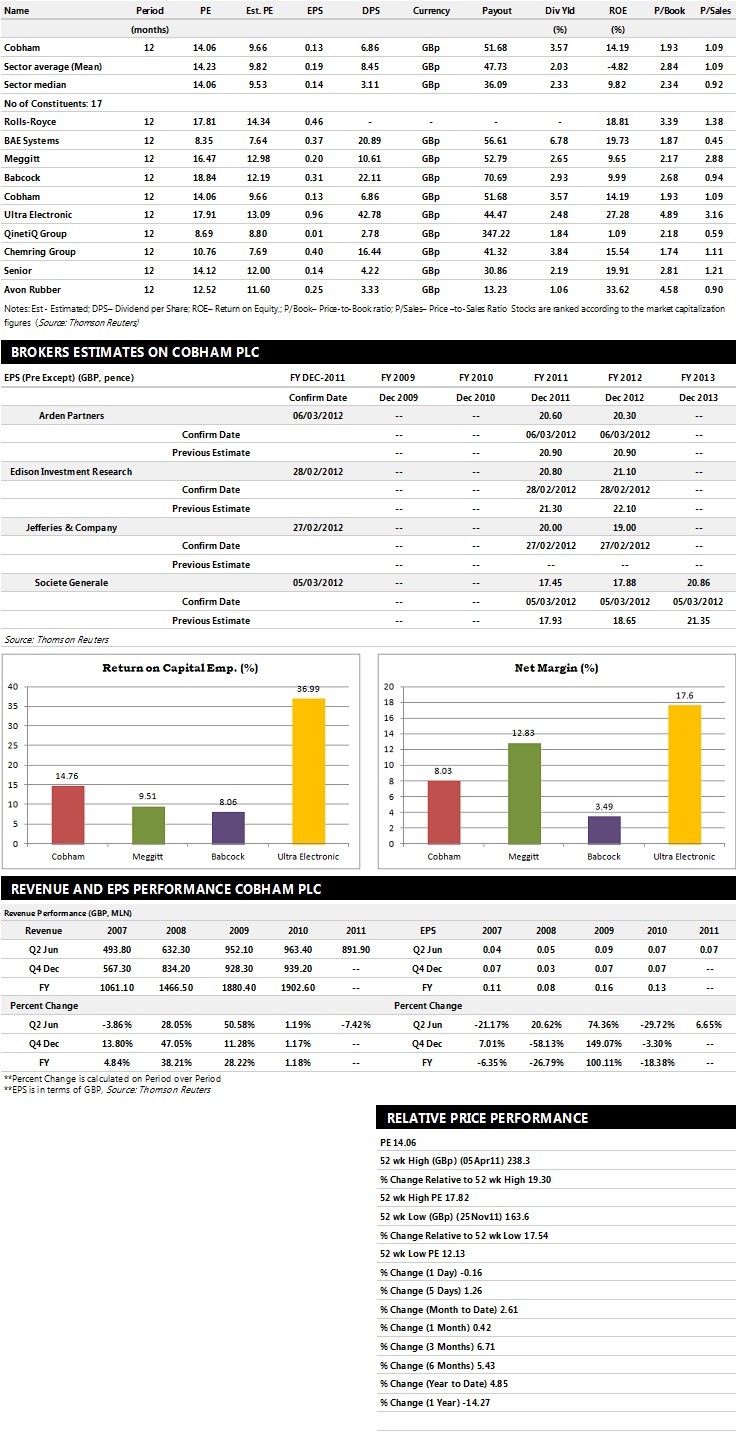

Brokers' Views:

- Arden Partners recommends 'Neutral' rating on the stock

- Societe Generale assigns 'Hold ' rating

- Jefferies & Co assigns 'Buy' rating on the stock with a target price of 230.00 pence per share

Earnings Outlook:

- Societe Generale estimates the company to report revenues of £1,838.00 million and £1,632.00 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £184.00 million and £189.00 million. Profit per share is projected at 17.45 pence for FY 2011 and 17.88 pence for FY 2012.

- Arden Partners projects the company to record revenues of £1,810.00 million and £1,675.00 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £308.00 million and £293.00 million. EPS is estimated at 20.60 pence for FY 2011 and 20.30 pence for FY 2012.

- Edison Investment Research expects Cobham to earn revenues of £1,879.00 million for the FY 2011 and £1,752.00 million for the FY 2012 with pre-tax profits of £315.00 million and £309.00 million. Earnings per share are estimated at 20.80 pence for FY 2011 and 21.10 pence for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector.The table below represents top ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.